Warwick, RI Colliers International’s Capital Markets team arranged $16 million in financing for Briarwood Meadows, a 552-unit multifamily community. Spread across 36 acres, the 100% market rate community consists of 32 residential buildings, a fitness center, an indoor pool, an outdoor pool, tennis courts, a clubhouse and parking. The best-in-class community has consistently boasted near-zero vacancy while being meticulously maintained by onsite management of the owner, The Driscoll Company.

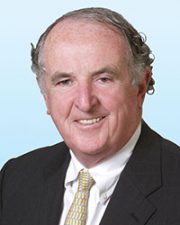

The Colliers team of co-chairman Kevin Phelan and associate Sean Burke arranged the financing on behalf of The Driscoll Co. The lender, Principal Real Estate Investors, provided the low leverage, long-term fixed rate financing, allowing The Driscoll Co. to refinance its existing debt while interest rates remain competitively low. The interest rate was locked in advance of closing, allowing ownership to avoid rising rates during the closing process.

“The financing provides flexibility and a competitive structure that met all of our client’s needs,” said Phelan. “Briarwood Meadows is an exceptional multifamily community and The Driscoll Company has done a great job operating and maintaining the asset. “We are extremely pleased with the outcome.”