Marcus & Millichap" width="240" height="300" /> Tim Thompson, Marcus & Millichap

Marcus & Millichap" width="240" height="300" /> Tim Thompson, Marcus & MillichapPositive job growth has spurred significant household formation in the Boston Metro. Young professionals who are moving to the area seeking higher-paying employment opportunities are creating enough demand to nearly offset the vacancies resulting from the largest gain in rental deliveries in at least 15 years. While there has been a slight uptick in vacancies resulting from apartment deliveries outpacing demand, continuing household formation, increasing demand for metro rentals, and the high cost of single-family homes is expected to mitigate further vacancy increases.

Boston’s employment level remains strongest in biotech and technology, in part due to the city’s educational institutions and venture capital support that allow the area’s bioscience and technology companies to flourish. As a result, companies are locating new offices in the core, in the suburbs, and especially along the 128 Beltway to take advantage of the growing labor force. Though many companies are attracted to core areas such as Kendall Sq. and the Seaport, other companies are beginning to utilize spaces west of the 128 Beltway. It is anticipated that new suburban rentals along transportation routes will lease up quickly as young families move outside the 128 Beltway for a more affordable lifestyle and well-ranked suburban schools systems. Some residents are even moving as far west as Worcester, which has seen a 150-basis-point drop in vacancy in the past 12 months.

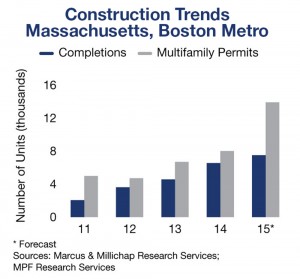

Developers have noted the impact of job growth gains on vacancy and are set to deliver a new peak level of units with construction focused in the core and close to proposed and planned corporate relocations along transportation routes.

Despite short-term trends in core apartment concessions, continuing job growth is expected to bolster occupancy. Net absorption has already surpassed that of 2014, which is evidence of the continuing trend. As a result, owners and investors continue to show extreme enthusiasm in Boston’s multifamily market, and continue to seek out local apartment assets.

In the core, demand for older product, primarily from indebted college graduates, will raise average rents in those buildings, while newer rentals are expected to offer concessions initially to lift occupancy. Some affluent residents, including many downsizing empty nesters, are rushing to new luxury rentals downtown, so even with new units becoming available, concessions during the lease-up phase will not significantly impact average effective rents. Overall, average effective rents are on the rise in core Boston and throughout Massachusetts.

Developers aren’t the only ones who have noticed the area trends of strong job growth and multifamily demand. In addition to institutional investors who have been attracted to the market by the recent development of a large number of top-tier assets, smaller investors are also driving demand for multifamily assets in Boston’s core. This has reduced cap rates, which across the state have averaged above 5 percent in the last four quarters, and enhanced the price per door in Boston’s core. At the same time, as cap rates compress in the core to sub-4 percent, some individual investors are turning to suburban product in search of higher yields. Buyers of suburban assets out to the 128 Beltway can see an additional 50 basis points on yields compared to assets in the core. Those willing to travel further west toward the 495 Beltway can see first-year returns up to 150 basis points higher than those in the core. Finally, trades of older assets in well-located areas near the city can obtain cap rates near levels seen with trophy trades, pushing value-add players farther out into the suburbs, a trend which is likely to persist.

Tim Thompson is sales manager at Marcus & Millichap, Boston, Mass.

.png)