The investment market in New England has undergone a dramatic evolution over the last several years, and many significant changes have taken place during just the last 12 months.

The major movement right now among real estate investors is home flipping. Flippers, or rehab investors, recognize the market has hit bottom. As they renovate a home and sell it, they believe the market will remain flat or even tick up slightly during the course of the project. This is a big change from years past, when there was still a good chance value would depreciate over a three or six month project.

"We weren't seeing flipping in the market in recent years," said Dan Breault, executive vice president and regional director for RE/MAX of New England. "We're experiencing it now because prices are beginning to inch up; it makes for a great market for investors to purchase distressed properties, rehab them and put them back on the market. Their investment is only going to go up."

Interest rates are also a driving motivator. As interest rates teeter at or near historic lows, investors who are not partial-cash or 100% cash buyers are able to assume a mortgage debt at a very manageable rate. At 4%, their return on investment will far outweigh the actual cost of the mortgage.

Traditionally, foreclosed or REO properties were the primary targets of savvy investors. Now, there is also an emphasis on short sales. It's better for the bank, but more importantly it's better for the family. Many Realtors report hearing that banks are still unwilling or exceptionally slow to modify loan agreements. However, they seem to be warming up to short sales - and for good reason. The timeline has improved greatly with banks and mortgage holders often evaluating viable offers within two to three months. In fact, beginning this month, Fannie Mae and Freddie Mac backed homes will provide feedback on offers within 30-60 days.

According to the National Delinquency Survey from the Mortgage Bankers Association, 6.94% of homeowners nationwide are past due on their mortgage. In New England, it is 6.84%. In addition, 3% of New England families are also past due by 90 or more days, compared to 3.05% nationally.

Nearly 20.8 million homeowners are also underwater on their mortgage, and even those easily able to stay current on their payments will likely be unable to sell their homes in the next five years without a short sale if the need arises.

Foreclosures still outnumber short sales but the gap is closing. Although short sales are often a tenuous and

frustrating process, a report by RealtyTrac found there were only 2,600 more REO sales than pre-foreclosure sales nationwide in January of this year.

According to Branden Lowder, a licensed Reealtor, Certified Investor Agent Specialist (CIAS) instructor and expert on distressed properties, investors should not panic at the reduction in foreclosures because there is tremendous opportunity for those who understand the new market. "It not always about the REO product anymore," Lowder said. "There is a whole world of opportunity for real estate investors beyond foreclosures, such as short sales, but many people remain focused on this narrow area."

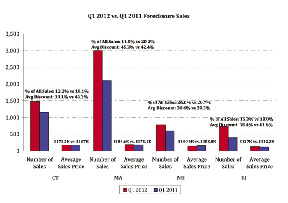

During Q1 of 2012, distressed property sales accounted for 26.46% of all home transactions in the United States, according to RealtyTrac. Connecticut (12.22%), Massachusetts (11.51%), New Hampshire (25.95%), and Rhode Island (15.26%) each finished under the national average. (Data for Maine and Vermont is not available.)

A frequent observation is that there seems to be no shortage of cash available for investment buyers right now. With low prices and low interest rates, many people see real estate as a far safer and more lucrative investment than the stock market. Whether they plan to flip the property in the short term or hold it long term as a rental, more people are realizing real estate is still capable of delivering a great return. Investor activity is expected to remain strong through the remainder of 2012 and beyond. While experts anticipate a steady supply of REO and short sale properties, the frenzy of activity created by a high level of demand will ensure they do not linger on the market.

As more of these properties are scooped up, and more families are freed from the burden of a suffocating mortgage, watch for traditional home values to begin to show modest appreciation.

Tags: