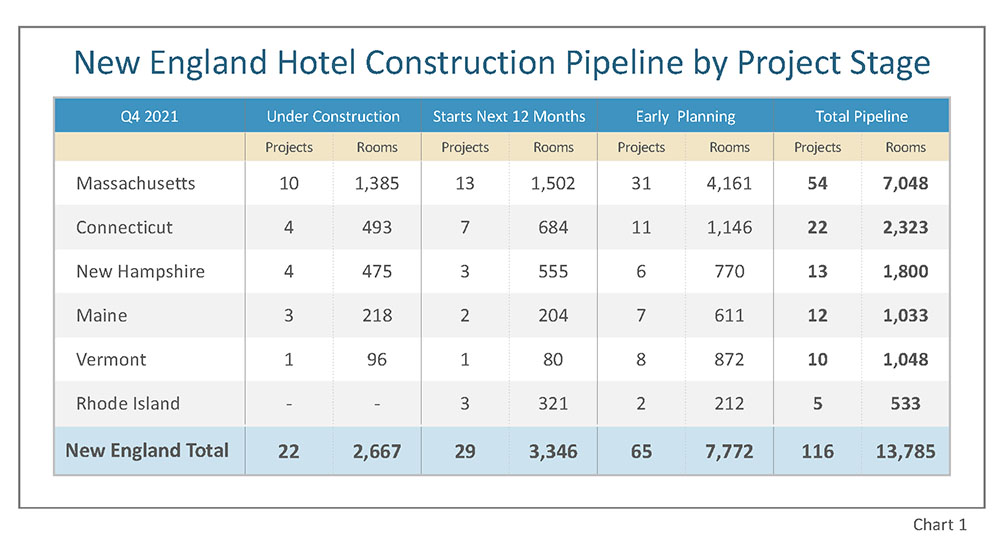

As seen in the Q4 2021 Hotel Construction Pipeline Trend Report from Lodging Econometrics (LE), the total New England hotel construction pipeline at year-end 2021 stands at 116 projects/13,785 rooms. New construction project counts in the region are down 20% by projects and 25% by rooms year-over-year (YOY), compared to 2020s year-end totals of 145 projects/18,396 rooms. Massachusetts leads the region with the most hotel projects in the pipeline, at Q4, with 54 projects/7,048 rooms, accounting for 47% of new construction projects in New England’s total pipeline. Connecticut follows Massachusetts, with 22 projects/2,323 rooms, then New Hampshire with 13 projects/1,800 rooms, Maine with 12 projects/1,033 rooms, Vermont with 10 projects/1,048 rooms, and, finally, Rhode Island with five projects/533 rooms. (See Chart 1)

At the end of Q4 2021, New England currently has 22 projects/2,667 rooms under construction, 29 projects/3,346 rooms scheduled to start in the next 12 months, and another 65 projects/7,772 rooms in early planning. Not surprisingly, Massachusetts leads in all three stages of the pipeline and accounts for 45% of the projects under construction, 45% of the projects scheduled to start in the next 12 months, and 48% of the projects in early planning for the region.

Throughout New England there were a total of 18 hotels, accounting for 3,081 rooms that opened in 2021. With 61% of the 2021 new openings in Massachusetts, with the Boston market accounting for 44% of the state’s total opens. LE analysts forecast 17 projects, accounting for 2,006 rooms, to open across the New England region in 2022, and another 19 projects, accounting for 1,985 rooms, are expected to open in 2023.

