Although this winter has seen very cold temperatures throughout our region, the New Hampshire office and industrial real estate markets are starting to realize a spring thaw.

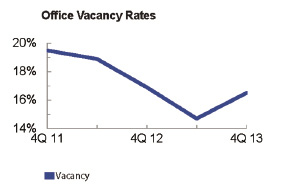

Colliers International | New Hampshire tracks over 17 million s/f of office space in the market and is reporting a statewide office vacancy rate of 16.5% in the 4Q 2013. This is an improvement of .4 basis points from the 4Q 2012 vacancy rate of 16.9%. Office vacancy was an unhealthy 19.5% in 4Q 2011.

The vacancy rate is the amount of physically vacant space divided by the inventory. This includes direct and sublease vacant space.

The Greater Salem and Greater Rochester markets have the tightest office markets at below 10% vacancy rates. Greater Manchester and Greater Portsmouth have seen slight improvements in office space absorption. The office market in Greater Nashua still remains stagnant.

While there are still many examples of musical chair leasing, where a company leaves one building for greener pastures in another, the current market is starting to see some solid absorption coming from companies that are expanding and eating into already vacant space. We are also seeing growth from startup companies launching from incubator space into more traditional office space, as rates have come down and it remains a tenant's market.

Conversely, the New Hampshire industrial real estate vacancy rate in the 4Q 2013, based on the almost 62 million s/f of industrial space tracked, plunged below the 10% mark for the first time in several years to 9.1% statewide. This is an improvement of 2 basis points from the same period in 2012. Industrial real estate vacancy was recorded at 14.4% in 4Q 2011.

All submarkets realized improvement in the past year from industrial space absorption. Four of the six submarkets show an industrial vacancy rate of lower than the statewide 9.1% vacancy rate, while Greater Nashua and Greater Salem are still lagging behind. Ample supply of industrial product in the Hudson Industrial Park area still exists and there are several large industrial buildings in the Burke St. area of Nashua that remain empty.

The expectation is that the industrial real estate market will continue to strengthen as several large 50,000+ s/f vacant industrial properties are under agreement, including two in the Manchester Boston Regional Airport District, and are scheduled to close in the near future.

However, there continues to be a lack of available options for modern, high bay, industrial buildings in the region. We may be reaching the tipping point for a lot more new construction in the future as the prices for existing buildings increase gradually.

Spring is just a couple of weeks away. Warmer temperatures should coincide with increased market activity in both the office and industrial real estate markets in New Hampshire.

Jim DeStefano is the vice president of sales & marketing and a principal and Laura Nesmith is research manager of Colliers International | New Hampshire.

.png)