In our three decades of Green Investing, never have the environmental challenges loomed so large, nor has the investment universe of sustainable solutions been this compelling.

The BP catastrophe in the Gulf of Mexico is the most recent in a rapidly expanding list of global wake-up calls from Mother Nature. If there were ever a perfect storm brewing, this is it. Led by global warming and climate change, this tempest is dotting the earth with increasing frequency and intensity. Extreme weather patterns are no longer the exception as the daily weather report inevitably includes one or more life-ending reports of tornados, hurricanes, mudslides, hail storms, wildfires, drought, floods or heat waves.

The encouraging news is that we have a rising tide of imperatives - environmental, economic, and regulatory - that are triggering green solutions activity by all segments of society. While the prevention of global warming is no longer an option, there are enormous mitigation and adaptation challenges that are inspiring innovative green solutions and revitalizing established ones.

Tantalizing, big new markets are offering long-term, double-digit growth rates. These new markets inevitably attract entrepreneurs with new ideas, followed by capital and larger companies seeking meaningful growth.

The universe of high-growth, well-managed and investable companies offering "bona-fide" green products and services is growing. Sustainable business models are expanding, especially those addressing climate change and resource scarcity. Green companies are no longer just young startups with entrepreneurs struggling to make payroll and spending more time raising money than building their businesses. Indeed, in just the last few years, there has been and continues to be a dramatic expansion of green product and service offerings.

For example, when we founded Winslow in 1983, there were hardly any green companies with sustainable business models. Today, our research network indicates that the investable global universe of green companies exceeds 1,000, with more on the way. We believe the potential investment returns in the green space are compelling and offer double-digit growth drivers in sizeable but nonetheless rapidly expanding markets. Green Investing is even more compelling when compared to the current era of lethargic, economic growth.

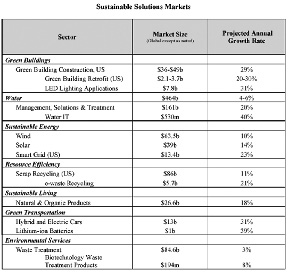

To help us identify the most compelling investment prospects, we grouped seven major environmental challenges with the corresponding solutions categories: green buildings; green transportation; resource efficiency; sustainable energy; sustainable living; environmental services, and water. After extensive research into each category through more than 22 third-party academic, consulting, and industry sources, we were able to ascertain what we believe to be realistic market sizes and growth rates for each sector.

Given the embryonic nature of several categories, we did not include data where dependable information was either spotty or too sparse. Below is an abbreviated table that illustrates our findings.

The exhibit shows a wide range of opportunities. Lithium ion batteries, for example, currently offer a relatively small sustainability market of $1 billion but with a compelling projected annual growth rate of 39%. Conversely, there is a much larger market in water of $464 billion, but a more modest expected growth rate of 6% as this sector includes regulated water utilities. The water management market within the water segment is estimated at $161 billion with a 20% annual growth rate. The water IT market is even smaller, at $530 million, but is growing at a hefty 40%. Importantly, the average estimated annual growth rates for these 16 categories is a compelling 22%.

With unprecedented economic and population growth in some of the most populated, less developed countries such as Brazil, China, and India, the rising global demand for the world's finite resources is unparalleled. There simply are not enough minerals, water, food, land, energy, and natural resources to meet the rising world-wide demand. As a result, resource scarcity has quickly become a compelling challenge. Recycling is one of the sustainable solutions that addresses the challenge presented by resource scarcity. We believe that recycling is a very attractive market at close to $100 billion, with an estimated annual growth rate of 11%. The much smaller electronic recycling market, estimated to be $6 billion in the U.S., has a much higher promise of annual growth at 21%. This is not surprising given the escalating health problems associated with e-waste.

Recognizing the gap between the rising demand and available supply of natural resources such as coal and other minerals, some countries like Australia are imposing new taxes on the profits from mining natural resources. While there are multiple motives for such a tax, the net effect will be to increase prices, thereby making the efficiency and recycling industries doubly attractive.

The green category that has received the most attention over the last decade is sustainable energy or "cleantech" in the financial vernacular. After attracting the most capital in the venture capital space for a number of years, the alternative energy category has created its own bubble due to too many dollars chasing a limited number of technologies. While valuations suffered a subsequent decline, the growth for this category continues to be very attractive, especially for the smart grid where estimates exceed a 20% annual growth rate.

The quantity and quality of sustainable green business models available to investors is extensive and offer compelling double-digit growth rates. With the BP catastrophe igniting and catalyzing a global call for green solutions, we believe the outlook for Green Investing is extremely promising.

Jackson Robinson is the founder and CIO for Winslow Management Co., Boston.

Research: Julie Sullivan, Winslow Management Co., Boston.

Sources: Canaccord Adams, Lux Research, ABI Research, McGraw Hill, 2009 Green Outlook: Trends Driving Change, D.A. Davidson,

Advanced Materials - Tech & CleanTech Quarterly Industry Update, March 22, 2010, McGraw Hill Construction SmartMarket Report -

Green Building Retrofit & Renovation, 2008, Robert V. Steele, Strategies Unlimited, July 14, 2009, www.ledsmagazine.com, March 2010,

Jefferies & Co, Clean Technology, Feb. 26, 2010, Janney.snetglobalindexes.com, Jeffries & Co, Clean Technology Alternative Solutions -

Water, 2010, www.luxresearchinc.com/press/RELEASE_Water_IT_LIG-11_4_09, Cleanedge.com - Clean Energy Trends 2010, March

2010, Global Wind Energy Council, www.gwec.net, www.luxresearchinc.com/press/RELEASE_SolarForecast3_9_10.pdf, Institute of

Scrap Recycling Industries, Inc. Industry Facts, June 2009, Newton-Evans Research, Smart Grid Projects 2010, April 13, 2010,

www.luxresearchinc.com/press/RELEASE_EnergyStorage_3_31_10.pdf, Nutrition Business Journal, March 2010,

http://www.environmentalleader.com/2010/03/29/, Barclays Capital Clean Technology, February 25, 2010, ABI Research "e-Waste

Recovery and Recycling", Worldsteelassociation.com, Recyclingtoday.com, WasteBusinessJournal.com

Tags: