The Wilmington market totals just over 4 million s/f of commercial space, with the majority, over 3.1 million s/f, being flex space. This submarket was hit particularly hard by the recession, causing the office vacancy rate to increase to 33.7% by the end of 2009. Small to mid-size manufacturing users, which make up a large part of this flex market, saw their prospects from company growth frozen by the lack of capital available during this time. Large companies that anchor this market were also impacted by restructuring and consolidation plans. All of these factors caused a significant contraction in the flex market and vacancy increased to almost 28% by the end of 2009.

However, the Wilmington market has several key factors that have helped this submarket make a significant recovery. The strategic location provides direct access to Rte. 93, is less than 7 miles to Rte. 128 and Rte. 495 is only 6 miles away providing tenants excellent highway access. The high concentration of skilled manufacturing and contract workers provides industrial companies the employee base needed for their operations. Competitive rental rates compel users to consider this market. The town of Wilmington is extremely pro-business and is easy to work with.

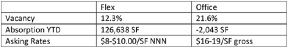

The Wilmington flex market has recovered exceptionally well. Vacancy has dropped to 12.3% from its peak of 27.8% at the end of 2009, one of the largest drops in the Greater Boston area. Average asking rent is nearing $9 per s/f, averaging $8.84 per s/f on a triple net basis quarter to date. With 126,638 s/f of positive absorption year to date, market fundamentals are strong without any new supply under construction.

As an example, the North Wilmington Business Park, a 350,000 s/f, 6 building flex and office campus, has seen a ten-fold increase in activity in the past 6 months. The property's proximity to Rte. 93, availability of quality flex and office space with room for expansion on the campus, and experienced, respected local ownership, have made this location a hot spot for activity. Due to the nature of the contract manufacturing business, tenants need landlords that understand their potential for expansion and contract their real estate depending on their business inflow. The owner of Wilmington Business Park, Spinelli Commercial Properties, based in Cambridge, has worked successfully with tenants to provide short and long term expansion, relocations, temporary warehousing, etc. In fact, Spinelli Commercial Properties just signed a month to month lease with a medical device company that is in the midst of restructuring and requires ultimate flexibility while they determine their space needs.

Another recent tenant to expand in the Wilmington market includes Teradiode, who recently moved into 24,500 s/f at 30 Upton Dr.

The 985,000 s/f Wilmington Office market is 21.6% vacant with 194,000 s/f vacant. The market is improving steadily, with vacancy down 12% from its peak in 2009. Average asking rents are in the mid to high teens, on a full service gross basis. Absorption has been spotty, with the market giving back 2,043 s/f to date. Net absorption in 2012, however, was positive, at 24,000 s/f, including the office relocation of LoadSpring Solutions, Inc. from a property in Lawrence to 7,219 s/f at 187 Ballardvale St. in Wilmington. LoadSpring was able to move into a larger space, in a better location with rents in the mid-teens, on a gross basis. Fortunately, the market currently has no office product under construction.

Fundamentals for both the office and flex market are strong, marked by an accelerated recovery from steep vacancies caused by the recession. The Wilmington market is expected to continue to achieve positive absorption and increasing rental rates.

The amenity base for the Wilmington market is expanding as well with the recent announcement of a new Target on Ballardvale St. close to Rte. 125. Additionally, there will be a convenience retail development as part of that development project providing tenants with sought after amenities.

Jack Kerrigan Jr. is principal of Avison Young, Burlington, Mass.

Tags:

Wilmington... A silver lining in the North Shore commercial real estate market

May 30, 2013 - Spotlights