Fletcher Tilton PC

The Tax Cuts and Jobs Act provides a dramatic decrease in the tax rates applicable to C corporations, along with changes that may benefit other U.S. businesses including S corporations, partnerships, and other pass-through entities.

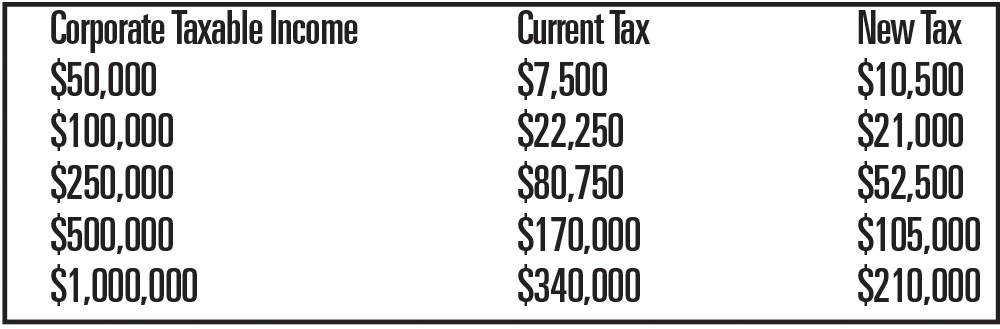

Corporate Rate Reduction: The tax replaces the graduated tax rate schedule for corporations. Beginning at 15% for the first $50,000 of taxable income ranging up to 35% on taxable income in excess of $10 million. This graduated tax rate schedule is replaced with a flat corporate tax rate of 21%.

The examples in the corporate taxable income chart indicate the corporate rate reductions under the new tax law. (Chart 1)

These new rates are effective for taxable years beginning after 2017. In addition, these new rates are intended to be permanent. Finally, the tax law repeals the corporate alternative minimum tax.

Expensing of Depreciable Assets (The Section 179 Deduction): The tax law contains a series of amendments designed to increase the total write-off in the year depreciable property is placed in service. The Section 179 depreciation deduction increases from $500,000 to $1 million with a $2.5 million phase-out. Bonus depreciation is increased to 100% retroactively to the effective date of 9/27/17.

The other new rapid write-off rules are applicable to property placed in service after December 31, 2017. With these changes, nearly all qualifying new assets can be fully expensed in the year of purchase instead of over many years.

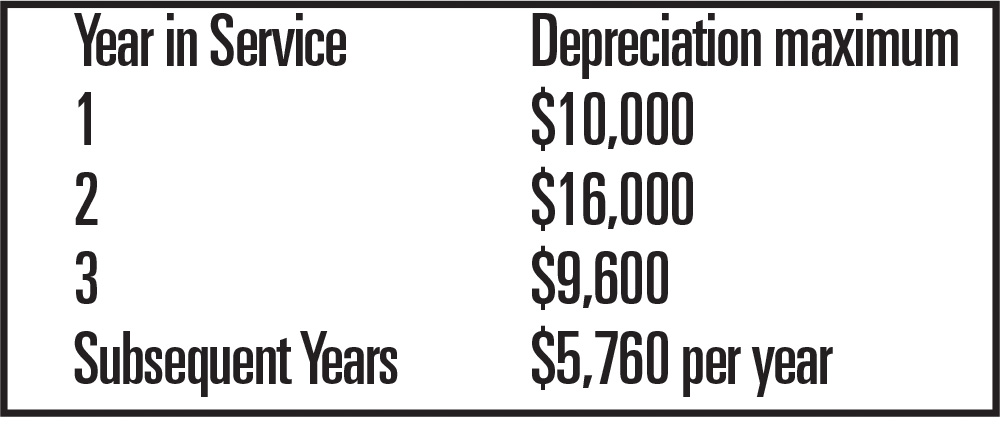

Depreciation of Passenger Automobiles Increased: There are several depreciation rules that accelerate the amount of an asset’s cost that can be expensed in the year of acquisition. Depreciation of passenger automobiles, however, has been subject to rules that limit the amount of depreciation that can be deducted in any year for an automobile used in business.

While these rules are still in effect, the amount of depreciation that can be claimed in a year has been greatly increased. See the following depreciation chart below. (Chart 2)

Like-Kind Exchanges: Under the previous like-kind exchange rules, no gain or loss is recognized on the exchange of like-kind properties used in a business or held for investment purposes. Property eligible for a tax-free exchange included real property, personal property and intangible property provided the property was not held for resale.

Under the tax law, the tax-free exchange rules are limited to exchanges of real property only.

Fringe Benefits and Entertainment Deductions: After many attempts at limiting the “3 martini lunch,” the Act eliminates any deduction for an entertainment activity even if directly related to taxpayer’s trade or business. For example, the law had previously denied a deduction for an entertainment facility such as a country club. However, if a taxpayer incurred expenses entertaining a client at his club and could demonstrate that the expense was directly related to its business, the expenses, subject to a 50% limitation, were deductible. Under the act no deduction is permitted for entertainment expenses even if directly related to taxpayer’s trade or business.

An employer who provides meals to its employees at an eating facility that qualifies as a de minimis fringe benefit, will be able to deduct 50% of such.

In another change to the fringe benefit rules, an employer who provides transportation as a fringe benefit such as parking can no longer deduct these costs. The employee will continue to be able to exclude such benefit from income, and in the spirit of tax simplification, bicycle commuting reimbursements are deductible by the employer but not excludable by the employee.

Finally, the Act provides a general business credit during 2018 and 2019 for wages paid as family and medical leave, such as maternity leave. Eligible employers can receive a credit equaling 12.5% of such wages paid to qualifying employees. If this FMLA compensation exceeds 50% of the compensation normally paid to the employee, the employer receives an additional .25% credit for each%age point above 50%. In other words, if the employer pays 60% of the employee’s normal wages during maternity or other FMLA leave, the employer can claim a 15% credit. The maximum credit is 25%.

Pass-Through Entities: Pass-through entities are those entities in which the income is taxed at the owner level. These entities include S corporations, partnerships, Limited liability companies and sole proprietorships. The income of these businesses is included in the income of the owner and subject to tax at the owners’ individual tax rate.

With the decrease in the corporate tax rate to 21%, the pass-through entity structure, whereby income would be taxed at the highest individual rate of 37%, would make such tax scheme unworkable.

Accordingly, The Act creates a new deduction equal to 20% of the pass-through entity’s qualified business income. This new deduction will result in a tax rate paid by the individual owner of the pass-through entity more in line with the 21% corporate tax rate. This provision is subject to many limitations and calculations too numerous and specific to discuss here.

The deduction reduces taxable income but does not reduce adjusted gross income. In addition, taxpayers who utilize the expanded standard deduction will still be able to claim this special deduction.

Accounting Method Changes: Under prior law, taxpayers who produced property or otherwise maintained inventories were required to use the accrual method of accounting, i.e., taxpayer was required to include receivables in taxable income. For tax years beginning after Dec. 31, 2017, the cash method of accounting may be used by taxpayers that satisfy a $25 million gross receipts test. This particular provision does not necessarily save money for the corporations; it just simplifies matters—which is one of the goals of The Act.

Submitted by the Tax Department at Fletcher Tilton PC, of which Dennis Gorman is the chair, Worcester Mass.