One of the advantages of being part of a worldwide real estate services firm is the opportunity to attend CB Richard Ellis' national meeting and to bring back thoughts from some of the best in the business:

The purpose of this article is to outline the road ahead, its likely turn, and what will occur on the other side.

The Road Ahead

Clearly, we have bounced through a lot of pot holes with more to come. At the same time, there is a new, "can do" attitude that is starting to develop. The gloom of the past 8 months is still there but those in the marketplace are realizing that they must live within it.

What this means is that deals are being done. Space is leasing. Small properties are selling. New companies are forming. Boston as one of the five 24-hour cities within the country and has truly a strong economic base. While the country's and Massachusetts' unemployment rate is 8.1%, our rate is 7.4%.

The Likely Turn

As Ben Bernacke outlined on 60 Minutes on March 15, 2009, we are in a financially induced recession. There is no question that our financial system has collapsed. We can not clearly project a turn until write-offs of bad loans have been taken. Unless we can unlock credit, we will remain in recession.

One of the people I had the opportunity to rub shoulders with at Summit 225 was Ray Torto, CBRE's global chief economist. His prediction is that our economy will hit bottom Q4 2009 to Q1 2010, depending upon if stimulus does or does not work. Real estate is a lagging market and his prediction as to when real estate hits bottom is:

* office 2011

* industrial 2010

* multi-family 2010

* retail 2010

Our economic downturn is not moderate nor is that of the real estate industry. From January 1, 2008 to recovery, the Summit 225 prediction was 19 quarters to recovery if the stimulus works and 23 quarters if it does not.

What's on the Other Side?

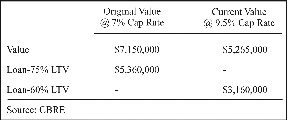

The answer is that it is back to basics. Within our office, we completed a 20 year study of capitalization rates and found that over this time period, rates were typically 110 basis points over the mortgage constant payments to debt service. With "constants" now at 8.5% to 8.75%, we are looking at 9.5% to 10.0% capitalization rates. 2003 to 2007 was a period of speculation. Many deals were done with 5.25% to 5.75% mortgage rates with little loan amortization. But for multi-family "Fannie and Freddie" interest rates are now at 7%+. To create a hypothetical example, if a property was originally bought with 75% financing and today the loan to value ratio is 60%, if that property's net income is $500,000 per year, the results are in the chart shown above:

What we are seeing is that values are at our less than loan amounts. In this example, value is now $5.265 million, which is less than the loan of $5.36 million. Unless income can be increased, on a "mark to market" basis, loans are under water. When loans come due in 2013 to 2017 is when we will start experiencing foreclosures. At the moment, actively of this type is limited to overleveraged properties.

The challenge is on how to manage through market change. In the case of CBRE, we out our clients first; always! Our objective is to perform beyond typical expectations and if a glitch occurs, to make it right.

Market knowledge is the first component clients expect and it is that knowledge which allows you to be creative and present a game plan. This is how true professionalism is created.

In conclusion, there are opportunities for those who can come up with solutions. We are in times of great opportunity. We must look at ways to add real, identifiable value as this will create relationships that last a long, long time.

Webster Collins, MAI, CRE, FRICS is executive vice president/partner of the valuation and advisory services group, CB Richard Ellis, Boston.

Tags:

Rise to the challenge: There is a new "can do" attitude that is starting to develop

March 25, 2009 - Spotlights