Highlights

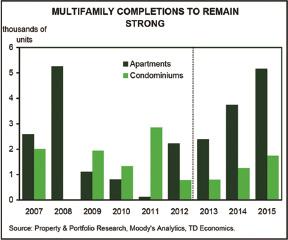

* The housing recovery to-date has been dominated by the multifamily sector. Both in terms of price growth and construction activity, the sector has bounced back quickly from the recession.

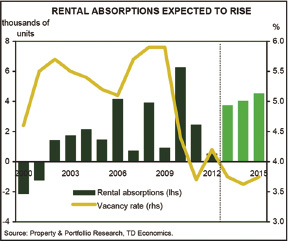

* Demand for multifamily residences will remain strong over the next several years, supported by improved household growth. Given limited upside to the current homeownership rate, 35% of new households are expected to be renters, which typically live in multifamily dwellings.

* This report considers the outlook for multifamily investment in 10 major metropolitan regions along the eastern seaboard from Boston to Miami.

* The markets that have the most upside potential are the ones that were hit the hardest during the most recent recession, including Miami, Tampa Bay and Jacksonville. Other southern markets including Atlanta and Orlando are also poised for improvements.

* In the larger markets of Boston, New York and Washington D.C., healthy population growth will sup- port housing demand, but poor affordability is likely to make the majority of these new households renters.

* In the more mature Northeast markets of Baltimore and Philadelphia, slower population growth will constrain demand, ultimately limiting the number of future development projects.

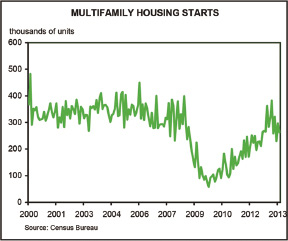

Over the last four years, the fastest growing segment of the housing market has been the multifamily sector. Since reaching a nadir of 82k in 2009, multifamily housing starts have risen over 350%. Price growth has been just as impressive. The price index for apartment buildings has rebounded 64% from its trough and is just 0.3% from its previous peak. Condo prices arrived later to the party, but they have still risen 25%, outpacing the growth in single-family dwellings.

It is not difficult to find the reason for the rebound in multi- family housing. The recession and foreclosure crisis turned homeowners into renters, and renters are much more likely to live in multifamily dwellings. At the same time, credit constraints limited the pool of first-time homebuyers, leaving them either staying at home or renting.

While these broad themes have played out in multifamily housing markets across the country, the real estate adage of "location, location, and location" still rings true. The strength in multifamily housing varies widely by local demand and supply fundamentals.

Over the longer run, multifamily construction is driven primarily by the outlook for local household growth and homeownership rates. However, in the short-run, vacancy rates and the pipeline of projects in development will determine how fast this demand is turned into additional supply.

In this report, we examine the outlook for multifamily housing investment in 10 major metropolitan areas along the eastern seaboard from Boston to Miami. The markets that have the most upside potential are the ones that were hit the hardest during the most recent recession, including Miami, Tampa Bay and Jacksonville. Other southern markets including Atlanta and Orlando are also poised for improvements. However, given the recent surge in multifamily construction, the risk of oversupply is mounting - especially towards the tail end of our forecast. In the larger markets (Boston, New York and Washington), healthy population growth will support housing demand, but poor affordability is likely to make the majority of these new households renters. Finally, in the more mature Northeast markets (Baltimore and Philadelphia), slower population growth will constrain demand, ultimately limiting the number of future development projects.

BOSTON

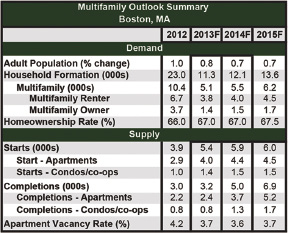

Following the most recent recession, the number of vacant apartments in the Greater Boston area reached an all-time high of 21,500 units. However, since mid-2009, the release of pent-up demand has resulted in a strong increase in absorptions (totaling 13,600 units) putting vacancies on a downward trajectory. Currently, the number of vacant apartments available for rent sits at 13,500 units, which is a touch below its historical average of 13,900.

With developers ramping up construction in early 2012, we expect a wave of new apartments totaling 11,300 units to make their way onto the market by the end of 2015. However, demand will continue to outstrip supply through to the end of 2014, keeping downward pressure on the vacancy rate. This pressure is unlikely to ease until 2015, when the estimated supply of new apartments (5,200 units) will be greater than our demographically driven estimate of renter demand (4,500 units).

