10-year market cycles are no longer the norm in commercial real estate. The market now changes far more rapidly. From 1960 to 2000, there were 4 distinct cycles. Over the past 13 years, the waters for commercial real estate have been choppy.

This article will address the "bubble burst" of September 2008, the back side of that burst and the ups and downs that have developed in the market.

The Bubble Burst

It is worth reviewing what happened when the commercial property market peaked in 2008:

Front side of the bubble

* Substantial increase in capital searching for real estate

* Falling mortgage rates encourage investment

* Spiking of construction costs

* Crazy mortgage underwriting

Back side of the bubble

* Credit crunch stops the market

* Capital withdraws from real estate

* Credit is not available to the degree found in a rising market

* Huge distress in real estate with special services taking over troubled property

Back side conditions existed to mid-2010 when commercial markets reached bottom and began to turn positive.

The 2011 into 2012 can be classified as years where "pockets" were formed. East Cambridge and the Seaport area became "hot buttons" and places to invest. Waltham and Burlington were looked at similarly. High end buyers with capital such as Boston Properties and others made significant investments within these markets.

The Market Today

Particularly hard hit by the great recession was Boston's Rte. 495 corridor. Particularly hard hit was the market known as Rte. 495-Mass Pike West.

To place the Rte. 495-Mass Pike West market in perspective, as of Q1-2004 the average asking rent for office space was $16.14 per s/f. Vacancies stood at 29.5% in an 11 million s/f market. As of Q1 2012, average asking rent for office space 8 years later were $16.17 per s/f. Vacancies were 31.4%.

Investors saw this as a market of opportunity and Marlborough became the center of major corporate moves. As of Q1 2013, vacancies were down to 21.7% and rents had risen to $17.32 per s/f. In Westborough, the market had reached $20 per s/f. In Marlborough for the "best of the best," rents have also reached $20 per s/f.

The point is that what were at one time depressed markets in Boston, over the past two quarters, major recovery has taken place.

Choppy Waters

Valuation issues have become just as sensitive to economic conditions as have Boston's markets. Most commercial property is financed as part of its sale. The interest rate paid has a significant impact on debt services and the price that will be paid.

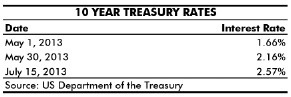

10-year treasury rates for decades have had an impact on a property's capitalization rate. Record low treasury rates have caused significant increases in value over the past several years. In May 2013, we have seen the start of a "spike" in treasury rates.

Treasury rates have "spiked" 91 basis points since May 1, 2013 for a 55% increase. Interest rates for commercial mortgages were typically at the 3.65% level in mid-May and are now upwards of 4.25%. A 60 basis point change results in a 6% reduction in cash flow, which, if equity returns requirements remain unchanged, results in a 6% reduction in property value.

My point is that a high degree of valuation volatility is in place in the market conditions that exist today making real estate values hard to handicap. The ups and downs of interest rates have been hard to predict which produces far more choppy waters for commercial real estate than observed over past real estate cycles.

Webster Collins, MAI, CRE, FRICS is executive vice president/partner the valuation & advisory group of CBRE/New England, Boston.

Tags:

Mid-year 2013 - The market has changed again since the "bubble burst" of September 2008

July 25, 2013 - Spotlights