Like with other going concern properties, golf courses and marinas include a combination of real estate, and non-realty. And there is an important distinction between the two. Land and buildings (sticks and bricks) are real estate, while real property is the bundle of rights flowing from the ownership of real estate. Real estate and tangible personal property can be touched or observed, while real property rights cannot. There are accepted guidelines for discerning whether something should be considered real estate or personal property, and each has common tests for determining that difference. When an object is permanently affixed to land or buildings, the object is usually considered part of the real estate. If an object is not permanently affixed and is movable, it is usually considered personal property. Non-realty can be broken down further between tangible non-realty (inventory, furniture, fixture & equipment) and intangible non-realty (business & goodwill) which accounts for things like a trained workforce, licenses, future bookings, logo, trademark and the like.

It is incumbent on the appraiser to allocate the overall going concern value into these various buckets. As stated in Standards Rule 1-4, part (G): “When personal property, trade fixtures, or intangible items are included in the appraisal, the appraiser must analyze the effect on value of such non-real property items.” When a business is intertwined with the real estate, financial institutions typically require a breakout of the collateral. For that reason, lending guidelines often include statements that instruct appraisers to allocate values when going-concern value is sought. For example, the U.S. Small Business Administration’s (SBA) appraisal requirements include the following: If the appraisal engagement letter asks the appraiser for a business enterprise or going-concern value, the appraiser must allocate separate values to the individual components of the transaction including land, building, equipment, and business. When the collateral is a special purpose property, the appraiser must be experienced in the industry. (U.S. Small Business Administration 2009). Similarly, the Federal Deposit Insurance Corporation (FDIC) appraisal guidelines state value opinions such as ‘going-concern value,’ ‘value in use,’ or a special value to a specific property user may not be used as market value for federally related transactions. An appraisal may contain separate opinions of such values so long as they are clearly identified and disclosed (FDIC 2010).

Property tax assessments require an estimate of market value of real property and, in some cases, personal property. In most jurisdictions, intangible assets are not assessed—at least not as part of the real estate. Because some property types are bought and sold with a business in place, it is necessary to analyze the price to determine whether any consideration was paid for intangible assets. This is one of the most controversial and poorly executed steps taken by appraisers who perform these types of properties. Most often the appraiser will take the value of the personal property from the balance sheet, however this is an accounting exercise based on depreciation schedules and it has no correlation to real world values. In addition, most appraisers simply state that no business exists, thereby covering their minimum standard requirements. This is really a cop-out by the appraiser. By claiming there is no business or goodwill then no deduction is required, thereby maximizing the loan amount and making it easier on the appraiser. While this would appear to be a win-win situation, in reality it is a disservice to the client/lender.

The courts have attempted to define intangible assets by identifying specific attributes. Based on various sources, a multi-step test can be used to help determine the existence of an intangible asset, as follows: 1. An intangible asset should be identifiable. 2. An intangible asset should have evidence of legal ownership, that is, documents that substantiate rights. 3. An intangible asset should be capable of being separate and divisible from the real estate. 4. An intangible asset should be legally transferrable. If the real estate cannot be sold without the intangible, then the intangible is probably not an asset on its own but, instead, part of the real property. For example, the Waldorf Astoria hotel in New York City may sell for a premium because of its historic significance. Some might argue this historic premium represents intangible value. However, the hotel cannot be sold without its historic significance in place, so the historic significance is not an intangible asset that can be valued separately from the real estate. Instead, it is an attribute of the real property and should be included in the value. The same is true for other real property attributes that are intangible in nature, such as prestige and reputation. All these are intangible in nature but cannot be sold without the real property, nor can the real property be sold without them. These attributes/influences can enhance the value of the real property, but they do not have a value of and to themselves. The point of the separability test is that the intangible asset should be capable of being separate and divisible from the real estate. There are intangible assets, such as goodwill, that might not be easily separated from a business. But the question is whether the business (which may include goodwill) could be separated from the real estate. An intangible asset must also be legally transferrable. In some cases, intangible assets can be sold separately from the real estate. For example, the owner of an ice cream store, liquor store, car wash, and the like can sell the business separately from the real estate. Many small businesses transfer this way. However, it is also common for real estate and intangible assets to transfer together. This transferability condition simply requires the ability of the asset to be legally transferred, with or without real property included. This is most often achieved by the owner of the business leasing the real estate, thereby separating the income stream, rent to the real estate and cash flow or net profits to the business.

When an appraiser is tasks with determining the real estate value of a golf course, they can estimate the fair market rent and convert that income into a real estate value by using a real estate capitalization rate. The task of finding rent-comparable properties is daunting, since they are few and far between. Rents for golf courses are usually based on a percentage of sales. This is common for other types of real estate like certain retail stores, grocery stores and restaurants. Most restaurants can afford to pay between 5% and 10% of their sales towards market rent. Grocery stores can afford to pay between 1% and 2%. Golf courses operate with a higher profit margin and can usually pay between 10% and 30% of gross sales on market rent, depending on the sources of income. Several factors come into play, like lease terms (gross vs net), required capital expenditures and importantly, sources of revenue. Different sources or “departments” are more profitable than others.

An alternate approach is to assume that the owner takes a hands-off approach to management, and they hire a company to run the facility. Property owners who choose to have a passive role in operations can hire a management company to oversee the business and real estate. The management fee approach is based on the premise that any intangible value arising from a going-concern can be measured by capitalizing the management fee necessary to compensate a third party to run the business. Theoretically, under this method, any value arising from the management of the business has been excluded. Under the theory of substitution, no one would pay more for a business or building than the presumed cost to replace it.

For lodging properties, the management fee technique is commonly called the Rushmore Approach. The Rushmore Approach was introduced by Stephen Rushmore, an appraiser and author. Critics also argue that including a management fee and franchise fee in an income capitalization approach removes no intangible value. The argument states that management fees are standard expenses in an income approach, often included in the appraisal of other properties such as office buildings, apartments, or retail buildings.

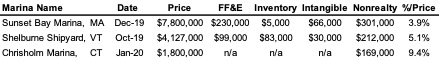

Lastly, we also rely on purchase price allocations by investors as a way of allocating the difference between real estate and non-realty. With marinas for instance, we have been able to research and show how much a buyer has ascribed to non-realty from the actual market transaction. Typically, when allocating non-realty from the going-concern we find the amount generally falls between 3% and 10%. Specific examples include the following:

This article should show that it is inappropriate to outright dismiss the potential for business value or goodwill when appraising certain property types. And why it is so important to hire a professional that specializes in these property types, since it is not a concept often faced by general property appraisers. The data and market support is difficult to obtain, but ignoring the issue is not a valid excuse.

Jeffrey Dugas, MAI, SGA, is founder of Leisure Appraisal, Cheshire, CT and Boca Raton, FL.