Part of the reason why we've seen a surge in rentals reflects the fact that the cost of homeownership (as indicated by the median sales price) remains more than double the national average. The inventory of single-family homes (currently 2,547) has fallen by over 32% in the last year and supply is expected to remain tight over the near term. This will keep home prices elevated and maintain interest in the rental market.

On the condominium side, supply also remains tight. According to the Boston Association of Realtors, the inventory of existing condos currently sits at 1,580 units, which is down nearly 40% from year ago levels. With very little new supply, prices have grown 9.7% year-over-year. Only 3,800 new units are expected to make their way onto the market by the end of 2015, which will fall short of estimates of an additional 4,500 potential buyers. Consequently, in spite of some mild offsetting influences stemming from the rental market, condo prices will continue to rise over the forecast horizon.

Tight supply of both detached and multifamily residences has for a long time been a constraint in the residential Boston market. This has resulted in rents growing by an average annual rate of 3.7%, while home prices have increased by double the pace of income growth. In an effort to provide some relief, mayor Thomas Merino recently announced a $16 billion housing plan that would bring an estimated 30,000 units of housing to the city of Boston by the year 2020. This plan is still in the early stages and many details still need to be ironed out, but there is no question that the plan, Housing Boston 2020, would be positive for the metro's multifamily sector.

PHILADELPHIA

In the city of Brotherly Love, a complete overhaul of zoning codes, coupled with the release of pent-up demand for apartments - as evidenced by the rising level of absorptions - has led to a surge in multifamily construction over the past year. This was certainly needed. In the two years prior, the vacancy rate on rental properties had steadily decreased, with the stock of vacant apartments falling to its lowest level since the late 1980's. Currently, vacancies sit at 17,620 units - well below the historical average of 22,400.

In August of 2012, the City approved an updated zoning code, which was the first revision made in over 50 years. The revised code not only reduced the number of zoning classifications, but also removed many of the very specific zoning regulations, which had previously hindered numerous development projects. Since it has been implemented, the number of new construction projects has picked up considerably. We expect this trend to continue with multifamily starts ending the year at 3,600 units, before accelerating to 3,800 and 4,000 in 2014 and 2015, respectively.

This construction reflects building in both the rental and buyers' market, with the lions share coming out of the rental sector. Nonetheless, we expect to see some shift in demand towards the buyers' side. To be clear, rental demand will remain supported by a relatively resilient labor market, which is helping to support household formation among the key renters age cohort (ages 20-34). However, the metro maintains a relatively weak long-term demographic outlook. We forecast that population growth will average an annual rate of 0.5%, which is 0.3 percentage points lower than the national average. So, it's unlikely that the favorable near- term supply shortage dynamics in the renters market will be sustained.

In addition to the weak demographic outlook, relatively affordable homeownership rates will also weigh on renter demand over the medium term. As of August, the median price for a detached single-family home in the Philly metro remained 7% below its pre-recession peak. And, with home prices only expected to grow by an annual average rate of 3.5% over the next several years, prices are unlikely to return to pre-recession levels until mid-2015. This poses a downside risk for future renter demand growth, as some households may be enticed to take advantage of the low price, low interest rate environment. In fact, assuming a 20% down-payment on a median priced home ($221,000) and an average fixed mortgage rate amortized over a 30-year period, the monthly mortgage payment ($1,186) is actually less than the current asking rental rate ($1,209). However, given the more stringent lending requirements now in place and the fact that the labor market recovery remains in a fragile place, a mass exodus to homeownership is unlikely.

BALTIMORE

Up until the beginning of 2013, the recovery in Baltimore's multifamily housing sector had remained relatively inconsistent; showing strong gains in absorptions one quarter, only to be met by lackluster demand in subsequent quarters. Luckily, the number of new apartment complexes coming online during this time also remained subdued - averaging 1,500 units a year from 2010-2012 - which helped to keep vacancies in check. However, with stronger job growth and homeownership currently sitting at an all-time low, the rental market is finally poised to have a stronger, more sustained recovery. So far this year, the data has confirmed this story. Net apartment absorptions have risen to 4,700 (annualized) units over the first half of 2013, which is more than double the level of absorptions posted the year prior. And, with demand having marginally outstripped supply over the first half of 2013, the vacancy rate has edged down by 0.3 percentage points and currently sits at 5.5%.

We expect this trend to continue through the remainder of 2013, but our demand forecast is subject to some downside risk. Most notable is Baltimore's exposure to Washington. With federal spending accounting for approximately 29% of the metro's total Gross Metro Product (GMP), sequestration stands to take a sizeable bite out of the latter half of 2013 economic growth. Furloughs to the defense sector alone will result in a 20% reduction in the take-home pay of over 45,000 Maryland employees. In addition to cuts in defense, a concentration of Baltimore's research industries in science & technology and medicine will also feel the pinch given their heavy dependence on government funding. However, there is a silver lining. Baltimore has recently become a hub for U.S. cyber security operations, which is set to add 10k- 13k jobs to the local economy over the next several years. While this is unlikely to offset any short-term decline in rental demand as a result of fiscal tightening, it will ensure a steady stream of young, highly skilled professionals over the remainder of the forecast. Taking this into account, we anticipate job growth for 2013 to grow at a rate of 1.8%, before gradually accelerating in 2014 and 2015 to 2.0% and 2.3%, respectively.

Stronger growth in employment will provide a modest lift in population growth, which in turn, will boost household formation. For 2014-15, we estimate that 5,100 new renter households will enter the market. With only 4,100 new apartment units expected to come online during this same time period, the vacancy rate will fall by 0.4 percentage points in 2014 and another 0.3 percentage points in 2015.

WASHINGTON

Demand for apartment rentals has picked-up considerably over the first half of 2013, with net absorptions currently sitting at an annualized 5,300 units - up over 26% from the 4,200 units posted the year prior. While the recent bump in absorptions partially reflects the release of several years of pent-up demand, we believe it also captures a structural shift in preferences. With the median single-family home price in Washington currently sitting at $600,000, well above its pre-recessionary high of $529,000, and almost three times the national median price, there is no question that housing affordability remains exceptionally low in this metro. With prices expected to remain elevated over the medium term, the rentals market stands to benefit from a steady influx of prospective homebuyers who have effectively been priced out of the detached single-family buyers market. As a result, we expect household formations to add 6,200 new renters to the market in 2013, before accelerating to 6,600 in 2014 and 7,200 in 2015.

Fortunately, this robust demand will be met by a steady stream of new supply. With construction of new multifamily apartment complexes having ramped up in late 2011, we estimate that 6,000 new units will come online this year, with another 6,700 and 7,400 to follow in 2014 and 2015, respectively. However, with supply expected to be inline with demand, the vacancy rate will remain flat at 5.9% from 2013 through to the end of the forecast.

In addition to the rentals segment, the condo market also stands to benefit from the recent shift in homebuyer's preferences - albeit to a lesser extent. With condo inventories sitting just north of record lows, prices have pushed well beyond their pre-recession highs of $375,000 and currently sit at an elevated $406,000. While new supply - estimated 3,700 new units by the end of 2015 - should moderate price growth, it is still likely to be a constraining factor to demand.

The main risk to our forecast lies to the downside and is a result of sequestration and ongoing political uncertainty. Historically speaking, growth in the public sector has always had a relatively weak (negative) correlation with apartment demand. However, since the 2008-09 financial crisis, demand for rentals has been more strongly (positively) correlated with government job growth - an indication that federal spending has helped to prop up the local economy, and fuel apartment absorptions. If this stronger correlation holds over the forecast, our demand projections run the risk of overstating the level of future absorptions, as ongoing fiscal tightening will continue to weigh on federal employment.

NEW YORK

Over the past three years, demand for apartments has surged in the Big Apple, averaging 10,900 units - well above the historical annual average of 6,300. The ramp up in absorptions has been driven largely by a labor market that has been growing at an above trend pace. Historically speaking, total employment in New York's metro has grown at an average rate of 0.4%, about a fourth of the national average. However, since 2010, employment has grown by an average annual rate of 1.1%, with strong gains coming from professional, financial and business services, technology, and retail. This momentum is likely to carry through over the coming years, with job growth in 2014 and 2015 expected to grow by 1.2% and 1.3%, respectively.

In addition to above trend job growth, long-term demand for rentals will remain solid. New York has traditionally been one of the most expensive metros in the U.S. to a purchase a home, with the median home price in Manhattan coming in well above $1 million. Condo prices aren't much cheaper, with their median sales price currently sitting at $865,000. Because most renters do not have the down payment necessary to purchase a home - let alone afford the monthly payments - this ensures that a viable renters market will remain intact.

On the supply side, an estimated 7,000 new apartment units will make their way onto the market by the end of this year, as projects that began in late-2010 - spurred by the acceleration of absorptions - have started opening their doors to new tenants. Beyond 2013, growth in adult household formation will continue to accelerate, which will prove supportive of future construction projects. For 2014 and 2015, we anticipate construction of new apartment units to total 7,300 and 8,000, respectively.

While fears of overbuilding in the multifamily sector have plagued other metros across the U.S., there is little risk of this happening in New York. For starters, developable land in the Big Apple remains a scarce commodity. And, because the land that is available is subject to strict zoning codes and is astronomically expensive, it deters even the most interested developers. As a result, builders have started looking beyond the city's vast skyline and are ramping up construction in nearby New Jersey along the Hudson waterfront. By the end of 2015, it is estimated that 2,000 new apartment units will have made their way onto market. And, with another 4,000 units currently in the planning stages, development along the Hudson should continue to help ease supply constraints in the New York metro.

ATLANTA

Atlanta's labor market has enjoyed relatively robust gains throughout the economic recovery, with year-over- year employment growth steadily running half a percentage point higher than the national average. Perhaps even more important than the speed of the recovery, is the fact that the gains are becoming increasingly broad-based across sectors. Indeed, this has led to an influx of young professionals into the vibrant metropolis, which has helped lead to a surge in demand for apartment rentals. While this has sent the vacancy rate on a downward trajectory - falling by over three percentage points in the last two and half years - it still remains well above most other major metros across the east coast.

Nonetheless, spurred by improving market fundamentals, developers have re-entered the Atlanta market. While monthly data for construction of multifamily housing starts is volatile, the twelve-month moving-average indicates that there has been a steady upward trend since bottoming out in the summer of 2010. We anticipate that this momentum will carry through the coming years, as developers look to get ahead of anticipated demand and lock in projects at lower interest rates. As a result, multifamily housing starts for the renters market should end the year up a net 6,700 (annualized) units, before accelerating to 7,800 and 8,700 in 2014 and 2015, respectively.

This ramp-up in construction will bring 17,500 new multifamily units to the Atlanta market by the end of 2015, with 15,500 of these being rental apartments. Helping to absorb this wave of new supply will be a gradually accelerating rate of household formation, which is expected to bring 22,000 new renters to the market by 2015. With demand expected to outstrip supply over the forecast, the vacancy rate will fall 0.6 percentage points in 2014, and another 0.2 percentage points in 2015.

Beyond the market for rentals, the condo/co-op market, which was hit particularly hard during the 2008-09 financial crisis has also been showing signs of rebound. Inventories of available condos currently sit just north of 1,000 units, well below the peak of 7,200 seen at the height of the economic downturn. Limited supply has pushed condo prices higher - rising by 20% in 2012 - and has helped pull an increasing share of owners out of negative equity positions. With very few new condo buildings currently in the pipeline, developers have started converting existing apartment complexes to condos in an effort to try and keep pace with the surging demand. While this will provide a temporary fix - particularly in the downtown core - we expect construction of new condos to accelerate over the coming year, growing by 700 units in 2014 and 800 units in 2015.

JACKSONVILLE

Up until the beginning of 2012, the recovery in Jacksonville's rental housing sector was essentially non-existent. The market was awash in unoccupied rentals, with vacancies peaking at 12,500 units - more than double its historical average. However, since the beginning of last year, demand for rentals has picked up markedly, helping to absorb some of the markets excess supply. As a result, the vacancy rate is likely to end the year at 11%, but nonetheless remain a full 2 percentage points above its historical average.

Arguably, the sluggish recovery in Jacksonville's rentals sector can largely be attributed to a stagnant labor market, which, up until this point, has lagged most other metros examined in this paper. In fact, as of August 2013, total employment in the greater Jacksonville area sat at 603k jobs - well below the pre-recession high of 635k. However, the good news is that the recovery in the labor market is now finally underway. Over the first eight months of 2013, aver- age annual job growth accelerated to an impressive 3.3%, more than double the national average. We anticipate this momentum will continue over the course of the next several years, with employment growing at an average annual rate of 2.9%. Consequently, this should prove supportive of population growth, as the lure of better employment prospects attracts an increasing number of young professionals to the River City. Overall, Jacksonville's population will grow by an average annual rate of 1.9% between 2013 and 2015. This is a touch faster than the state as a whole, and is estimated to bring 7,900 new renters to the market. As a result of increased demand and a deceleration of new complexes coming online, the rental vacancy rate should fall to 5.9% by the end of 2015.

With demand in Jacksonville late to the housing-recovery party, the lagged response of construction has contributed to condos/co-ops inventories plunging to 1,029 units, down over 32% since last year. This has put upward pressure on condo prices, pushing the median price 21% higher - currently sitting at $97,000 - relative to last year. Despite these gains, median condo prices still remain well off their pre-recession highs of $239,200, leaving many mortgage holders still deeply underwater. Buyers should continue to be attracted back into the market, alleviating some supply pressures as higher prices encourage more owners to sell, and several new complexes make their way onto the market.

ORLANDO

Demand prospects for rental properties in Orlando have picked up markedly in recent years reflecting robust gains in the labor market, falling homeownership rates and improving demographics among the younger age cohorts. However, things haven't always been so sanguine in the land of Mickey & Minnie. With a local economy that is heavily dependent on tourism, Orlando was hit disproportionately harder than most other surrounding metros during the 2008-09 financial crisis. As a result, industries closely tied to the tourism that typically hire young adults, experienced wide spread layoffs. This had a knock-on effect for rental demand, ultimately sending the inventory of unoccupied apartments to well over 19,000 - almost three times the pre-recession historical average.

Given that the economic recovery is now firmly intact, the region is now benefiting from improved job growth and the release of pent-up demand for family vacations. Orlando has reasserted itself as the most traveled tourist destination in the U.S., with over 56 million tourists visiting last year alone. Not surprisingly, employment in leisure and hospitality has led the way in Orlando's job recovery. In fact, of the 18,400 jobs added to the local metro's economy over the last year, 4,300 of those jobs were concentrated in the leisure and hospitality sector. And, with a little help from Mickey & company, the magic of this sector will continue to shine. Disney recently announced that they would be expanding its Downtown Disney area to include a more elaborate dining-shopping-entertaining district. The project is currently slated to be completed by 2016, and is estimated to create an additional 4,000 fulltime jobs for the local economy

Despite rental inventories still remaining comfortably above their pre-recession historical average, construction of new apartment complexes has ramped up significantly in 2013, averaging 6,600 (annualized) units over the first 8 months of the year. We anticipate that apartment construction will reach 7,100 units by 2014 before accelerating to 7,500 units by the end of 2015. While the rental vacancy rate will end 2013 0.8 percentage points lower relative to the year prior, it will serve as an inflection point, as supply will outstrip demand over the remainder of the forecast horizon.

The main risk to our forecast lies to the downside and is a result of state regulatory changes. The Growth Management Reform bill passed in Florida back in 2011 removed previous restrictions that were put in place to prevent urban sprawl and put the authority of residential development solely in the hands of local governments. As a result, the risk of overbuilding - especially in the multifamily sector - will remain elevated.

TAMPA BAY

Demand for apartment rentals in the Tampa Bay area has bounced back considerably over the last year, helping to absorb some of the estimated excess supply left on the market as a result of overbuilding through the mid-2000s. Facilitating this process has been the fact that completions of new properties (currently at 2,600 annualized units) remains well below the historical (annualized) average of 6,200 units. Given that the construction of new properties only started to pick-up in late 2012, we don't anticipate a substantial acceleration in new apartments until sometime in 2015. Even then, demand is likely to continue to outstrip supply, which will ultimately keep downward pressure on the vacancy rate over the forecast horizon.

Helping to fuel this strengthening demand has been favorable population growth, which has benefited from a relatively robust labor market recovery. As of August, year-over-year growth in employment sat at 3.8% (44,500 jobs), which is more than two percentage points higher than the national average. Even more encouraging is that the job gains are becoming increasingly broader based with trade, transportation and utilities (+4.7% year-over-year), leisure and hospitality (+5.3%), educational and health services (+6.2%), and construction (+8.0%) all growing well above their respective historical averages.

Beyond limited supply and favorable demographics, Tampa Bay's rental market has also been benefitting from an exceptionally low homeownership rate. Since peaking in 2008, the homeownership rate has fallen by a whopping 7.8 percentage points and currently sits at 65.8% - just north of its all time low of 65.1%. With banks now adhering to stricter lending standards and foreclosures and short-sales still accounting for roughly 28% of single-family home sales, homeownership rates will likely remain at depressed levels for the foreseeable future.

In addition to rentals, the Tampa metro also has a relatively large condo market, which was hit particularly hard during the past recession. At the height of the crisis, inventories spiked to an all-time high of 4,000 units, while the median condo price plummeted by over 50%. Fortunately, since 2009, sales of condominiums have soared, reducing the inventory of available homes on the market to just over 1,000. While roughly 31% of these sales are still a result of foreclosures and cash buyers, the share of condos purchased through traditional channels is rising as gains in prices continue to pull an increasing share of owners out of negative equity positions. This virtuous circle is likely to continue. As more owners are enticed to sell and more supply comes online, this should help provide some moderation to prices over the coming few years.

MIAMI

The recovery in Miami's rental market has been under- way for several years; however, it has remained tempered by uneven growth in the labor market. This year also marked a strong shift in preference to the buyers' market, a fundamental that will remain in place going forward. Fortunately, a strengthening labor market will help offset some of these influences in the rentals market over the medium term. Sectors such as leisure & hospitality (+2.8% year-over-year), trade, transportation & utilities (+1.1%) and health & educational services (+0.5%) continue to show resilience, and to date, account for two-thirds of the private sector job gains this year. With total housing starts expected to accelerate over the medium term, employment in the construction sector, which currently remains 77,000 jobs below its pre-recession level, should also start contributing to job growth. Furthermore, despite the public sector having shed 4,060 jobs this year, Federal government hiring has finally turned a corner, having added jobs in each of the last three months.

As the labor market recovery continues to broaden out, demand for rentals will accelerate. We forecast that the renters demographic will grow by 3,500 individuals per year over the forecast horizon. This will absorb not only the 6,300 units set to come online between 2013 and 2015, but also help to whittle down the estimated 13,500 vacant apartments.

While the building of new apartment complexes is still in the early stages, construction of condominiums/co-ops - the larger of the two multifamily components - has been underway for several years. According to the Miami Association of Realtors, condo sales were up 7.9% year-over-year in August, marking the 21st consecutive monthly increase. With the inventory of condos sitting at near record lows of 8,458 units (6 months supply), demand continues to outstrip supply. As a result, the median sale price was up 27.5% in August from year-ago levels and currently sits at $180,000 - well off the recessionary lows of $92k. The combination of higher mortgage rates, rising listings and an estimated 11,200 new units by the end of 2014, should help to slow the recent breakneck growth rates in condo prices.

Beyond the typical real estate drivers, the Miami market will also continue to benefit from a high presence of foreign investment. In fact, as of 2012, Florida accounted for 23% of the total U.S. international real-estate purchases. No surprise, Miami was the most popular purchase area for international clients, accounting for 21% of the total inter- national real estate investment within the Sunshine State. Given home prices remain well below their pre-recession highs and the fact that short-sales are still accounting for 35% of total sales, Florida will continue to attract a high-level of foreign investment for the foreseeable future.

Beata Caranci, VP & Deputy Chief Economist 416-982-8067

James Marple, Senior Economist 416-982-2557

Thomas Feltmate, Economist 416-944-5730

This report is provided by TD Economics. It is for information purposes only and may not be appropriate for other purposes. The report does not provide material information about the business and affairs of TD Bank Group and the members of TD Economics are not spokespersons for TD Bank Group with respect to its business and affairs. The information contained in this report has been drawn from sources believed to be reliable, but is not guaranteed to be accurate or complete. The report contains economic analysis and views, including about future economic and financial markets performance. These are based on certain assumptions and other factors, and are subject to inherent risks and uncertainties. The actual outcome may be materially different. The Toronto-Dominion Bank and its affiliates and related entities that comprise TD Bank Group are not liable for any errors or omissions in the information, analysis or views contained in this report, or for any loss or damage suffered.

Tags: