While recently attending this year's Hunter Conference in Atlanta, I was encouraged by the many conversations I had with hospitality industry executives who confirmed that the hotel industry is indeed in a growth phase and that good times have arrived. This is evidenced by growing profits in their own companies in 2014.

The industry as a whole is extremely positive after hotel operating performance set record highs in 2014. Some New England hotels have been slow to keep pace but, overall, the region is closely trailing average nationwide growth for revenue per available room (RevPar).

Many hotel companies and owners are also reporting strong increases in advanced group bookings for the leisure, corporate and commercial sectors. Bookings so far in 2015 are well ahead of 2014, excellent news as the industry continues to look ahead to another strong year.

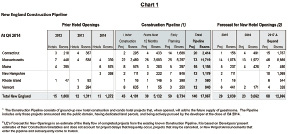

The Construction Pipeline

The Total US Construction Pipeline stands at its highest level in six years, according to a recent report by Lodging Econometrics (LE), New England Hotel Realty's sister company. The Pipeline has now posted five consecutive quarters of double-digit Year-Over-Year (YOY) growth. In both the third and fourth quarters of 2014 increases were particularly impressive, exceeding 20%.

Like the US, the New England Hotel Construction Pipeline ended 2014 at its highest level since 2006 with 123 Projects/14,523 Rooms. It is important to note that construction is concentrated in and around major markets. New England has 43 projects currently Under Construction as of year-end 2014, 40% of which are located in the Boston market.

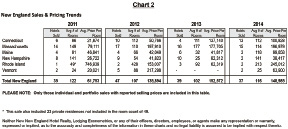

Sales Transaction Trends

In 2014 total investment in the US lodging industry was an estimated $30.8 billion. Of the 1,292 hotels that were transacted, 935 reported a selling price into the public domain. The average selling price per room for those hotels was $156,002, up a dramatic 20.6% YearOver-Year (YOY).

The healthy increase in selling prices is due to record-setting hotel revenues and profits, low interest rates and the availability of attractive financing. We foresee selling prices accelerating upward as hotel performance continues to shine in the absence of any significant new supply. Interest rates, which remain very attractive, contribute to the sales volume by increasing competition for single assets in high-quality locations and portfolio sales.

Good Time to Sell

When reviewing transactions that have taken place in New England and around the U.S., many owners are both sellers and purchasers. Why? It is the best time since 2007 to get the highest price for non-strategic assets, take profits and redeploy proceeds toward new and more targeted acquisitions and/or development.

In a macro sense, it is clear that guest room demand continues to outpace supply increases, contributing to rising hotel values and sale prices. The lending environment has become competitive again and is still offering historically low interest rates that empower purchasers to pay more than normal conditions would permit. It is an excellent time to consider selling.

If you are thinking about the potential disposition of an asset(s), now is the time to go through an opinion of value process. NEHR is ready to discuss your disposition ideas and share with you a confidential opinion of value for your hotel(s) to see if this is the right time for you to sell.

We have also added a new member to our team to assist you in your disposition needs. I would like to introduce Hans Wentrup, director of business development. Hans is a seasoned sales professional who has been responsible for the New England region as a sales director in his recent roles. Please join me in welcoming him to the New England Hotel Realty team.

NEHR is the highest volume hospitality real estate advisory and brokerage firm in the Northeast, providing acquisition, disposition, consulting and market research services to the lodging real estate and lending industries. Since 1977, the NEHR team has provided quality investment opportunities and seller representation in hundreds of hotel transactions. A new, exclusive partnership with Lodging Econometrics, the industry-leader for hotel real estate intelligence, enables NEHR to offer its clients unparalleled access to decision makers and market intelligence coast to coast. We are frequently called upon as advisors to assist in the analysis of a client's lodging investments.

Ken Ford has 20 years of experience in the lodging real estate industry and serves as the vice president of National Hotel Realty (NHR), New England Hotel Realty (NEHR) and Lodging Econometrics (LE). Powered by LE's Market Intelligence, NEHR and NHR provides real estate advisory services to hotel and management companies looking to expand their portfolios and acquisition and disposition services to investors in the Northeast and elsewhere throughout the country.

Ford provides the most accurate acquisition, disposition, consulting and market research services to individual and portfolio lodging owners, private and public investor groups, institutional clients, and lodging lenders. In addition to marketing hotel investment opportunities, Ken also provides seller representation in hotel transactions. Ken has participated in the sale of numerous hotel assets, in addition to managing multiple hotels for institutional clients and serving as an asset takeover specialist responsible for the development and implementation of "turnaround" improvement plans for various lodging assets.

Ford is a Certified Hotel Broker (CHB) and is a candidate for the Certified Commercial Investment Member (CCIM) of the National Association of Realtors designation. He is also an active member of the Turnaround Management Association (TMA), an international community of turnaround professionals that advise and consult companies on the restoration of corporate value.