I had just finished testifying at the Massachusetts Appellate Tax Board (ATB) and negotiations were underway to settle the case before a decision was rendered. My counsel forwarded me the ATB December 11th, 2008 decision in Fort Hill Associates v. the City of Boston. There was a one line statement in the decision:

"The board adjusted for potentially 'loaded' overall capitalization rates"

I was mystified. I called one of the attorney's involved with the case. I then called the leader of our investment sales group and one of our key investment sales brokers. I then reached out to Peter Korpacz, creator of the PWC Korpacz Real Estate Investor Survey. As CBRE has the largest appraisal group in the United States, I floated the concept by CB's "tech team."

Preamble

In Mass., assessed values are to be fee simple market values. Fee simple rightly so gives no weight to advantages or disadvantages of lease contracts. Value in its truest sense should be fair market, at fair market rent.

At the ATB, discounted cash flow (DCF) is frowned upon. The board in their decisions recognizes that investors rely upon DCF, but:

"The assessment of real property for tax purposes is based on the value of a fee simple interest for a period of one year only. Given these legal requirements, DCF analysis, appropriate for valuing the leased fee interest ... has not been adopted in the decision of this board"

Standard stabilized commercial property valuation divides net operating income (NOI) by a market derived "cap rate" to estimate value. The key is what to include in net income and how to derive the appropriate rate. The city in my case was claiming that reserves for replacement (as well as tenant improvements and leasing commissions) are not allowed under the Fort Hill decision.

Loaded Capitalization Rate

The "loaded" overall rate mentioned in the Fort Hill decision implies that reserves for replacement, tenant improvements, and leasing commissions are an excluded item from NOI and are not included in direct capitalization methodology.

The City of Boston argued that if you ask brokers, their reported NOI is before "loads."

Similarly, the Korpacz Survey for Boston is on a before "loads" basis. This is called "Method 2: NOI before capital reserve, TI's and leasing commission."

To address the issue, I asked investment sales brokers. Investment sales brokers are market participants. Their universal response to my question was "whoa; that is not right." If you are selling an office building or equivalent, the buyer will complete a year-by-year cash flow study and value cash flow after all costs, commissions, and reserves. While at the ATB, discounted cash flow is not followed, it is evidence of how buyers analyze property in the real world. Buyers take into consideration all leasing and tenanting costs. It is recognized that buyers in the real world respond to conditions they face. As markets are cyclical, if turnkey TI's or payments of a commission as a half are required, they are paid and must be recognized as part of the valuation process. There is not such thing as "Method 2" to buyers.

The 13th Edition of the Appraisal of Real Estate is as far thinking a document as has ever been published by the Appraisal Institute. This addition makes clear that tenant improvements or equivalents should be recognized:

"Stabilized net income should recognize the tenant improvements made to a property that are appropriate for the market"

1 Case Study

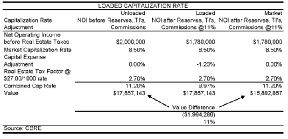

To explain the impact on value, I created a hypothetical example from the Fort Hill decision. In this example, I used a $2 million NOI before real estate taxes and 11% of this amount for TI's, commission, and reserves. The following is the result: (see chart)

In this case study what is clear is that the "loaded" cap rate approach produces a higher value than that suggested by the market participants I interviewed. As one said to me, "Appraisers are trying all kinds of imaginative ways these days." In the above example, the fair market cap rate of 11.2% is artificially deflated to 9.97% by not taking "loads" into account. When the 2.70 tax factor is deducted, this is the equivalent of a 7.27% cap rate.

What do market participants say?

The market participants I interviewed called what I had discovered an attempt to change the definition of a cap rate. Commentary I received pointed out that conventional use of a capitalization rate looks at a lot of things:

* IRR

* Price per s/f

* Mortgage/equity return

* Stabilized NOI

Participants point out that when a sale takes place, that TI's, commissions, and reserves are "implicit in the cap rate."

Webster Collins, MAI, CRE, FRICS is executive vice president/partner at CB Richard Ellis in their Valuation and Advisory Group, Boston, Mass.

Tags:

The myth of the loaded capitalization rate and Leased Fee versus Fee Simple Value

September 10, 2009 - Appraisal & Consulting