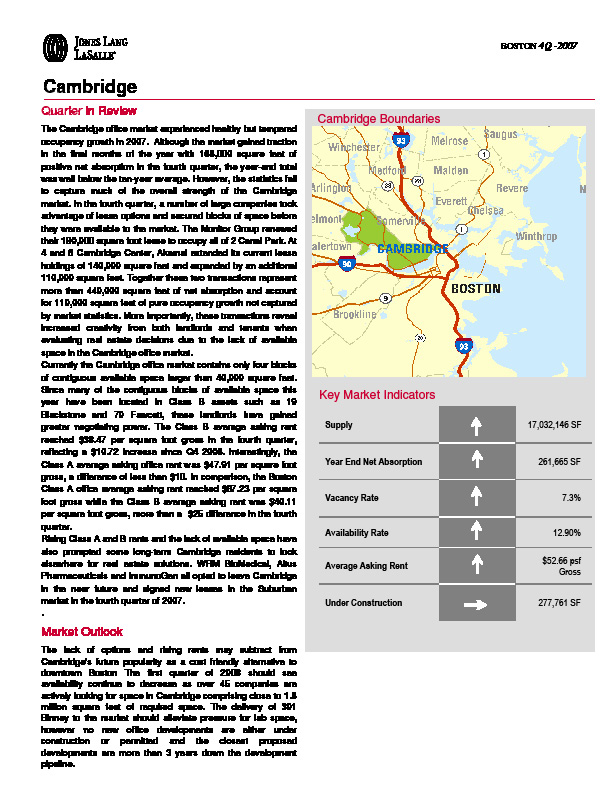

The Cambridge office market experienced healthy but tempered occupancy growth in 2007. Although the market gained traction in the final months of the year with 166,000 s/f of positive net absorption in the fourth quarter, the year-end total was well below the ten-year average. The statistics, however, don't tell the whole story or convey the overall strength of the market.

In the fourth quarter, a number of large companies took advantage of lease options and secured blocks of space before they were available to the market. The Monitor Group renewed its 190,000 s/f lease to occupy all of 2 Canal Park. At 4 and 8 Cambridge Center, Akamai extended its current lease holdings of 140,000 s/f and expanded by an additional 110,000 s/f. Together these two transactions represent more than 440,000 s/f of net absorption and account for 110,000 s/f of pure occupancy growth not captured by market statistics. More importantly, these transactions reveal increased creativity from both landlords and tenants when evaluating real estate decisions due to the lack of available space in the Cambridge office market.

Currently the Cambridge office market has just four blocks of contiguous available space larger than 40,000 s/f. Since many of these contiguous blocks are located in Class B assets such as 19 Blackstone and 70 Fawcett, the landlords have gained greater negotiating power.

The Class B average asking rent reached $38.47 per s/f gross in the fourth quarter, reflecting a $10.72 increase since fourth quarter 2006. Interestingly, the Class A average asking office rent was $47.91 per s/f gross, a difference of less than $10. In comparison, the Boston Class A office average asking rent reached $67.23 per s/f gross while the Class B average asking rent was $40.11 per s/f gross, more than a $25 difference in the fourth quarter.

Rising Class A and B rents and the lack of available space have also prompted some long-term Cambridge residents to look elsewhere for real estate solutions. WRM BioMedical, Altus Pharmaceuticals, and ImmunoGen all opted to leave Cambridge in the near future and signed new leases in the suburbs during fourth quarter.

Outlook

The lack of options and rising rents may diminish Cambridge's image as a cost friendly alternative to downtown Boston The first quarter of 2008 should see availability continue to decrease as over 45 companies are actively looking for space here comprising close to 1.6 million s/f of required space.

The delivery of 301 Binney St. should alleviate pressure for lab space. However, no new office developments are either under construction or permitted, and the closest proposed developments are more than 3 years away.

Jones Lang LaSalle's Research Group contributed to this story.

John Osten is a vice president at Jones Lang LaSalle, Boston.

Tags:

The statistics don't tell the whole story or convey the overall strength of the Cambridge market

January 23, 2008 - Spotlights