Nadeau & Associates

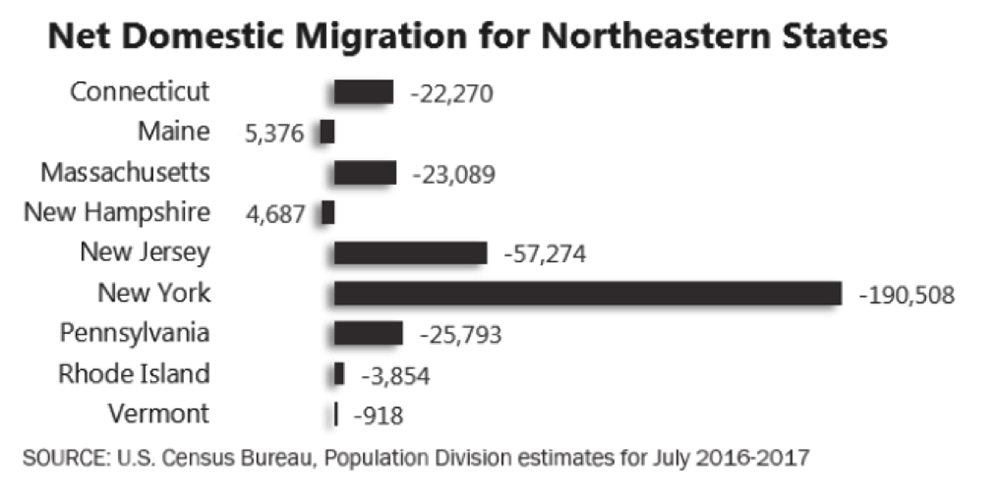

Being from Connecticut, I tend to focus on what’s happening here in the Nutmeg State, and it’s not pretty. We continue to lose population, mostly to southern states and states with greater tax advantages. The Connecticut Office of Policy and Management’s 2017 paper on migration focused on several issues, the number of persons leaving the state and income levels that those former residents were part of. The bottom line is a net loss. The declining population is not exclusive to Connecticut as many of the Northeastern states are also taking a hit when it comes to population. Graph 1 shows recent trends for Northeastern States.

What’s driving the Migration?

There are a number of factors that are driving the shift in population in Connecticut and New England for that matter. Firstly, we in Connecticut have been experiencing a relocation of employers with United Technologies, Pfizer and General Electric being at the top of the list. United Technologies, which includes companies like Pratt & Whitney, Otis Elevator, Kidde and Carrier committed to relocating their corporate and some manufacturing base to Palm Beach Gardens, Florida. The new facility, which opened in 2018 is a 224,000 s/f marvel in technology that is home to UTC’s Center for Intelligent buildings. The local Florida municipality cites a $660 million benefit over a five-year period. That’s $660 million that is no longer impacting Connecticut. An interview with a UTC executive revealed that many of the Hartford-based employees were offered packages to relocate to Florida, and many capitalized on the opportunity.

Pfizer, the pharmaceutical giant that had long planned its landing in New London, with the city of New London being at the helm of the largest and most controversial eminent domain case perhaps in this country’s history to accommodate Pfizer’s coming. (Kelo vs. City of New London) The case involved the taking of land from private property owners for private use, in this case, for Pfizer to construct a giant office park housing hundreds of workers. Pfizer developed a fraction of the promised buildings and then fled to Massachusetts, leaving vacant buildings and in some cases barren land where homes once stood.

Finally, General Electric, the Fairfield-based manufacturing and technology giant with a $130 billion business decided a couple years ago to up and relocate the headquarters to Boston. General Electric had been sparring with the state of Connecticut for several years, looking for greater incentives to keep their base here in the Nutmeg State. Massachusetts offered a mere $120 million in incentives along with $25 million in property tax relief and voila, GE and its giant workforce of both middle management and executives are committed to another market that will surely benefit from Connecticut’s loss. Governor Malloy’s response at the time was “This is a clear signal that Connecticut must continue to adapt to a changing business climate.

The list goes on with the three above references being just a piece of the puzzle. Not to mention that Connecticut and New England, once the manufacturing hub of the country have lost thousands of small business to other parts of this country, foreign companies and in some cases pure attrition, with that small business just evaporating.

Change in Federal Tax Laws

Congress enacted Trump’s tax plan during 2018 which is proving to be a deterrent for many property owners, especially for property owners in many parts of New England, where taxes are historically high, especially relative to income levels. For example, in Bayville, NY, a small community on Long Island the median income is $77,800, yet local property taxes on homes typically exceed $20,000. The new tax act now limits the amount one can deduct for state and local property taxes (SALT) to $10,000.

