CBRE | The Boulos Co.

The Greater Portland office market finally surpassed a total market size of 12 million s/f in 2017 in 341 Class A and Class B buildings — due to the addition of several new buildings. Vacancy rates continued to fall for the 8th consecutive year. Overall vacancy decreased to direct rates of 4.41% with a total rate of 4.61% that included subleased space. This is the lowest total vacancy rate we’ve seen since 2002. We had positive net absorption of 364,000± s/f, which is considerably more than the previous three years however, this absorption can be attributed to just a few deals. It’s interesting to note that the suburban market out-performed the downtown market for the first time in three years.

Downtown

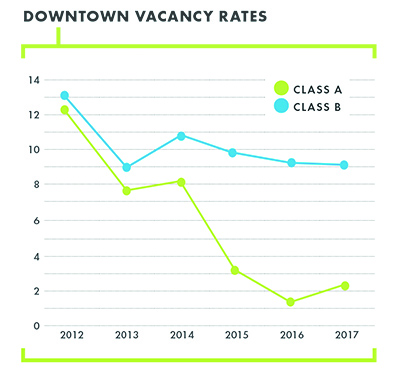

Over the past several years, the downtown office market was the key driver behind overall falling vacancy rates, but in 2017 downtown office markets inched up to 6.93%. Even with this slight increase, we still saw a positive net absorption of 14,000± s/f due to the Class A market, where we added 42,000± s/f at 16 Middle St. There was lower activity in the Class A market with a slight increase to 3.55% vacancy, but more importantly, no new direct leases were signed over 8,000± s/f last year due to the limited availability of space. There were very few spaces for Class A tenants looking for space over 8,000± s/f however, additional product in the pipeline and low absorption could lead to more opportunities in 2018. The Class B office vacancy saw a marginal decline to 9.85% with slowed activity over the last 12 months. The largest vacancies in the Class B market remain in the larger office towers in the Monument Sq. area. Smaller buildings in the historic Old Port area have much lower vacancy rates. The lack of movement overall downtown can be attributed to a lack of supply of Class A office space and a lack of demand in the Class B office space.

Suburban

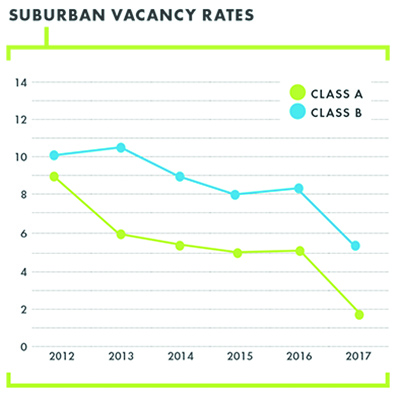

As previously mentioned, the suburban market had its largest drop in vacancy in over 10 years with a total rate of 3.41%, similar to the rates we saw in 2005 and 2006, and down from 6.53% in 2016. The suburban market had a positive net absorption of 303,000± s/f; due in a large part to Maine Health’s purchase of the 134,000± s/f building at One Riverfront Plaza in Westbrook—a property that had been vacant for several years. This one transaction dramatically influenced the suburban market and overall vacancy rate. Another significant suburban transaction was WEX’s lease of 30,000± sf at 30 Darling Ave. in South Portland. As expected, the Westbrook and South Portland/Scarborough submarkets accounted for the majority of the suburban activity in 2017.

Medical

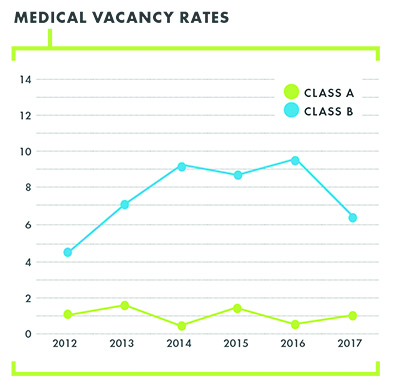

Available medical space remained scarce through 2017 with medical companies behind some of the larger suburban office leases. The overall vacancy rate fell to just 1.57%. Only one vacancy was reported out of the 36 Class A medical buildings in Greater Portland, resulting in some medical practices leasing Class B office buildings and retail buildings. Significant transactions included Maine Medical Center leasing 19,000± s/f at 265 Western Ave. in South Portland, Intermed leasing 24,000± s/f across the street at 50 Foden Rd. and the sale and occupancy of the10,000± s/f building at 117 Auburn St. in Portland.

Summary

We anticipate additional new space will be introduced to the market in 2018. We also expect vacancy rates, especially in Class A markets, to remain low enough to spur new construction, with several significant projects already underway. Developers recently broke ground on the 100,000± s/f WEX headquarters on Hancock St. in downtown Portland and two buildings—totaling 40,000± s/f—are under construction at 1945 Congress St. Another smaller building in downtown Portland is set to break ground shortly, this results in great opportunities for businesses looking to relocate or grow their businesses. In short, 2018 should be another year of steady but limited improvement with no large vacancies on the horizon and several new construction projects coming to fruition.

Nate Stevens is an associate broker with CBRE | The Boulos Co., Portland, ME.