Nowhere in dictionaries of real estate terms is "time" properly defined. The time component in real estate is an increasingly more and more important part of the equation. The impacts of time are huge both on the upside and downside.

My own definition of time centers on one word - risk.

* The risk that NOI will change in the market.

* The risk that financing will not be available under contractual terms that are livable.

* Market value risks as brought about by changes in capital markets.

This article will have two distinctly different parts:

* The current time bar as relates to the Great Recession

* A case study of how a major property has run counter to time and captured an unique market niche

Current Time Bar

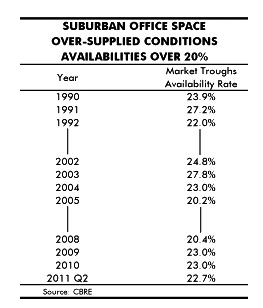

The following graphic illustrates the current condition of the market.

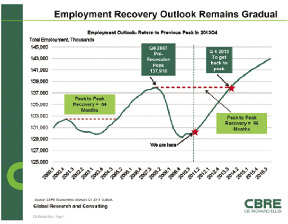

The employment recovery chart predicts 96 months or 8 years for all jobs lost since 2007 to be gained back.

What is not shown is prior recoveries. CBRE Global Research has been studying real estate cycles for years. On January 5, 2009 at our firm's kick-off meeting, charts and graphs were presented that showed 66 months (5.5 years) for the market to recover. This would be slightly longer than in the past but livable.

Over the past 22 years, we have had one 9-year period and one 2-year period when our suburban markets in particular have not been seriously over-supplied with office space. The time equation to live through in two prior cycles was 3 or 4 years when we were over-built.

What we see today is a far longer "time bar" than I have even seen in my some 30 to 40 years as an appraiser. Eight years is a long time. To place perspective, the Great Depression was 10± years. We are in a period of huge market value risk brought about by the current lags in timing of employment recovery.

A Counter Balance - The Story of Vertex

It is businesses that truly drive our markets. Businesses and related enterprises are what make Boston such an unique city.

In 1989, Vertex was founded in Cambridge and houses in excess space within Vappi Construction buildings. The mission was to research, create, and manufacture pharmaceuticals to treat life threatening diseases.

Although a long time coming, on May 23, 2011, the antiviral drug Telaprevir, to treat Hepatitis C, was approved by the FDA. To manufacture, a new, state-of-the-art building was required. On June 27, 2011, building permits were issued for two 15- and 16-story office/lab/manufacturing buildings at Boston's Fan Pier, next to the Federal Court House. Construction has begun and completion is scheduled for December 27, 2013. With all tenant/lab/manufacturing fit-up, this is a $900± million project and is a huge boost for Boston in what has been a down market.

Conclusion

It is the Vertex story that is the solution for the time bar. They offset the well-known John Hancock, 3 Com, Fidelity Marlborough campus pull-backs.

In Cambridge, Vertex's move-out would be a time when the free-up of lab space would tie to the Q4 2013 recovery period predicted by CBRE Global Research.

What is clear is that build-to-suit construction works independent of the market. The specialized use of lab/manufacturing is not office space and it is this class of space that presents the unique opportunity captured by The Fallon Co.

One of the central themes of prior articles written this year is the capture of opportunities in a dismal market. The Vertex story is just such an opportunity.

Webster Collins, MAI, CRE, FRICS is executive vice president within CB Richard Ellis Valuation and Advisory Group, Boston.