Outline of the requirements of and timelines for performing a 1031 tax-deferred exchange - by Brendan Greene

When buying or selling investment property, investors are often introduced to the idea of performing a 1031 exchange in order to defer paying capital gains taxes. Once the process has been presented to them, they’ll want to get in touch with a Qualified Intermediary (QI) to discuss the logistics of a 1031 exchange in order to determine if it will work for them. Below is a general outline of the requirements of and timelines for performing a 1031 tax-deferred exchange.

A 1031 tax-deferred exchange is a method allowed by Internal Revenue Code (IRC) §1031, whereby an owner of certain investment or business property may defer paying capital gains taxes on the sale of such property if the owner acquires “like kind” property within a certain period of time.

All real estate held for investment or business purposes may be considered “like kind” to any other real estate held for investment or business purposes. For example, raw land can be exchanged for an apartment building. The exchanger must be able to demonstrate that both the property being sold (the relinquished property) and the property being bought (the replacement property) is held for business or investment purposes. Note that stocks, bonds, partnership or LLC interests, personal residences or inventory do not qualify as like kind property.

Investors may have a variety of motives for exchanging their property. Such motives include: Deferring paying capital gains taxes; exchanging several smaller hard to manage properties for one larger easier to manage property; exchanging a partial interest in one property to a full interest in another; exchanging to a property an investor may use in his own practice (i.e. a doctor could sell a rental property and buy an office building he may use for his practice); exchanging raw land for rental property to generate cash flow; exchanging depreciated property to higher value property that can be depreciated; or even exchanging a rental property in Boston for a rental property in Florida, which may be allowed to later serve as a retirement home.

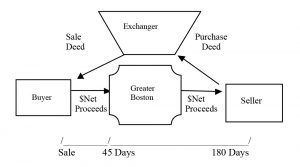

So, if an investor has determined that he meets the criteria for completing a 1031 exchange, Diagram 1 is helpful for visualizing the mechanics.

The exchanger assigns his interest in the purchase and sale agreement for his or her relinquished property to the QI. The QI receives the net sale proceeds so that the exchanger does not have actual or constructive receipt of the funds. The QI holds the net sale proceeds until they are needed for the close of the replacement property. The exchanger has 45 days beginning the day after the sale of the relinquished property to identify replacement property, and will do so by giving written notice to the QI. The exchanger then has 180 days to close on any identified replacement properties. The 180-day clock begins the same day as the 45-day clock: the day after the sale of the relinquished property. During this 180-day period, the sale proceeds are held in a federally insured account with local banks and are held in the name of Greater Boston Exchange Company, LLC.

In order for an exchanger to defer all capital gains taxes, there are two general guidelines that must be followed. First, the taxpayer must roll over the entire net proceeds into the replacement property. Second, the purchase price of the replacement property must be equal to or greater than the relinquished property.

Some transactional costs paid by the exchanger reduce realized and recognized gain and increase the tax basis of the replacement property. For instance, if the exchanger receives $15,000 cash back in the exchange but applies $10,000 to the brokerage commission, the exchanger will recognize only $5,000 taxable income and $10,000 will be added to the tax basis of the replacement property. Practitioners suggest that other transactional costs may also be deducted if “paid in connection with the exchange.” These costs typically include commissions, transfer taxes, finder’s fees, title insurance premiums, legal fees, intermediary fees, and recording fees.

Brendan Greene is owner, operator and attorney with Greater Boston Exchange Company, LLC (a subsidiary of McCue, Lee & Greene, LLP), Boston.

Atlantic Property Management expands facilities maintenance platform: Assigned two new facility management contracts in RI

Connecticut’s Transfer Act will expire in 2026. What should property owners do now? - by Samuel Haydock

Unlocking value for commercial real estate: Solar solutions for a changing market - by Claire Broido Johnson

Tenant Estoppel certificates: Navigating risks, responses and leverage - by Laura Kaplan

(1).png)

(1).png)