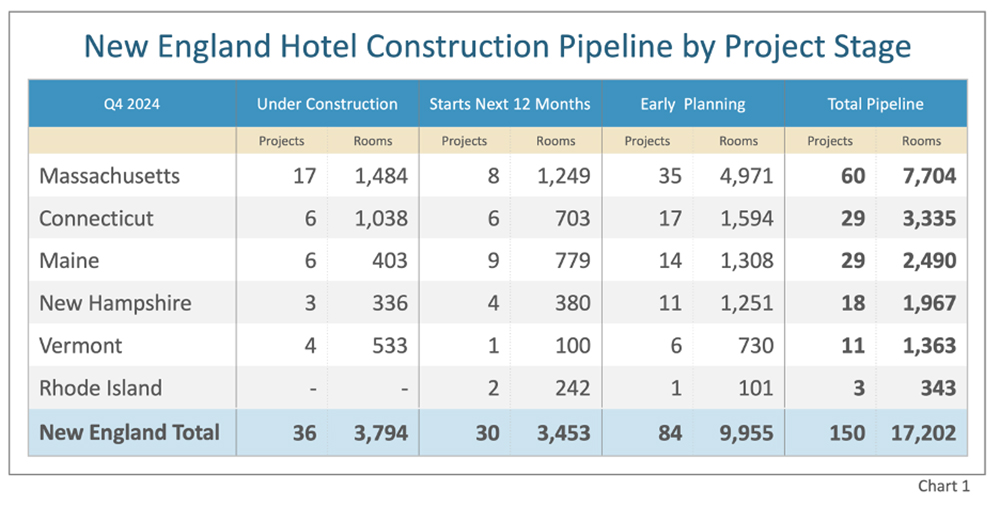

The New England hotel construction pipeline shows robust growth according to Lodging Econometrics’ (LE’s) Q4 2024 U.S. Hotel Construction Pipeline Trend Report. The region’s pipeline reached 150 projects with 17,202 rooms, marking significant year-over-year (YOY) increases of 10% in projects and 11% in rooms from Q4 2023’s figures of 136 projects and 15,468 rooms. Massachusetts dominates the regional hotel development landscape, claiming 60 projects totaling 7,704 rooms–representing 40% of all projects and 45% of rooms in the hotel pipeline in New England. Following Massachusetts, Connecticut and Maine tie with 29 projects each, though Connecticut’s room count is higher at 3,335 compared to Maine’s 2,490. New Hampshire follows with 18 projects and 1,967 rooms, while Vermont has 11 projects comprising 1,363 rooms. Rhode Island rounds out the region with the smallest pipeline: three projects totaling 343 rooms. See chart 1.

New England’s hotel construction pipeline by project stage showed strong momentum at the Q4 2024 close, with 36 projects and 3,794 rooms under construction – representing substantial YOY increases of 38% in projects and 36% in rooms. Looking ahead, 30 projects totaling 3,453 rooms are scheduled to begin construction anytime within the next 12 months. The early planning stage demonstrated healthy growth, expanding by 17% in projects and 14% in rooms compared to the previous year, reaching 84 projects with 9,995 rooms. Early planning projects are those that are more than twelve months away from starting construction.

Massachusetts leads both the under construction and early planning stages of New England’s pipeline with 17 projects/1,484 rooms under construction, and 35 projects/4,971 rooms in early planning. Maine has the most projects scheduled to start anytime within the next 12 months with nine projects/779 rooms.

In 2024, in New England, 13 new hotels opened adding 1,187 rooms to the open & operating supply. LE analysts are forecasting 23 projects/2,377 rooms to open across New England in 2025, for a 1.1% room supply growth rate. LE is forecasting another 18 projects/1,767 rooms to open in 2026.

