Few of us, if any, in the commercial real estate (CRE) industry will miss 2023. And while we are optimistic about the prospects for 2024 it’s helpful to understand what led to 2023s sharp overall decline in acquisitions and financing activities and how much those factors persist heading into the new year, including:

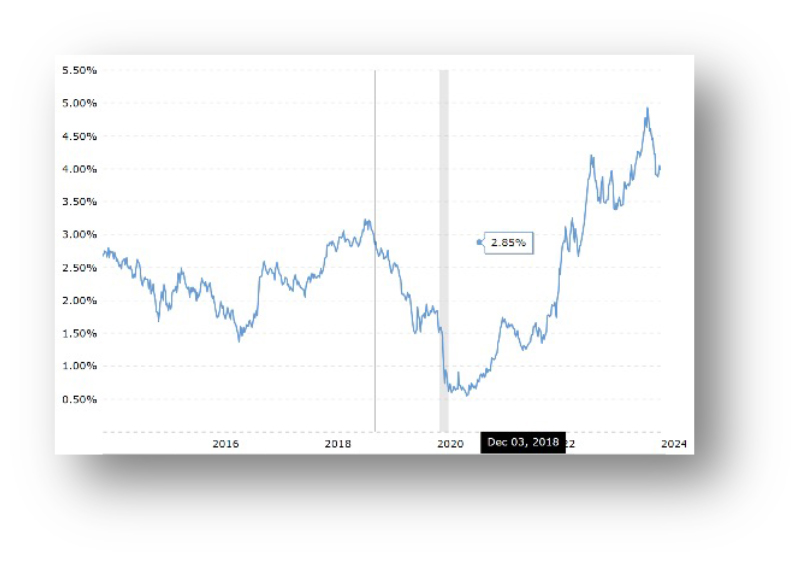

• The aggressive response by the Fed’s to their delayed curtailment of Quantum Easing Policies which triggered eleven increases, totaling 5.25%, in the Fed Funds Rate, the last of which occurred in July 2023.

• On-going economic and geopolitical concerns surrounding the Russian – Ukrainian war as it enters its thirdyear and the conflict in Gaza in response to Hamas’s October 7th attack on Israel.

• The first quarter 2023 crisis of confidence in the banking system caused by the failures of Silicon Valley, Signature and Republic Banks. While the crisis was quickly quelled by the Fed and the FDIC which agreed to provide a backstop, the financial shock waves caused a wide-spread curtailment in new loan activity as banks paused to assess the health of their own capital structures.

The impact of the uncertainty above caused a sharp decline in sales and mortgage lending activity last year, which in turn created a dearth of sales comps and market data. Per Trepp CMBS issuance dropped by 44% to a level not seen since the Global Financial Crisis.

However, pleased with the drop in inflation over the past 12 months amid solid job growth, the Federal Reserve has indicated an end to future rate hikes and the strong possibility of interest rate reductions as early as the first quarter 2024.

While investors are certainly more optimistic at the prospects a ‘soft landing’ and banks are expected to slowly emerge from last year’s financial self-assessment pause, +/- $544.3 billion in loans are scheduled to mature in 2024 into a significantly higher rate environment than when the loans were originally placed (see graph).

We anticipate real estate investment activity to gain momentum in the second half of this year, although lenders and investors will likely require an infusion of preferred equity to “right size” their capital structure to avoid foreclosure and keep their portfolios healthy.

Larew Doyle & Associates is cautiously optimistic as we look forward to 2024. The prospect of a “soft landing” appears more realistic, CRE investors have more confidence in the stability of interest rates, and the disparity between “bid – asking prices” is expected to tighten as property owners digest the impact higher interest rates have had on property values. Lenders are expected to gain confidence in the vitality of 2024s real estate market and are expected to ease back into a more confident lending posture by the second quarter this year.

At Larew Doyle & Associates, we highly value our client and lender relationships. Our experienced team of professionals look forward to continuing to assist our clients meet their investment objectives by providing tailored debt and equity financing solutions.

Jeff Miller is a senior vice president and Alan Doyle is a principal with Larew Doyle & Associates, Inc., Providence, R.I.