Samuels & Associates begins construction on 201 Brookline

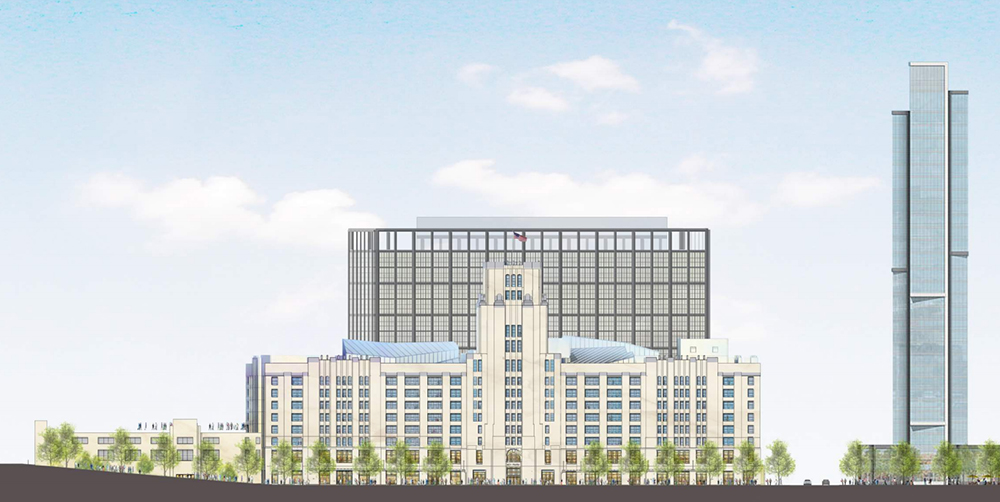

Boston, MA Samuels & Associates and institutional investors advised by J.P. Morgan Asset Management have started construction on 201 Brookline, with expected completion in spring 2022. The creation of 500,000 s/f of office and lab space at 201 Brookline is Phase II of the redevelopment of the 401 Park building. This will be a new 14-story mixed-use building with ground-floor retail and 13 stories for office, tech, and life sciences companies.

Samuels & Associates have signed the first two tenants to its expanded lab and office space at 201 Brookline Ave., located at the corner of Brookline Ave. and Fullerton St. in the Fenway neighborhood, next to the Time Out Market food hall and public open space at 401 Park. This will be a building with amenities which include a large outdoor terrace, a rooftop deck, and a conference center.

Third Rock Ventures will occupy 24,000 s/f. The company will move its headquarters from Back Bay to Fenway, a desirable location for biotechnology company creation given the neighborhood’s proximity to the Longwood Medical Area and Cambridge’s Central and Kendall Sq.

Tango Therapeutics has leased 65,000 s/f of space, designed to support the full complement of the company’s research, clinical, and translational medicine activities.

“This neighborhood has always been a place where ideas come to life,” said Peter Sougarides, principal at Samuels & Associates. “It’s clear that The Fenway is a thriving market for innovation. With construction of 201 Brookline underway, we are excited to have Third Rock Ventures and Tango Therapeutics join this innovation community as our tenants and neighbors.”

“Our portfolio companies are launched from bold ideas at the intersection of science, business, medicine and strategy – providing the best opportunity to make a dramatic difference in patients’ lives,” said Kevin Gillis, partner and COO at Third Rock. “We’re thrilled to be anchored within The Fenway’s budding innovation scene, and excited for the opportunity to tap into the array of amenities to match the energy and diversity we hold as important to our efforts.”

“We are very much looking forward to be expanding Tango Therapeutics into this beautiful space in the heart of The Fenway,” said CEO Barbara Weber. “Discovering and developing important context-dependent medicines for patients with cancer depends on state-of-the-art technology and collaborative spaces within which to work. At 201 Brookline we found not only the square footage we needed, but a vibrant neighborhood our team is excited about, is attractive to the broader talent pool and is tightly connected to the world-class academic and biotechnology ecosystem that surrounds it.”

“The Fenway has become a phenomenal backdrop for biotech and life sciences companies looking to grow and scale their workforce, in part because of the plethora of amenities, but more so the lively energy that permeates every corner of this neighborhood,” said Erik Grabowski, executive director, real estate Americas, at J.P. Morgan Asset Management. “We are proud to have partnered with a thoughtful developer like Samuels & Associates who has curated a unique and exciting mix of tenants and retailers to launch the next space for Boston’s innovation economy.”

Newmark Knight Frank is representing the landlord.

Atlantic Property Management expands facilities maintenance platform: Assigned two new facility management contracts in RI

Unlocking value for commercial real estate: Solar solutions for a changing market - by Claire Broido Johnson

New Quonset pier supports small businesses and economic growth - by Steven J. King

Connecticut’s Transfer Act will expire in 2026. What should property owners do now? - by Samuel Haydock

(1).png)

(1).png)