CBRE

On January 9, 2020 at the Intercontinental Hotel in Boston, CBRE presented its 2020 market forecast. This article will feature the highlights of the standing room only presentation. The central theme is centered around a huge change that has taken place over the past two decades. The Charles River, while once separated by a bridge too far to cross, has now breached and transitioned Boston downtown from a financial center to a tech center. Amazon, who once occupied 35,000 s/f of space, now has 750,000 s/f. “The Faangs,”* which had 100,000 s/f, now occupy 1,800,000 s/f and will double their size in 3-5 years. Boston is one of the top cities in the world for real estate investment.

The Five Pillars of Boston

The #1 pillar is talent. It takes a total of 12 million s/f to cover occupancy and housing requirements for the talent growth that has taken place in Boston.

The #2 pillar is foreign money. Over $8 billion in foreign capital has been invested in Boston over the past two years. Boston is truly an institutional market. With much of Europe carrying a 0% interest rate for international capital, Boston is a place for a return on investment.

The #3 pillar is live-work-play. A new definition of Class A was provided by CBRE’s panel: “Class A is whatever it takes to get the best tenant into your building.” Boston is facing real shortages now.

The #4 pillar is ease of doing business. Burdensome regulation is limited. For every rule there is an exception. The city of Cambridge has had no mid-rise apartment construction since the level of affordable housing was raised to 20%.

The #5 pillar is infrastructure. Of all major cities, Boston ranks #5 in infrastructure and ease of access. The above five pillars have led to astonishing statistics for the city of Boston

Urban Boston Has an On-Demand Economy

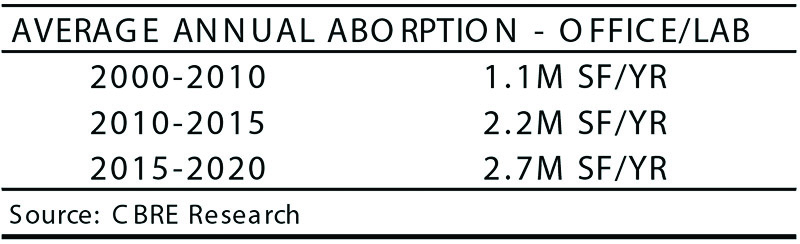

Over the last two decades, the urban office and lab markets have grown by leaps and bounds.

The two greatest growth engines in this time frame have been life science (29%) and technology (36%). Historic rent growth has been the result. Between 2017 and 2019, rent growth within the urban office market averaged 15.9% per year. The Central 128 suburban office rent growth mimicked Boston at 11.6%.

Urban Lab rent growth was even stronger. The lab growth is 25.1% with rents now averaging $94 per s/f triple net (NNN).

In terms of the suburban markets, the term used today is “dead as we know them.” The suburbs have completely changed. The buildings in demand are high bay warehouses. Between 2017 and today, 1.9 million s/f of high bay warehousing has been constructed. 97% of that space is now occupied. As a side note, the greatest growth in rents has been in the industrial market. Across the board, from Q1 2017 to Q4 2019, asking average rents have increased from $7.18 per s/f NNN to the $10 per s/f NNN level.

Conclusion

Overall, Boston’s rate of employment growth in 2008 to 2019 was double the pre-2008 growth rate following the 1990 recession. The type of growth is from software companies. Employment growth is primarily in the 25-39 age group.

When all five pillars are combined, CBRE has concluded that the Greater Boston real estate market “will grow for the next 4-5 years.” There is “no recession in CBRE’s forecast.” Further interest rates are forced up by inflation and “there is no inflation in CBRE’s forecast.” The central theme of CBRE’s program was “growth is everything that matters.” Worldwide, the “places of greatest growth” are the United States and the United Kingdom. In the United States, in Boston, we will have “continued near term rent growth.” “Lab growth still is in its early innings” and a “mobile agile workplace is here to stay.”

Webster Collins, MAI, CRE, FRICS is an executive vice president in the valuation and advisory services group of CBRE, Boston, Mass.

* acronym for the market’s five most popular and best-performing tech stocks, namely Facebook, Apple, Amazon, Netflix and Alphabet’s Google. According to article written by Will Kenton, https://www.investopedia.com/terms/f/faang-stocks.asp