Investors often must juggle multiple investment options, like where to invest and with whom. When it comes to evaluating a Delaware Statutory Trust or DST investment, real estate investors should look for a firm that specializes in DST investments to help ensure their 1031 Exchange is executed, with no detail being dropped.

What to Look for When Searching for a Delaware Statutory Trust Company?

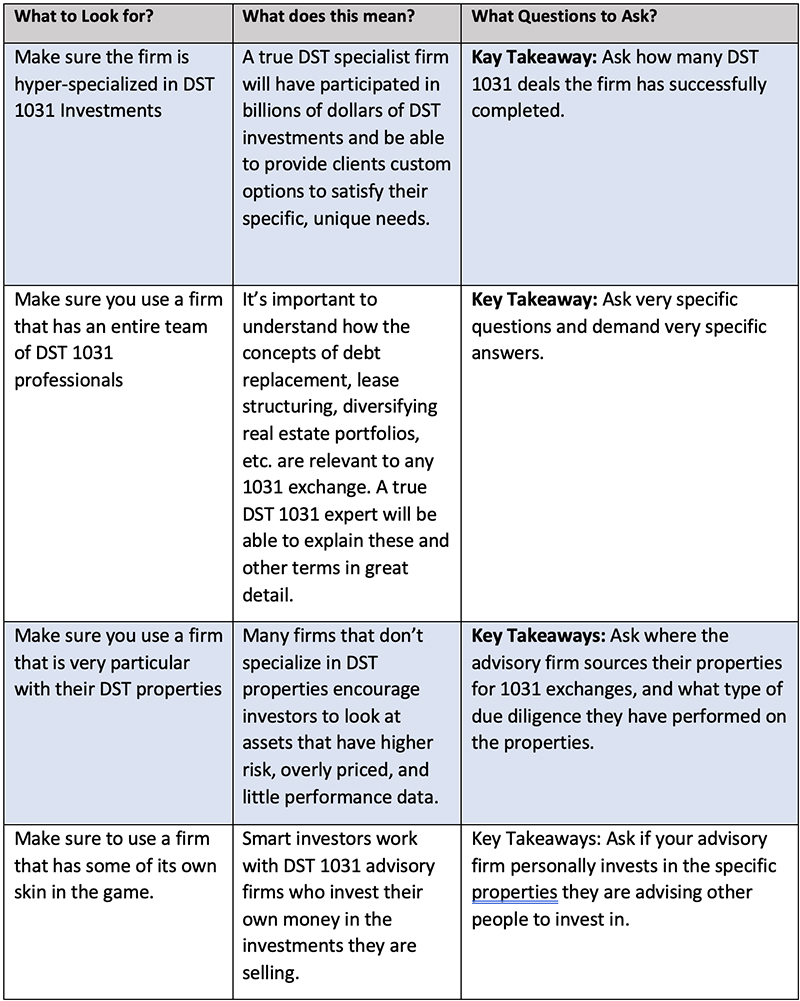

See the chart to the right.

What Kay Properties Can Do for You?

One of the tremendous resources offered to investors by Kay Properties is the kpi1031.com online marketplace. The www.kpi1031.com platform provides access to the marketplace of DSTs from over 25 different DST sponsor companies, custom DSTs only available to Kay clients, independent advice on DST sponsor companies, full due diligence and vetting on each DST (typically 20-40 DSTs) and a DST secondary market. Kay Properties team members collectively have over 150 years of real estate experience, are licensed in all 50 states, and are 1031 exchange DST brokers who have participated in over $30 billion of DST 1031 investments.

Sophisticated real estate investors know that choosing the right DST broker is critical when looking to place their 1031-exchange or cash-investment dollars into a DST.

Dwight Kay is the CEO and founder of Kay Properties and Investments, LLC, New York, N.Y.

Kay Properties is a national Delaware Statutory Trust (DST) investment firm. The www.kpi1031.com platform provides access to the marketplace of DSTs from over 25 different sponsor companies, custom DSTs only available to Kay clients, independent advice on DST sponsor companies, full due diligence and vetting on each DST (typically 20-40 DSTs) and a DST secondary market. Kay Properties team members collectively have over 150 years of real estate experience, are licensed in all 50 states, and have participated in over $30 billion of DST 1031 investments.

This material does not constitute an offer to sell nor a solicitation of an offer to buy any security. Such offers can be made only by the confidential Private Placement Memorandum (the “Memorandum”). Please read the entire Memorandum paying special attention to the risk section prior investing. IRC Section 1031, IRC Section 1033 and IRC Section 721 are complex tax codes therefore you should consult your tax or legal professional for details regarding your situation. There are material risks associated with investing in real estate securities including illiquidity, vacancies, general market conditions and competition, lack of operating history, interest rate risks, general risks of owning/operating commercial and multifamily properties, financing risks, potential adverse tax consequences, general economic risks, development risks and long hold periods. There is a risk of loss of the entire investment principal. Past performance is not a guarantee of future results. Potential cash flow, potential returns and potential appreciation are not guaranteed.

Nothing contained on this website constitutes tax, legal, insurance or investment advice, nor does it constitute a solicitation or an offer to buy or sell any security or other financial instrument. Securities offered through FNEX Capital, member FINRA, SIPC.