Shift in Demographics

In as much Connecticut has seen a negative outflow of population, there have been a number of people moving into the state as well. Unfortunately, the outflow is largely by those individuals that have high-paying jobs and/or are of significant wealth. Conversely, the incoming population is largely that of more service and hourly workers that can’t begin to offset the income that was formerly flowing into Connecticut’s coffers.

Massachusetts also has an overall negative population flow however, the surrounding Boston market has been expanding for years, with a booming real estate market and what has been for a long time, increasing values. The benefits come from the expanding base of tech business and biotech companies that have migrated to the area. An interview with a recent hire in the pharmaceutical business relocated to Boston from Connecticut for a job with a foreign company who set up offices in Boston to be “near what is a confluence of biomedical and pharmaceutical giants.”

Impact upon Property Values

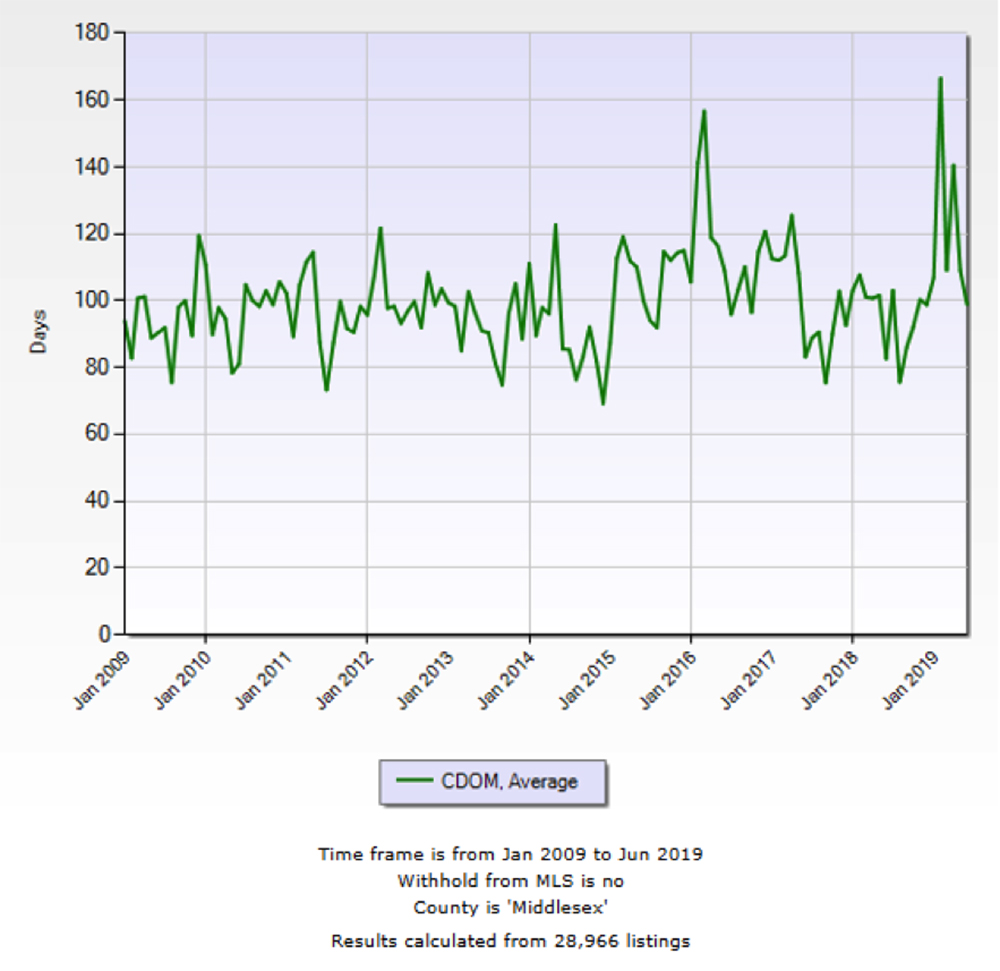

By and large the market in Connecticut is experiencing a wane in values with the upper end of the marketplace being most impacted. As the audience shrinks for high-end product, so do values. Along the shoreline in Eastern Connecticut, where this appraiser is located, there has been a noticeable increase in marketing times and a decline in prices for homes in excess of $500,000. Relating to marketing times, Graph 2 showing a slow but steady increasing number of days it takes to complete a sale from the inception of listing.

Summary

This appraiser anticipates greater fallout from the migrating employers, tax limitations and what is translating into an ever more expensive place to live. As for Connecticut, it will likely take some time to right Connecticut’s economy. That new footing will have to start with a more cohesive bipartisan state government, as Republicans and Democrats have long been at odds with each other and cannot seem to agree on how to solve the state’s economic dilemma.

Marc Nadeau, SRA, is owner of Nadeau & Associates, Guilford, Conn.