Boston, MA Similar to existing law, the Consumer Financial Protection Bureau’s final TILA-RESPA rule restricts the circumstances in which consumers can be required to pay more for settlement services than the amount stated on their loan estimate.

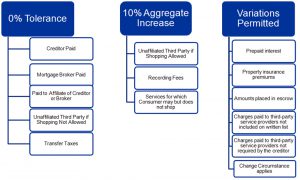

Generally, good faith requires the closing cost estimate on the initial loan estimate to equal the final amount charged on the closing disclosure. Here’s a look at which fees can and can’t change (see chart 1).

In today’s current practices, many providers add a cushion for costs on the HUD-1 to account for items that can vary between the signing and when the transaction is settled after recording, such as recording fees, pro-rations and prepaid interest. The overage is then refunded after the final disbursements are made. Under the new rule, lenders and settlement agents must make more rigorous good-faith efforts to provide estimates that are more accurate. However, the delay between consummation and settlement in escrow states its likely to increase the need for post-closing corrected disclosures.

If the closing disclosure becomes inaccurate before consummation, the creditor shall send corrected disclosures so that the consumer received the corrected version at or before consummation. The changes are still subject to good faith requirements. Once the initial closing disclosure is issued, all changes should be made with an updated closing disclosure. The creditor may not provide a revised loan estimate on or after the date the creditor provides the consumer with the closing disclosure.

Under the new rule, if a lender allows a consumer to shop for a settlement service, the lender will be required to provide the consumer with a written list identifying available providers of that service and clearly stating that the consumer may choose a different provider for that service. The CFPB has provided a blank model form for the written list of settlement service providers, a sample of written list of providers consumers can shop for and a sample of written list of providers consumers cannot shop for.

What About Title Insurance?

According to the CFPB, owner’s title insurance that is not required by the creditor is not subject to the 10% variance. The CFPB said it is aware that the preamble to the final rule contains potentially conflicting language, but advises that the final rule text is what should be followed.

The 10% variance category includes recording fees and charges paid to unaffiliated third-party service providers when the consumer is permitted to shop for a settlement service provider, but chooses a provider from the creditor’s written list of providers (§ 1026.19(e)(3)(ii)).

Owner’s title insurance is not a charge that is assigned to a particular variance category. Therefore, the applicable variance category depends on other factors, including whether the creditor requires the insurance and, if so, whether the consumer may shop for the provider of the insurance.

To the extent owner’s title insurance is not required by the creditor and is disclosed as an optional service, under the rule the insurance is not subject to any percentage variation limitation, even if paid to an affiliate of the creditor.