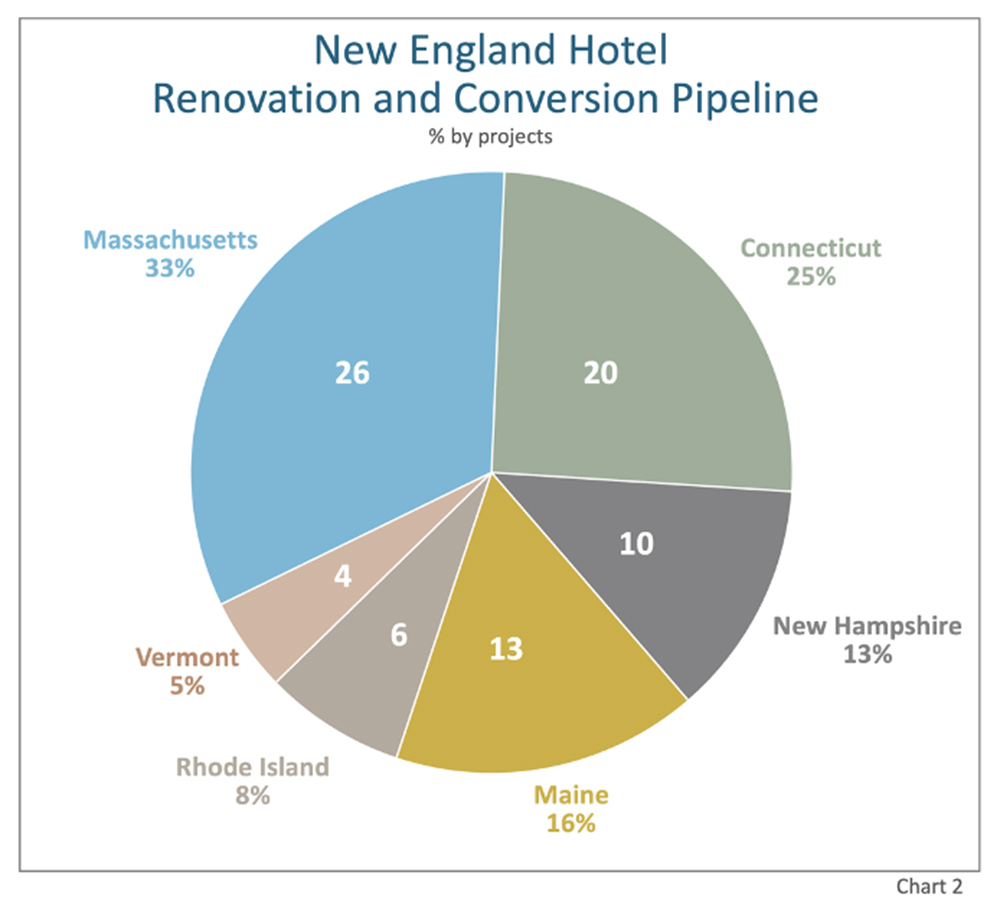

Hotel renovation and conversion activity across New England demonstrated significant growth at the Q4 2024 close as well, with year-over-year increases of 22% in projects and 29% in rooms. The region has 79 properties encompassing 8,964 rooms undergoing either renovations or brand conversions. Massachusetts led these repositioning efforts with 26 projects and 4,740 rooms under renovation or conversion. Connecticut follows with 20 projects totaling 1,684 rooms, while Maine has 13 projects with 860 rooms. New Hampshire has 10 projects comprising 815 rooms, Rhode Island shows six projects with 563 rooms, and Vermont rounds out the region with four projects totaling 302 rooms. See chart 2.

At the end of Q4 2024, three major hospitality franchise companies dominate New England’s hotel pipeline, with Hilton Worldwide, Marriott International, and IHG Hotels & Resorts collectively representing 57% of all planned projects. Within these companies, the standout brands were Home2 Suites by Hilton, Residence Inn by Marriott, and Holiday Inn Express from IHG. However, a substantial portion of the region’s pipeline – 37% of all projects–consist of independent, unbranded projects. A high percentage of these currently unbranded projects will likely select a brand as they progress through the pipeline.

For more information on the hotel development pipeline or hotel transactions in New England, or any individual market in the U.S., global city, country, or region: contact Lodging Econometrics 603.431.8740, ext. 0025, or info@lodgingeconometrics.com.

Lodging Econometrics is one of the leading providers of global hotel development intelligence, decision-maker contacts, and unparalleled customer service. With decades of lodging industry experience, a real-time pulse on market trends, and extensive knowledge of key decision-makers, LE delivers actionable business development programs for hotel franchise companies looking to accelerate their brand growth, hotel ownership and management companies seeking to expand their portfolios, and lodging vendors/suppliers looking to increase their sales.

JP Ford, CHB, ISHC, is senior vice president and director of global business development at Lodging Econometrics.

Ford leads all the strategic sales initiatives globally for Lodging Econometrics. He is an industry-leading trusted advisor to franchise companies looking to identify branding opportunities; ownership and management groups looking to add real estate assets and management contracts to their portfolios; lodging industry vendors seeking to increase product distribution and Wall St. analysts interested in evaluating hotel development, hotel sales transaction trends, and assessing investment potential in hotel companies and markets.

Ford chairs the committee responsible for gathering nominations and selecting the finalists for the Americas Lodging Investment Summit (ALIS) “Development of the Year” awards, which recognizes the most outstanding achievement in hotel construction and design in the country. Ford is also a committee member of the Caribbean Hotel and Resort Investment Summit (CHRIS), which selects the “Development of the Year Award” in the Caribbean. Ford is also a speaker at various hotel industry events and conferences and regularly contributes to several lodging real estate publications.

Ford is a Certified Hotel Broker (CHB) and a Member of the International Society of Hospitality Consultants (ISHC).