Pivotal Manufacturing Partners and Declaration Partners LP acquire 165,000 s/f facility from King Street and Baupost Group for $74m

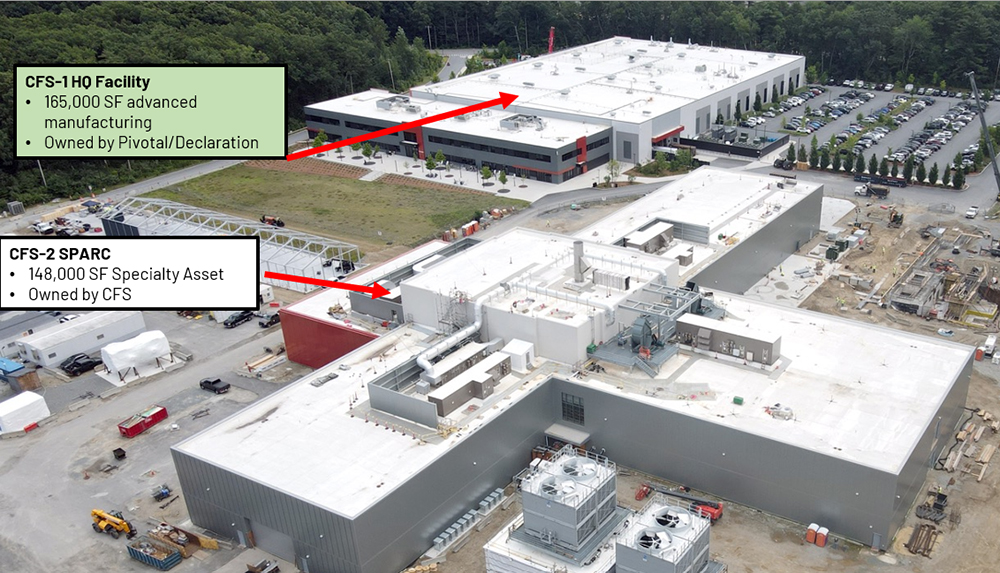

Devens, MA Pivotal Manufacturing Partners, a real estate investment platform focused on next-generation advanced manufacturing, and Declaration Partners LP have completed the $74 million acquisition of the Commonwealth Fusion Systems (CFS) global headquarters building at the company’s campus located at 117 Hospital Rd. Goldman Sachs provided financing for the transaction. CFS, backed by leading investors and strategics including Google, Nvidia, Temasek, and Mitsubishi, will continue to operate the asset on a long-term lease as its primary critical magnet manufacturing facility and corporate headquarters.

CFS is one of the world’s leading and largest private fusion companies, advancing rapidly towards its goal of commercializing fusion power and transforming global energy generation. The company has raised nearly $3 billion to date from a broad range of strategic investors including some of the largest technology companies, pension funds, and industrials businesses globally. The company recently announced an $863 million financing round alongside a significant milestone and strategic partnership with Google, signing a groundbreaking offtake agreement for CFS clean fusion power from its inaugural commercial power plant in Virginia, alongside corporate investment in the business.

Originally developed in 2022 by King Street Properties and The Baupost Group, the 165,000 s/f facility anchors the CFS Devens campus and houses it’s critical magnet manufacturing operations and global headquarters.

Pivotal, an advanced manufacturing focused real estate investment platform, has acquired and will manage the facility in partnership with Declaration, an investment firm with $2.2 billion in assets anchored by the family office of David M. Rubenstein.

“We are proud to acquire this state-of-the-art facility with support from our partners at Declaration and invest behind the transformative work underway at CFS,” said David Robbins, managing partner of Pivotal.

“We are confident in the strategic value of this real estate – an asset benefiting from significant, market leading existing infrastructure and heavy power access. As artificial intelligence and robotics continue to penetrate industrial supply chains driving new requirements for infrastructure, we are excited to own and operate this trophy real estate asset with specifications tailored to this next generation industrial renaissance.”

“Declaration is excited to partner with Pivotal on the acquisition of this best-in-class building with an attractive long-term lease profile and a well-capitalized tenant. We look forward to working with CFS as landlord to support their incredible mission,” said David Rabin, a Partner at Declaration Partners.

This acquisition is a landmark transaction as Pivotal scales its platform focused on advanced manufacturing real estate. By targeting industries critical to supply chain security, Pivotal delivers an essential real estate solution to the acute shortage of modern manufacturing product available to meet the needs of today’s most innovative industrial occupiers. The CFS headquarters is a strategic addition to the Pivotal portfolio, reinforcing its strategy to acquire and operate mission-critical assets fueling the next generation of advanced manufacturing.

Atlantic Property Management expands facilities maintenance platform: Assigned two new facility management contracts in RI

Tenant Estoppel certificates: Navigating risks, responses and leverage - by Laura Kaplan

New Quonset pier supports small businesses and economic growth - by Steven J. King

Connecticut’s Transfer Act will expire in 2026. What should property owners do now? - by Samuel Haydock

(1).png)

(1).png)