The value of Mom & Pop tenants should be assessed more carefully - by Michael Branton

Michael Branton, KeyPoint Partners

Michael Branton, KeyPoint PartnersIt began in a small health food store in Austin, Texas; a sporting goods store in New York City; and a general store in Arkansas. While the names may be different, many powerhouses in retailing today have their origins in the “Mom & Pop” stores of yesteryear.

And yet, in today’s retail environment, Mom & Pop stores are often overlooked - and perhaps under-appreciated - by retail landlords. The reasons why could be debated endlessly, but one can make a strong case that the value of Mom & Pop stores should be assessed more carefully. After all, a long time ago, the three retailers mentioned above, better known as Whole Foods, Abercrombie & Fitch and Wal-Mart, were not the retail aristocracy that they are today.

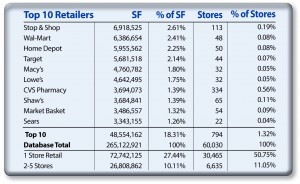

At KeyPoint Partners, we maintain a database, of more than 265 million s/f of retail space encompassing 60,000 storefronts and more than 33,000 unique tenants in Eastern Massachusetts, Southern New Hampshire and Greater Hartford - our unique, proprietary GRIID. According to the most current GRIID data, the top 10 retail tenants by square footage occupy 18.3% of the total retail space of the market, but only 1.3% of the total storefronts.

On the other hand, Mom & Pop stores (defined for this purpose as those operating one store and not affiliated with a larger chain or franchise) occupy 30,465 storefronts and 27.4% of the retail space within these three regions and a whopping 50.7% of all retail storefronts. The table below outlines the top ten retailers in the GRIID database by square footage and number of storefronts, compared with single-store retailers:

Mom & Pop stores are unquestionably the largest segment of the GRIID database, while smaller, multi-store retailers operating two to five stores constitute only 11% of all retail stores. As a result, Mom & Pop stores have a dramatic impact on a host of salient retail real estate issues such as vacancy rates, rental income, and property valuations.

Apart from sheer numbers, these one-of-a-kind retailers can add value to a property by enhancing the quality of a center. By their very nature, Mom & Pop stores create uniqueness, are constantly re-defining their originality, deliver a high quality customer experience to shoppers, and create diversity within the tenant mix. Mom & Pop stores often occupy second-generation spaces, and often, the most challenging spaces in shopping centers.

Furthermore, from a leasing standpoint, negotiations with Mom & Pop retailers are often simpler, less capital-intensive, and typically less protracted. An independent retailer’s decision to open (or close) stores is not tied to Wall Street, not dependent upon chainwide performance, and not linked to anything other than the merchant’s own ambition and availability of capital.

Landlords, brokers, and developers should take advantage of the opportunity to support local businesses, and enhance shoppers’ experience of their centers, by cultivating relationships with Mom & Pop stores. This year, when looking at merchandising plans and vacancies within your portfolio, why not consider the significance of Mom & Pop stores. Perhaps you can be the one to provide them with the opportunity of becoming the retail leaders – the Whole Foods, Abercrombie & Fitches, and Wal-Marts - of tomorrow.

Michael Branton is a senior associate with KeyPoint Partners, Burlington, Mass.

RapDev leases 17,587 s/f at 501 Boylston St. - lease brokered by JLL

Newbury Street: Boston’s timeless retail gem thrives in a modern era - by Joseph Aquino

Boston’s iconic Newbury St. continues to thrive as one of the most vibrant and compelling retail corridors in the United States. Nestled in the heart of the Back Bay, this historic St. has evolved into a powerhouse of high-St. retail, where luxury meets lifestyle and legacy brands coexist with up-and-coming names. With its European charm, diverse architecture, and unmatched foot traffic, Newbury St. remains a dynamic reflection of Boston’s energy, culture, and economic strength.

End of the year retail thoughts - by Carol Todreas

Retail / tariffs / uncertainty and (still) opportunity - Carol Todreas

As new tariffs continue to impact the global economy, retail businesses and investors are grappling with heightened uncertainty. From new high tariffs to supply chain issues to evolving consumer behaviors, continual changes are making it as or more challenging than the pandemic years. Yet, amidst this turbulence,

Placemaking and retail in 2024 - by Carol Todreas

Placemaking. That is the word for 2024. While the concept has historical precedence in urban development, it became part of our current culture in the 1960’s when urbanists started to think about cities for people, not just cars.

.png)