Nonresidential fixed investment in structures expanded 4.6% on an annualized basis during the second quarter of 2013, according to the July 31 gross domestic product (GDP) report by the U.S. Commerce Dept. This increase followed a 4.6% decline in the first quarter of the year.

Fixed investment in equipment rose 4.1% in the second quarter and overall investment in structures expanded 6.8%. Residential fixed investment increased 13.4% following 12.5% expansion in the first quarter. Fixed investment in the nation's residential sector has been growing at a double-digit clip since the third quarter of 2012.

Personal consumption expenditures expanded 1.8% in the second quarter, with spending on goods rising 3.4%. Expenditures on services, on the other hand, advanced only slightly at 0.9%. Expansion in real private inventories contributed 0.4%age points to real GDP growth for the second quarter after adding 0.9% during the first quarter.

Federal government expenditures declined 1.5% during the second quarter primarily due to a 3.2% drop in non-defense spending. Meanwhile, national defense spending dropped 0.5%. State and local government spending rebounded mildly, growing only 0.3% during the second quarter following three consecutive quarters of declines.

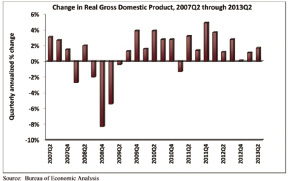

In total, real GDP expanded 1.7% during the second quarter following a revised 1.1 increase in the first quarter of the year.

ANALYSIS

"There was nothing particularly shocking in today's GDP report," said ABC's chief economist Anirban Basu. "As predicted, the economy expanded less than 2% during the second quarter, though many predicted today's GDP growth estimate would be below 1%.

"Today's report also indicates ongoing and gradual recovery in nonresidential investment," said Basu. "Investment in nonresidential structures expanded 4.6% during the second quarter, essentially offsetting the decline in activity registered during the first quarter.

"On Aug. 1, the government will provide additional details on which nonresidential construction segments generated the most growth in activity in June," Basu said. "During the past year, lodging has been the fastest recovering nonresidential construction sector, while segments such as office and commercial have produced only sporadic expansion.

"Overall, consumer spending remains at the heart of the nation's economic recovery, including in housing-related categories," said Basu. "However, today's GDP report is only modestly reflective of recent increases in mortgage rates, which could soften residential investment growth in the months ahead.

"ABC continues to forecast roughly 2% growth in the U.S. economy in 2013, though the first half was associated with sub-2% growth," Basu said. "It remains likely that the economy will accelerate a bit during the second half of the year, but there continue to be headwinds such as rising interest rates, sequestration and a loss in municipal confidence in the aftermath of Detroit's bankruptcy.

Key Federal Reserve officials are among those who anticipate a second half snapback and appear poised to alter monetary policy accordingly," said Basu. "Therefore, the benefits to the nonresidential construction industry associated with faster growth easily could be offset by the negative impacts of rising interest rates."

Reprinted from http://www.abc.org/NewsMedia/ConstructionEconomics/ConstructionEconomicUpdate/tabid/270/entryid/1261/nonresidential-fixed-investment-in-structures-expands-4-6-percent.aspx

Tags:

Nonresidential fixed investment in structures expands 4.6% - reprinted from www.abc.org

August 15, 2013 - Construction Design & Engineering

(1).jpg)

.png)