The Industrial Market

The industrial markets have never been stronger. What has happened is that the build out of Devens with new high-tech biotech manufacturing with housing to service these buildings serves as the connector required to really make the I-495 West market sizzle. Worcester has been the beneficiary and is now listed as part of Greater Boston in CBRE’s Q2 2024 Industrial Market Survey. Total Central Massachusetts market statistics indicate a market of 60,435,586 s/f for Worcester.

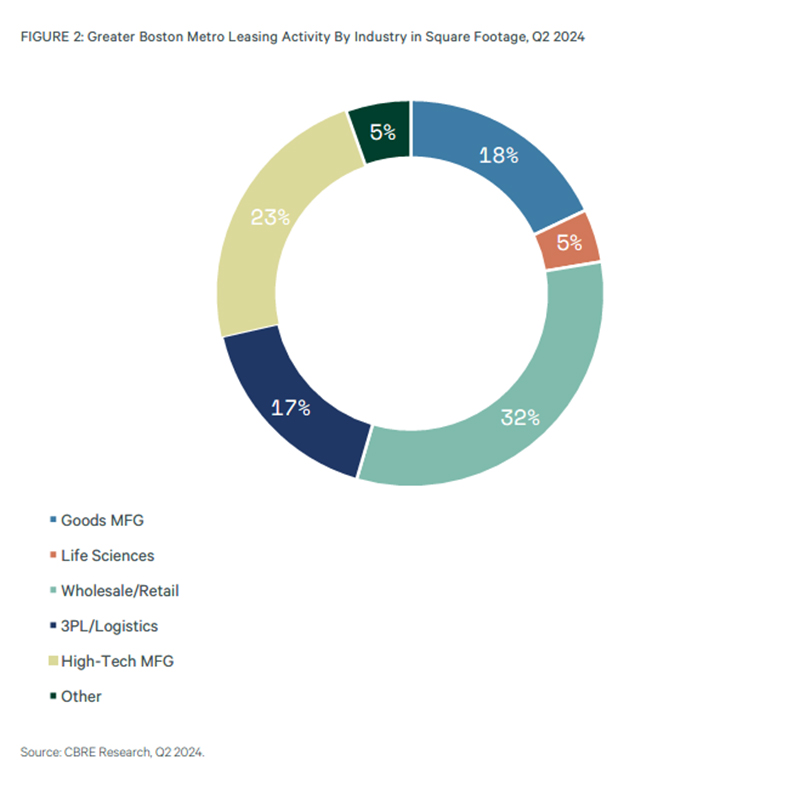

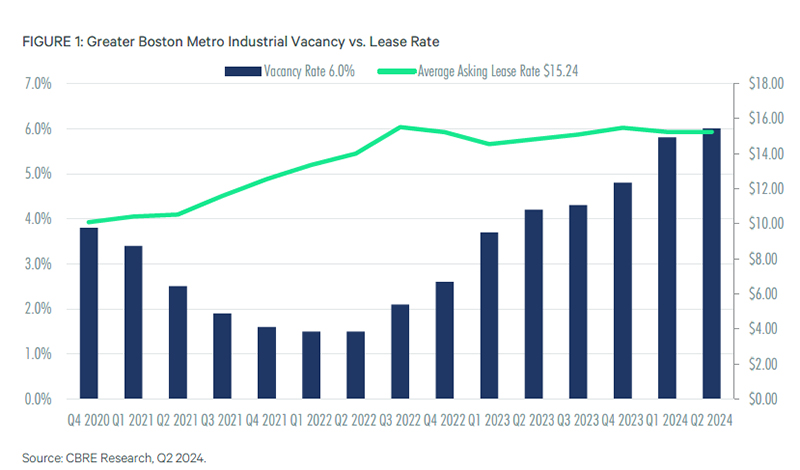

With Central Massachusetts added, the total industrial market contains 313,941,183 s/f. The average vacancy in this market is 6%. The average rent is $15.34 per s/f, NNN. The following summary of leasing activity tells the story:

In terms of lease activity, 32% represent wholesale uses, 17% represent logistics companies, 18% represent other uses, 23% is high-tech manufacturing, and 5% general. To the extent that life science uses are industrial, at 5%, is manufacturing, leasing activity of only 5%.

Overall, the Greater Boston market industrial real estate firms are projecting a very strong 4.2% vacancy rate.

