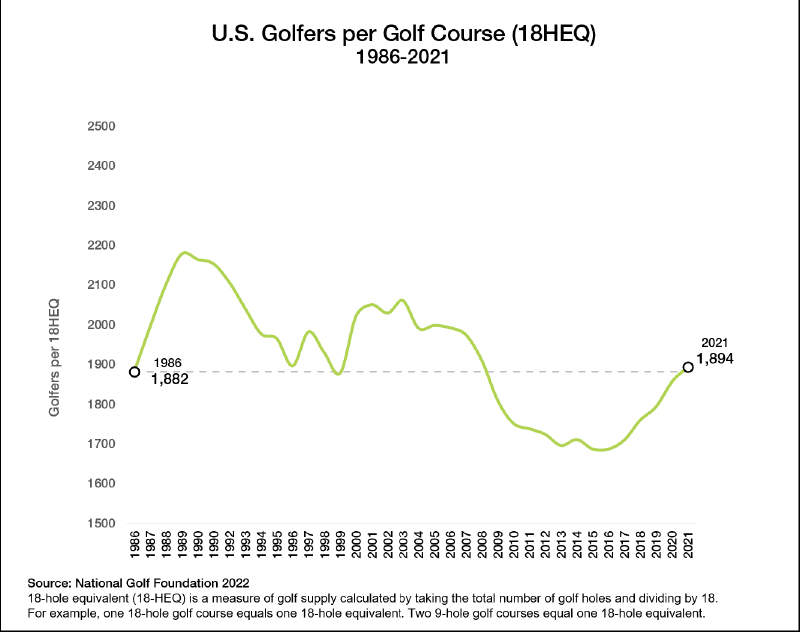

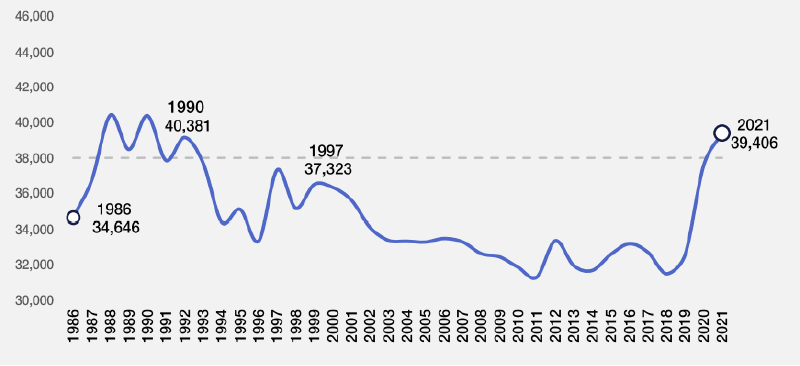

The national golf market last peaked around 2000 with a market participation rate of 11.1%, but it was the demand felt during the late 1980s that fueled the building boom experienced in the late 1990s. As indicated by the graph below, in 1990 there were just-under 2,200 golfers per 18-hole golf course. At that time, the average course hosted 40,381 golf rounds. After 2000 and the effects of 9/11 the market began to decline. The number of core golfers grew from 24.7 million in 1995 to 28.8 million in 2000, and peaked at 30.0 million in 2005. But with the addition of thousands of new golf courses now on line, and despite an 11.1% participation rate, the number of rounds per course dropped to the low to mid 30,000 range.

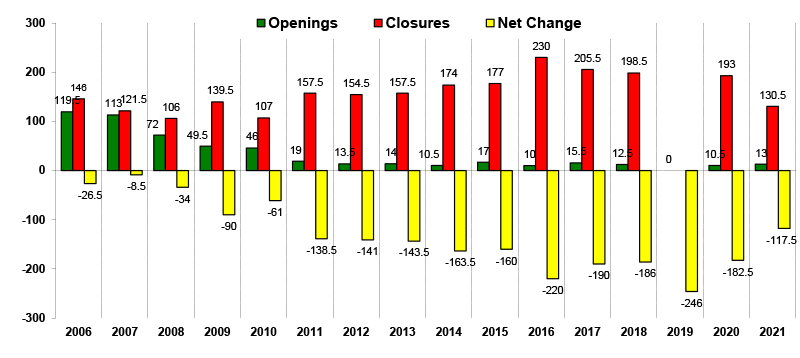

During the boom years, or between 1995 and 2000, roughly 350 courses a year were constructed. That number peaked at 399 in 2000. Since that time there has been a steady decline in the number of golf courses built and beginning in 2006 the market has actually begun shedding golf facilities. For the next 13 years we saw an accelerated reduction of golf courses, peaking in 2019 when 246 net facilities were removed from service. Even as rounds increased in 2020 and 2021, there was a net loss of 182.5 and 117.5 courses, respectively. So the market was able to correct itself.

The number of golfers per 18 holes is returning to a balance seen decades ago, before the building boom that added over 4,000 courses to the U.S. market. This oversaturation, coupled with the burst of the housing bubble and ensuing financial crisis, resulted in an imbalance between golfers and golf courses for much of the past decade or so. Amid the increase in golfers during the pandemic and the ongoing correction that’s reduced the number of courses, there are indications of a supply/demand equilibrium not seen in years. As seen below, the number of rounds played per golfer has reach levels not seen since 1990. What’s different today is that construction costs have grown so much that new construction in most cases is not financially feasible, despite the rise in values.

Conclusion: Most owners/operators surveyed expect there to be some long-term positive impact on market demand factors going forward as a larger percentage of employees will continue to work from home even after the virus is fully under control. And, they are anticipating that the 2020 golf season has also re-energized demand amongst the golfing public that will carry over for some time. Therefore, considering the above factors, it is our opinion that the golf industry will continue to remain strong since there is little threat of new construction given the rise in costs from chain supply issues. And, work from home/remote will likely remain in place for some time going forward. And, most people will continue with outdoor activities that allow for social distancing, as fallout from COVID-19 remains ongoing.

Jeffrey Dugas, MAI, SGA, is founder of Leisure Appraisal, Cheshire, Conn.