The hospitality industry continues its forward momentum… - by JP Ford

In our Q4 2015 report to the lodging industry, New England Hotel Realty (NEHR) and its partner company, Lodging Econometrics (LE), stated that the United States hotel construction pipeline totaled 4,413 projects/546,135 rooms, a significant year-over-year (YOY) increase of 21% by projects and 19% by rooms.

Both construction starts and new project announcements into the pipeline increased significantly compared to Q4 2014. Construction starts are up 57% by projects and 69% by rooms YOY, and have reached their highest room count in 5 years. In Q4 2015, new project announcements rose 85% by projects and 97% by rooms YOY and also hit their highest point by rooms since Q2 2011.

These metrics tell a compelling story of continued forward momentum in the U.S. hotel construction pipeline, a trend that is expected to continue for the next two to three years. Overall developer sentiment is positive as optimism permeates the industry due to strong operating improvements, the continued increase in lending sources and the general upward economic improvement.

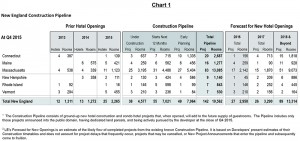

New England Construction Pipeline At the end of Q4 2015, New England’s hotel construction pipeline consisted of 142 projects/19,562 rooms (Chart 1). This accounts for approximately 3.2% of all projects and 3.6% of all rooms in the U.S. Pipeline. NEHR forecasts that 27 hotels with 2,958 total rooms will open in New England in 2016, and 26 hotels with 3,290 new rooms will open in 2017. New England room supply growth rates are forecasted to be 1.4% and 1.6% for those years, respectively…well below the expected percentages for the U.S. as a whole.

At the end of 2015, NEHR anticipates that new hotel openings in New England for 2016 and 2017 will show the largest growth in Massachusetts both by projects and by rooms. Thirty-two new hotels with 4,012 rooms are forecasted to open during that span in Massachusetts. No other state in New England is expected to open more than five hotels over the next two years.

Obviously, not every city, town or municipality will see new hotel construction over the next few years, however, if you are an owner it makes sense to pay attention to the pipeline in your markets of interest as developer sentiment remains positive. Going forward, look for developers to continue to favor select service hotels due to their wide consumer acceptance, and large reservation systems which are attractive elements to lenders.

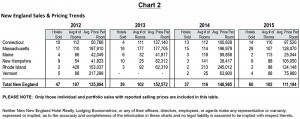

New England Lodging Transaction Values At the close of 2015, lodging transactions in New England have seen their most significant increase of late, up 62% YOY with 60 hotel sales (Chart 2). Conversely, average selling price per room (ASPR) has decreased to $111,184 in 2015 from $148,985 in 2014 and is at its lowest level since prior to 2012.

Nevertheless, in the New England region we expect a continued robust transaction market going forward in 2016 and 2017. We are in an unusual time period right now where it is a good time to be both a buyer and a seller. It feels like equilibrium. Among other things, interest rates are low and lending is available from many sources, making it a great time to buy properties. At the same time, with buyer demand surging and cap rates relatively low, it’s a great time to take profits as a seller. In fact, there has not been a better time to sell hospitality real estate since 2007 than right now!

NEHR is the leading full service hotel real estate advisory and brokerage firm in the Northeast, providing comprehensive disposition, acquisition and consulting services for over 35 years.

When thinking about selling an individual hotel or disposing of a portfolio of assets, NEHR’s team of real estate advisors can assist you. We can customize a market intelligence report to assist you with your decision-making, and then provide you with a complimentary opinion of value estimating what your hotel might bring in today’s marketplace. Should you decide to sell, NEHR can present your asset to a pre-qualified list of investors, quickly and confidentially to obtain the highest possible price in today’s market place.

When interested in acquiring hotel assets, NEHR can present to your its extensive roster of hotels available for sale or assist you in locating properties that meet your exact specifications.

JP Ford, CHB, ISHC, is senior vice president of New England Hotel Realty (NEHR). NEHR provides acquisition, disposition, consulting and market research services to the lodging real estate industry. Ford oversees and directs the company’s hospitality brokerage department, working with new clients, and servicing the disposition and acquisition needs of existing clients.

Atlantic Property Management expands facilities maintenance platform: Assigned two new facility management contracts in RI

New Quonset pier supports small businesses and economic growth - by Steven J. King

Unlocking value for commercial real estate: Solar solutions for a changing market - by Claire Broido Johnson

Connecticut’s Transfer Act will expire in 2026. What should property owners do now? - by Samuel Haydock

(1).png)

(1).png)