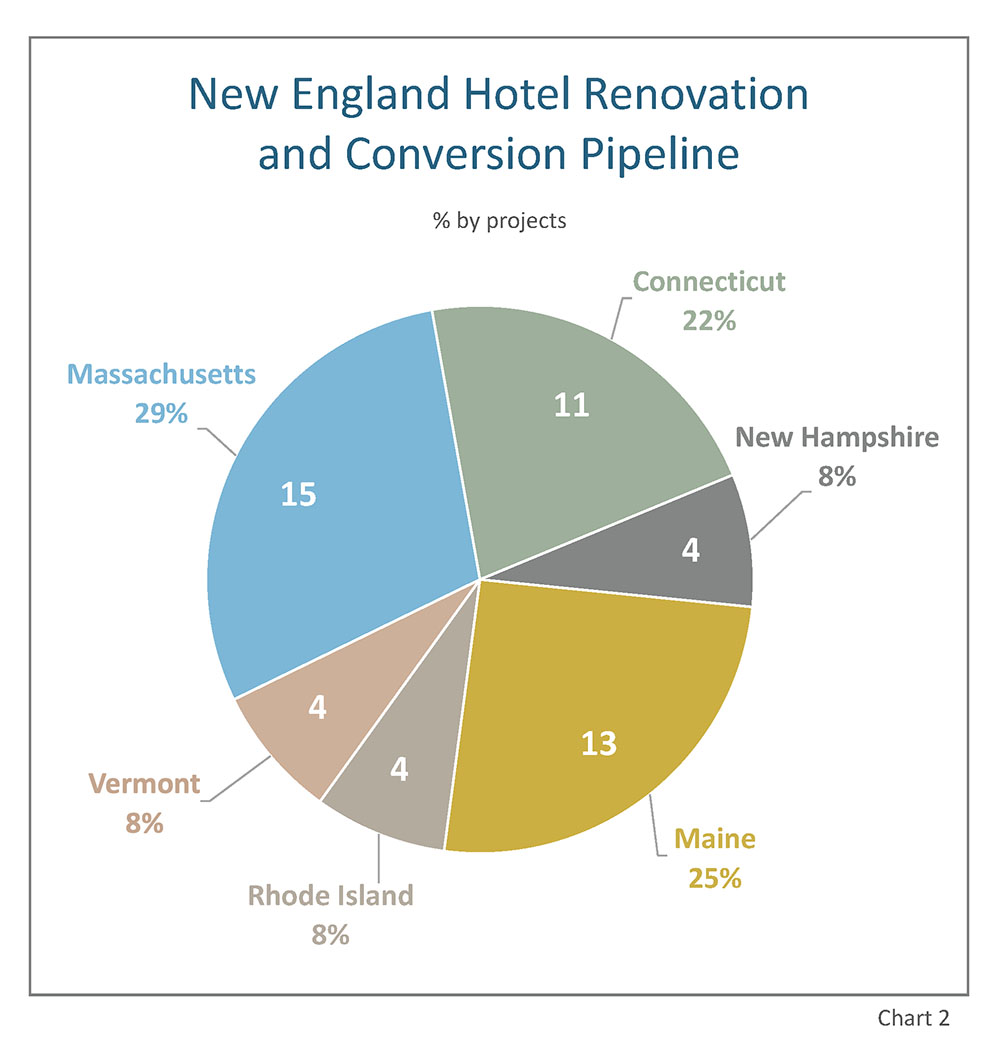

Hotel renovation and conversion activity YOY in New England is down as well, at the end of Q4 2021, there were 51 hotels/6,910 rooms reported to be in the renovation or conversion pipeline. Massachusetts has 15 hotels/2,574 rooms, Maine follows with 13 hotels/1,102 rooms, then Connecticut with 11 hotels/1,467 rooms under renovation or conversion. New Hampshire, Rhode Island, and Vermont all reported having four hotels in the renovation or conversion pipeline, accounting for 693 rooms, 640 rooms, and 434 rooms, respectively. (See Chart 2)

Franchise companies, in the New England states, with the largest project counts in the construction pipeline, at Q4, are Hilton with 36 projects/3,927 rooms, Marriott International with 23 projects/2,674 rooms, and InterContinental Hotels Group (IHG) with six projects/591 rooms. These three companies account for 61% of the total projects in the region’s construction pipeline at the end of 2021.

The leading brands in New England for each of these franchise companies are Home2 Suites by Hilton with 15 projects/1,639 rooms, Marriott’s Fairfield Inn brand with six projects/610 rooms, and IHG’s Holiday Inn Express brand with five projects/465 rooms.

In 2021, there were a reported 24 hotels/2,731 rooms sold in New England with an average selling price per room (ASPR) of $158,340. These sales occurred in Connecticut, Maine, Massachusetts, and New Hampshire. Massachusetts had the highest number of total hotels sales, with 10 hotels sold for an ASPR of $181,685. The total number of hotels sold in New England, in 2021, is roughly on par with 2020s total of 23 hotels/2,673 rooms.

Marriott’s AC Hotels brand topped the charts for the highest ASPR of any hotel sold in New England in 2021, with its Albany St. Boston location selling in October for an ASPR of $434,146. In December 2021, the Union Bluff Hotel in York Beach, ME sold for the second-highest ASPR in New England at $389,831. Following the Union Bluff Hotel is another AC Hotels by Marriott in Portland, ME which sold in August for an ASPR of $375,281, and then Marriott’s Aloft Hotel Portland location sold for an ASPR of $326,115 in September.

JP Ford, CHB, ISHC, senior vice president and director of global business development. Ford leads all the strategic sales initiatives globally for Lodging Econometrics. He is an industry leading real estate advisory specialist with 35 years of experience providing business development, acquisition, and disposition services.

Ford serves as a trusted advisor to franchise companies looking to identify branding opportunities; ownership and management groups looking to add real estate assets and management contracts to their portfolios; lodging industry vendors seeking to increase product distribution and Wall Street analysts interested in evaluating hotel development, hotel sales transaction trends, and assessing investment potential in hotel companies and markets. He is also knowledgeable about tourism trends and the impact of macroeconomic trends on the lodging industry.

Ford chairs the committee responsible for gathering nominations and selecting the finalists for the Americas Lodging Investment Summit (ALIS) “Development of the Year” awards, which recognizes the most outstanding achievement in hotel construction and design in the country. Ford is also a committee member of the Caribbean Hotel and Resort Investment Summit (CHRIS), which selects the “Development of the Year Award” in the Caribbean. He is also a speaker at various hotel industry events and conferences and regularly contributes to several lodging real estate publications.

Ford is a Certified Hotel Broker (CHB) and a member of the International Society of Hospitality Consultants (ISHC).

For more information on the New England hotel construction and development pipeline or hotel transactions in New England, or any individual market in the U.S., the entire U.S., or any market: contact Lodging Econometrics.

Lodging Econometrics is the leading provider of global hotel development, decision-maker contacts and unparalleled customer service. Combining 40 plus years of industry experience, a real-time pulse on market trends, and extensive knowledge of key decision-makers, LE delivers actionable business development programs for hotel franchise companies looking to accelerate their brand growth, hotel ownership and management companies seeking to expand their portfolios, and lodging vendors/supplier looking to increase their sales.