Markets recover differently depending on product type. This is one of two companion articles which describe the apartment and office markets.

In this case, I will study the apartment market, start with basic economics, create a hypothetical case study, and then present conclusions. My observation is that there is a valuation dispute going in the apartment market between owners and appraisers which I will address herein.

The Power of Analysis

Study of population, employment, and income make it clear that for apartments, the recession is over, and that growth is starting to take place. Moody's Economy.com predicts for Boston a 20,400 population growth between 2009 and 2012 with a corresponding recovery of all jobs lost since December 2007 and a 14.3% cumulative increase in personal income.

Recovery this time around for apartments will be completely different:

* There is no speculative capital and no mortgage money for speculative construction to overbuild the market.

* Rents are projected to increase by 2%-3% per year as the market firms.

* There is no RTC taking over banks' portfolios and dumping Class A apartment property on the market.

* Unlike the office market, properties are held in much stronger hands. Although income may have declined, huge drops in price are not appearing on the market's radar screen.

The issue of value is a two-sided coin and will be described in the following case study.

A Case Study

Real estate professionals know the definition of market value contains such words as "willing seller", "willing buyer", and "undue stimulus". Similarly, as is well known, income is the primary determinant of market price.

In recessionary times, apartment income declines. There is the issue of free rent and loss to lease - a fancy term for vacancy and leasing commissions of 1/2 to 1 months rent.

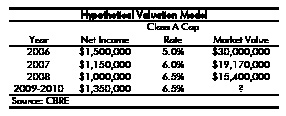

The following case study parallels conditions observed from study of a number of apartment complexes:

Traditional appraisal modeling would give weight to "trailing 12 month" income and discounted cash flow in the hypothetical model to suggest a value of say $15.4 million.

Buyers of property who are trying to buy using this model are receiving quite a surprise.

Owners of Class A property not forced to sell are openly and vocally rejecting appraisal methodology and offers that discount the underlying value that they see in apartments. They are openly and vocally rejecting appraisals that do not reflect intrinsic value of what they have and the true economics of their ownership.

The problem is that followers of real estate hear such phrases as "values are off by 50%". For Class A apartments, great resistance to that type of thinking is taking place. The reasons are best described in the following conclusion.

Conclusion

Apartment owners think back to the 1990-1991 recession where fortunes were made by purchase of property at cents on the dollar. These sales were caused by undue stimulus as proven by resales at far higher prices in relatively little time.

Apartment owners believe they have economics on their side. High vacancies found in such products as office buildings do not exist. Apartment surveys suggest typically 5%-7% vacancy which is not high.

Apartment owners of Class A product who have experienced a temporary "hiccup" in income believe appraisals that value based on a "hiccup" to be an affront. Appraisers however cannot be faulted for using long established guidelines.

In my mind, it is the power of analysis and basic economics of the market that should be the final arbitrator in this value dispute. There are certain apartment properties where the precepts of this article can just not apply. Not all apartment properties are prime. At the same time, there is Archstone Smith quality product out there which carries panache and where there will be multiple bids. In my opinion, Class A product requires a different mind set.

With owners of high quality apartments, the coin is not two sided. They recognize that we are back to long term ownership concepts in real estate and that wide swing of value seen during the "flips" of the early part of this century were not market.

Overall, in the apartment market values today are viewed as long term. Short, interim steps over a few years are looked at as just that. Cash flow and the ability to generate cash flow at times when cash yields on money investments are minuscule are what make apartments such an attractive investment vehicle.

Webster Collins, MAI, CRE, FRICS is executive vice president/partner within CB Richard Ellis in their Valuation and Advisory Group, Boston.

Tags:

The recovery from recession - The tale of two markets - The apartment market

October 20, 2009 - Spotlights