The City of Boston Class B/C Office Market

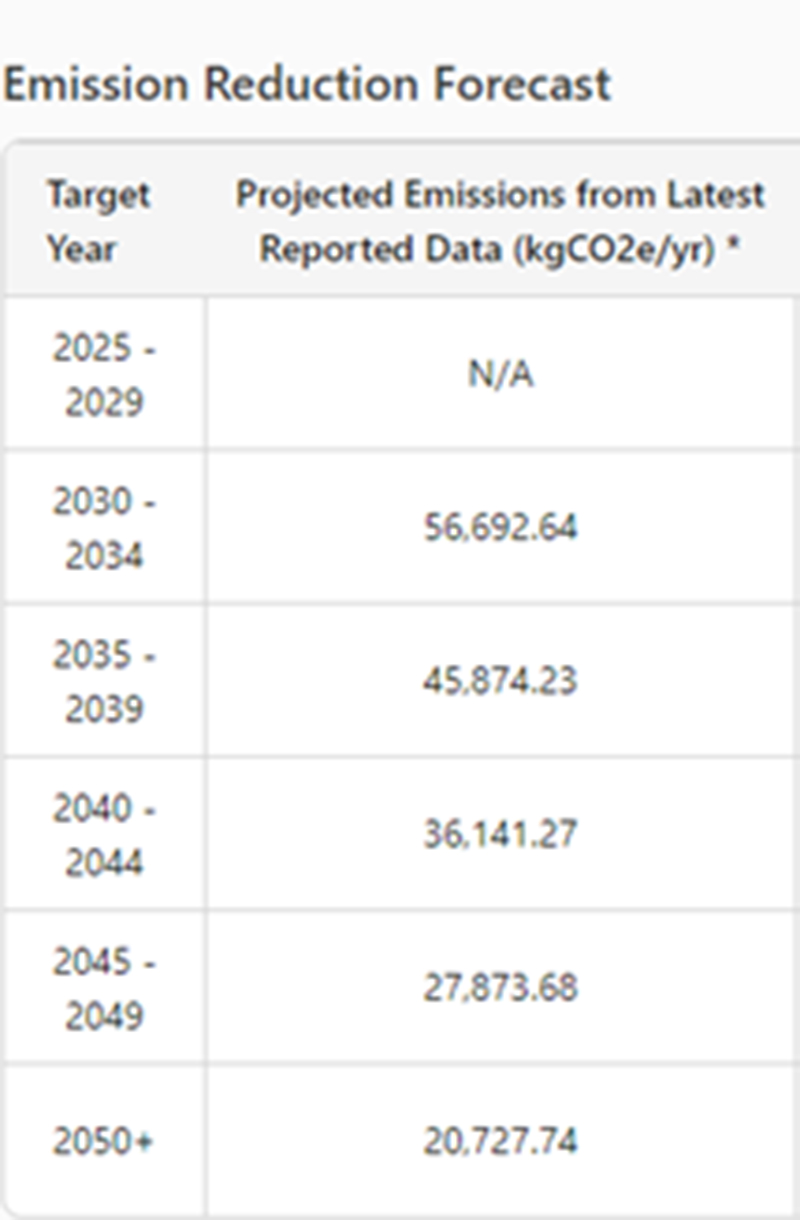

The wild card is the Boston class B/C office market which is experiencing many head winds. As this market continues to struggle, it faces an increase in operating expenses that cannot be passed through to tenants. This expense is to pay for what is the equivalent of a tax to pay for a building’s “emission metrics” for each office building beginning in 2025. This is known as the Building Emissions Reduction Disclosure Ordinance or “BERDO 2.0” this additional expense, I believe, will have a meaningful impact on B/C office buildings.

The wild card is the Boston class B/C office market which is experiencing many head winds. As this market continues to struggle, it faces an increase in operating expenses that cannot be passed through to tenants. This expense is to pay for what is the equivalent of a tax to pay for a building’s “emission metrics” for each office building beginning in 2025. This is known as the Building Emissions Reduction Disclosure Ordinance or “BERDO 2.0” this additional expense, I believe, will have a meaningful impact on B/C office buildings.

As a case study I asked for the computer printout for a 1988 built midrise office building in Downtown: The “Emission Reduction Forecast” shows a scale in cost for this building beginning in 2030 through 2049 with related cost.

Each building will be required to hire an expert to monitor.

As of Q2 2024, the class B/C office market in Downtown was experiencing a vacancy rate of 22.1%. The asking rent of $51.32 per s/f was a myth. For the preparation of this article, I conducted a broker survey and found that the taking rent within class B/C buildings was as low as $35-$38 per s/f with new leases at rates in the $40-$43 per s/f range. I also looked into the Back Bay and found a vacancy rate of 17.9%. The Seaport area has a 21.7% vacancy rate in class B and C office buildings made up of mostly gut rehabilitated former industrial spaces.

The major takeaway between vacancy rate versus asking rent is shown in the following graph. (Source – CBRE). In CBRE’s Q2 2024 office report, the following statement is made:

“Both the mayor’s proposal for a tax shift and the future commencement of BERDO 2.0 Emission Standard’s in 2025 could have meaningful implications for all properties throughout the city. Similar to other recent economic catalysts, these events could have similar disproportionate impacts on Boston’s divided asset classes as well.”

Webster Collins, MAI, CRE, FRICS is a managing director of BBG, Inc., Boston, Mass.