Prior to World War II, a series of small battleships were built to try to hide under world treaties that had been signed.

To many people, the "Great Recession" has felt like a war. Some have referred to it as the worst downturn since the depression of the 1930s.

Out of this recession, small pockets have developed where a vibrant and thriving market has been formed.

This article will address one such market hidden from sight, not identified by most parties, and one that is of major importance to Boston. This article has three parts. The first identifies the location. The second addresses why it is such an important market. Finally, this article will provide comparisons which help quantify its true meaning.

Location

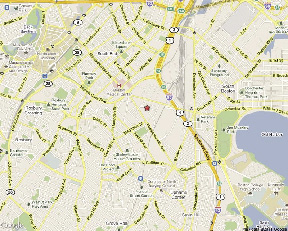

The location is the Newmarket Sq. area, just off the Southeast Expressway in the Roxbury section of Boston. Just look at the location:

The area is just off the Southeast Expressway by the Mass. Ave. connector. The connector is a 4-lane highway to Mass. Ave.

The uses in this location are industrial. This is a heavy industrial area with a variety of uses from warehousing to cold-storage to distribution.

The area is a direct product of post-World War II growth combined with buildings left over from the 1920s that have been rehabilitated.

Why Newmarket?

The answer is that there is nowhere else to go! It is only 0.5± miles from the Mass. Pike. It is a great distribution hub.

What makes Newmarket so important is that industrial properties can no longer locate in the Seaport area. The Seaport area is slated for mid-rise to high-rise development. The Seaport area has all new infrastructure such as utilities, rapid transit stops, the "BCEC" Convention Center and is Boston's "new city" area for the 21st Century.

Industrial properties do not belong in high-density, high-profile, higher-use locations.

Where industrial properties belong is in the close-in, dense areas heavily-laced with roadways with easy access to the city and to major highways. Industrial properties belong in interchange-type locations.

Basic economics for any major city like Boston require distribution. Close-in distribution means trucks and truck access. This is why Newmarket is so important for the health of and service of Boston.

True Meaning of the Market

"Pocket" markets take on a life of their own. They are tight in terms of size, with high barriers to entry.

Let's prove this by going out to the suburbs. The market size is 138,520,000 s/f with a 22.9% availability rate and average asking rent of $6.71 per s/f. That means close to one out of every 5 s/f is available to lease.

In contrast, if you drive around Newmarket, you might find one or two buildings available with the buyers being largely users who want to come into the area.

The Newmarket area is very small and very specialized. It is a niche market and a "pocket" often overlooked.

I recently completed an assignment in the area and found a March 2011 short-term lease at $10.33 per s/f NNN, 54% above a typical suburban lease rent. I also found values far above that in the suburbs.

Conclusion

In 2009, one of my partners with "tongue in cheek" predicted May 16, 2011 as the turnaround date for recovery of the Boston market. His thinking was that an 18 to 24 month lag time for real estate is not unrealistic. While with 22.9% industrial availability, this market overall has clearly not recovered.

This said, conditions are not always bleak. "Pockets" can develop where values hold their own and due to unique demand circumstances, can even increase.

We have seen this at One Brigham Circle and 10 Brookline Place in the Longwood Medical Area on the Boston/Brookline border. We have seen this with Class A rents in key East Cambridge locations.

Strategic thinking for 2011 is to keep your eyes open for pockets of opportunity which most certainly will develop. This is the real world of real estate.

Webster Collins, MAI, CRE, FRICS, is an executive vice president/partner of the valuation & advisory group of CB Richard Ellis, Boston

Tags:

Webster Collins - Keep your eyes open for pockets of opportunity which will develop post recession

May 25, 2011 - Spotlights