Many real estate professionals struggle with the concept of a price/unit, such as $/s/f of gross building area or $/acre. These metrics are often dismissed as "too variable" to be meaningful in an analysis of the market. Underlining this perception I have been told, "Appraiser's just don't get it; if a property sells for $205/s/f why are you adjusting for size differences at $55/s/f?" The answer to both these questions lies in the proper analysis of the behavior of buyers and sellers to changes in unit count.

Over very small changes in unit count, say +/- 10% of the subject, it is possible to properly reflect the actions of the market using only linear techniques. Even a circle may be modeled as a series of short straight lines over very small arc lengths; a technique used every time we digitally print or publish a document on the computer. Over relatively small changes in real estate unit counts (rentable suites, loading docks, s/f of conditioned storage...) the same is almost always true. The only caveat is to be careful of zoning ordinances that encourage a step-change in value with increasing utility based on a site reaching a minimum size that allows more intense development. Linear analysis; from our high school algebra, y=Mx+B or rewritten as it applies to a real estate market, Price/Unit = Slope of the Line (Unit Count) + a Constant; is a technique appraisers and analysts should already be using. The ubiquitous nature of spreadsheets such as Excel makes this technique perfectly painless and easy to place into a report. In fact, under USPAP's Standards Rule 1-1a we could argue this technique is now required to produce a credible assignment result, expected by clients, and commonly employed by other practitioners in the field. If you need instruction on the use of this tool the Appraisal Institute has no less than seven courses, seminars and books, as well as an entire Professional Development Program, dedicated solely to this topic.

However, real world analysis is often not so simple. When has your market analysis used only comparables within +/- 10% of the unit count of the subject? In my practice in rural Vermont, outside of the Burlington MSA, I will tell you there are never enough market data available over a reasonable time frame to meet this criterion. As we include more and more data to form a credible model of how buyers and sellers behave using a price/unit count metric the data refuse to behave using linear analysis techniques. The most common response of a market including real differences in unit count is an exponential decay in price/unit; resulting in a most common response from the analyst of, "Exponents... Drat!"

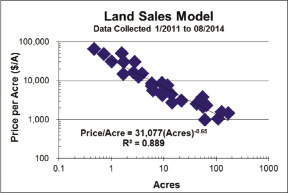

Exponential decay, from our high school algebra is simply a mathematical model that decreases at a decreasing rate. Rewritten as it applies to a real estate market; the incremental change in price/unit decreases as the unit count increases. I am a visual learner; even writing those words leaves me a little vacant and lost. I always prefer to express this concept graphically. The chart above shows actual data from a land market in rural Vermont, sorted only by including those arms' length sales with a single-unit residential highest and best use, no other discriminating factor was applied to sort the data set.

The resulting model; Price/Acre = 31,077(Acres)-0.65; explains 89% of all the variation in price over changes in parcel size that cover four orders of magnitude And changes in price/unit over three orders of magnitude!

No wonder many real estate professionals consider a price/unit count metric to be "too variable." Taken individually and out of context, a difference in price/unit of three orders of magnitude implies a market that is out of control, or a unit of comparison that makes no sense. However, as shown above, with simple non-linear techniques these individual data form beautiful patterns that explain the behavior of buyers and sellers, support unit count adjustments, and allow an analyst to make supported predictions outside of an observed range in size. Next month I will expand on these concepts and show the value these techniques have in your practice.

Sean Sargeant, MAI, SRA is the president of Vermont chapter of the Appraisal Institute, Rutland, VT.

Tags: