Just look at moves that took place in 2010. Bain Capital moved to the Hancock Tower. This triggered a chain reaction of leasing by tenants who feared "shut-out". Then the property was sold for $930 million. The next move was MFS backfilling the entire vacancy left by Bain at 111 Huntington Ave. Then Wilmer Hale renewed its 370,000 s/f at 60 State St. - a 20-year lease!

The point is that in real estate, when you have good quality product, you can make the right moves.

THE 2010 MARKET

The 2010 market was driven by moves involving the best assets. In Boston office space, 2009 was a bad year with (1,703,365) s/f in negative absorption. It was corporate business decisions that drove the 2010 market and created positive absorption in the city of Boston office market, albeit small - 11,725 s/f.

Cambridge was at a much stronger 504,563 s/f of positive absorption for office and lab space.

The suburban office market was spotty. This is a huge market of 106,706,828 s/f and essentially broke even with only a slight positive absorption.

The market that is really suffering is the industrial market. This is a 144,199,242 s/f market with only darkness in the tunnel ahead. There was 1,017,174 s/f of negative absorption.

The point I am making is that it is corporate moves that count. It is these moves that will drive our market to recovery even without job growth; which leads into the key point of this article.

STRATEGIC THINKING

The Boston economy, in particular, is an "innovation economy." Because of this, we have performed relatively well in these "Great Recession" times.

The moves described above were accomplished without any real growth in employment. We are stuck at an 8.5% unemployment rate, which will probably last for another four years before we gain back lost jobs.

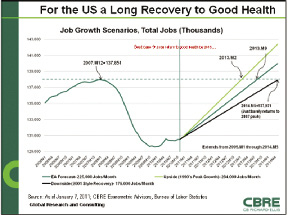

On January 7, 2011, I went to the Associated Industries of Mass. (AIM) forecast just to hear Ray Torto (CBRE's global chief economist) speak on these issues. When we talked, he was forthright on his projections. When we spoke, he said "We were wrong Web, its going to take to 2014 to 2015 before we gain all jobs lost" (see chart).

So how do you move forward under these very long-term, very slow-growth economic conditions? The answer is that for the typical person in the real estate business, you reposition the assets you have to bring them up to the level of quality where they can attract users who "make the right moves", occupy, and create long-term value.

In turn, this will require capital. Those with high leverage and little equity will continue to suffer but those who can make the right moves are clearly going to benefit.

Strategic thinking has attracted large amounts of capital to real estate. This is strategic capital. It does not invest at rates suggested by Pricewaterhouse Coopers's Real Estate Survey for Q4 2010, investment grade rates of 8.31% (going-in), 8.56% (exit) and 9.72% (discount).

The Hancock Tower rates are confidential but if you reduce each rate by 200 basis points, you will have a far better view of the thinking of how the major players look at the market.

The major players are investing in Boston/Cambridge/Waltham and the rates I describe herein are far closer to the market for core assets in these locations.

CONCLUSION

As I was thinking about this article last night, I thought of the three-legged milking stool. The legs of medical, pension and debt have just grown so long that we can not fit under the cow to do our job; we are being crushed. A reduction of government and its various debts is clearly required. At the same time, due to innovation and smart people within the real estate industry, the right moves can and will continue to be made. Huge risks are there if we do not suffer the pain of cuts to the legs of the stool but if we do, the next decade can be a very positive one for us all.

Webster Collins, MAI, CRE, FRICS is executive VP/partner of the Valuation & Advisory Group of CB Richard Ellis/New England, Boston.

Tags:

The 2010 market - The year of right moves and strategic thinking - 2011 and beyond

January 27, 2011 - Spotlights