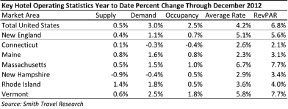

After a strong first half of the year, the New England Lodging market's performance slowed considerably. Likely explanations for the slowdown include Super Storm Sandy, concerns over the fiscal cliff and a softer convention period in Boston. On a positive note, the RevPar growth in both the Massachusetts and Vermont lodging markets exceeded the national annual RevPar growth.

Connecticut was one of only two states in the region that reported a decline in room nights sold (demand). Fortunately operators were able to achieve some growth in average rate, leading to positive RevPAR growth for the state. The decline in demand can be attributed to a variety of factors, however, a reduction in government contract demand and softening demand from the casinos are considered to be the primary factors.

Maine finished the year with an occupancy rate that was slightly higher than 2011. Although demand growth was modestly positive, an uptick in supply limited the state's ability to increase occupancy. The average rate for the state grew by 2.3% to $102.92 resulting in RevPAR growth of 3.1% for the year. Two notable markets that performed well were Bangor, which benefitted from casino and airport related demand, and Portland. The Portland market is getting a lot of attention from developers with four hotels proposed, including an Autograph, a Hyatt Place, Courtyard and Hilton Home2.

Lodging performance in Massachusetts, as a whole, is heavily impacted by activity in Boston. More than half of the hotel rooms in the state are located in Greater Boston with approximately one-quarter in the cities of Boston and Cambridge alone. Boston also serves as a critical gateway for the rest of New England as travelers frequently add extra days to business or convention trips to visit other areas of the region. Very strong convention demand in the first half of the year helped to drive occupancy growth, however, the second half of the year was a bit softer and that demand waned. While the Boston Convention calendar looks soft in 2013 many of the large group hotels have been able to compensate by booking in-house groups.

The performance of the New Hampshire market in 2012 was surprisingly tepid for an election year. Normally, the state experiences a strong surge in demand and average rate leading up to the Presidential primary as candidate teams and the media flood the state. In 2012, however, only the republican primary was of importance and the reorganizing of the primary calendar likely had an impact. Lastly, the state's winter tourism was likely impacted by a very mild winter. These factors combined contributed to minimal change in the statewide occupancy. Operators, however, were able to raise room rates which resulted in a 2.9% increase in state-wide average daily rate.

After a strong spring and summer, demand in Rhode Island began to slip in the fall. According to Smith Travel Research demand in the state finished the year up 1.8% compared to 3% for the country as a whole. While average rates grew by a strong 3.6% they still fell short of the national average of 4.2%. The good news for Rhode Island is that RevPar has come a long way since 2009 when the state's RevPar dropped to $60. However, the state's $73 RevPar in 2012 still falls below the peak $78 Revpar that the state experienced in 2007, and even further from the $83 RevPar in 2000. The Providence market experienced the strongest lodging metrics, while the Warwick (airport) market continued to experience weak performance.

Three transactions over the past year are likely to impact the Providence market. The Biltmore sold early in the year and a major renovation is underway. The Renaissance Hotel was purchased by the Procaccianti group, the former owner of the Westin, while the Westin recently sold to Omni, thereby changing the headquarter hotel flag.

One of the top performing states in the region was Vermont with RevPAR growth of 7.7%. While the state benefitted in the early part of the year from crews related to the clean up from Hurricane Irene, the drop off in demand in the second half of the year was not as strong as might have been expected, leading to an annual demand growth of 2.5% and an annual occupancy of 60.1%. Operators, however, were able to significantly increase room rates during the peak tourist seasons. Vermont is only one of five states in the country with an average daily rate over $120.

While demand growth in New England softened in the second half of the year, we remain optimistic about the prospects for the regional lodging market. Boston will have a softer convention year, but many operators have been successful in getting smaller in-house groups to compensate. Moderate economic growth in other areas of the region coupled with limited new supply should help occupancy levels remain at healthy levels and enable operators to continue to increase room rates at above inflationary levels.

Matthew Arrants, ISHC is the managing director of Pinnacle Advisory Group. For the firm, he specializes in market asset management, new development and operational reviews.

Prior to joining Pinnacle, Arrants worked in operations in various capacities with The Four Seasons Hotel in Boston, and Rock Resorts in Hawaii and Wyoming.

He holds a masters degree in Hotel Administration from Cornell University and a BA in Political Science from Hartwick College.

Tags: