Sassoon & Cymrot, LLC

DiCicco, Gulman & Company

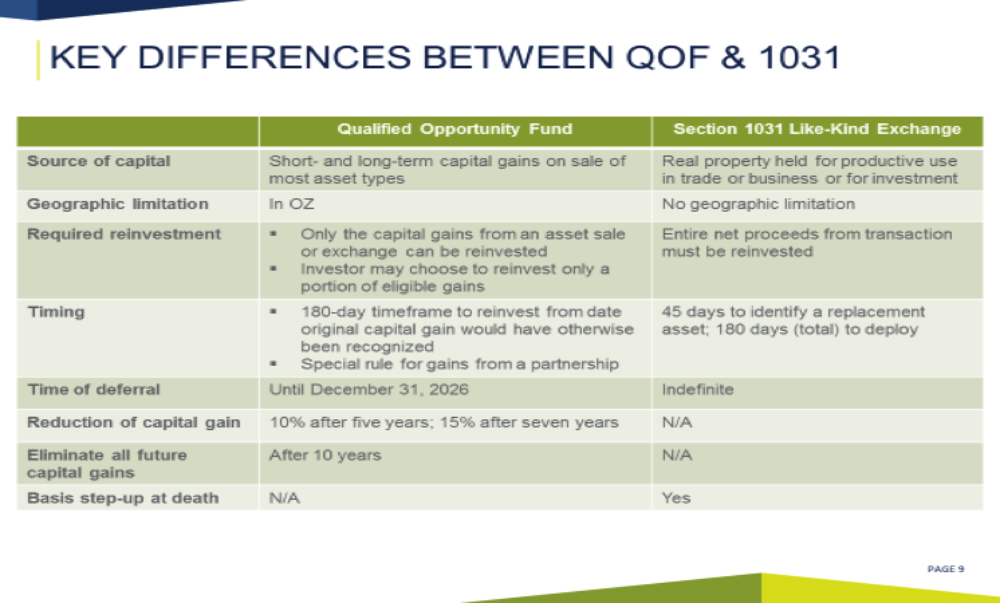

Qualified Opportunity Funds (QOF), a tax incentive created under the Tax Reform Act of 2017, is the newest mechanism under the federal tax code to defer capital gains tax. Real estate investors can now choose between a 1031 like-kind exchange and a QOF when seeking to defer the tax on their capital gains. Which of these tools is a better choice for real estate investors? In this article, we will highlight a few key differences.

Qualified Assets and Source of Capital Gain: Only real estate assets can now qualify for a 1031 exchange, pursuant to changes implemented under the 2017 Tax Reform Act. However, QOFs allow a greater range of investment assets to qualify for deferral of capital gains tax (i.e., sale of stock and business as well as real estate).

Investment Structure: A 1031 exchange can accommodate a single asset acquisition owned by a single investor, while a QOF may be structured to support a pooled investment fund owned by multiple investors acquiring multiple qualified assets. A taxpayer conducting a 1031 exchange may be an individual or an entity, including a limited liability company structured as a disregarded or pass-through entity. However, a QOF must be a partnership, corporation, or a limited liability company taxed as either a partnership or corporation.

Geographic Limitations: The tax benefits associated with QOFs are designed to stimulate economic development and investment in low income census tracts known as Opportunity Zones, designated by the Governor of each State. Passive real estate investments do not qualify because substantial improvements are required for the QOF asset to qualify for the tax benefit. In contract, 1031 investments may be made in any type of investment real estate asset located anywhere in the country; substantial improvement of the 1031 asset is not required. Thus, 1031 acquisitions may be existing multi-family or commercial buildings, NNN retail properties, or undeveloped land.

Rollover Period: The time frame for conducting a 1031 exchange is tighter than the time frame for investing through a QOF. In a 1031 exchange, the sale of the exchange asset and purchase of the replacement property must occur within 180 days. With a QOF, the taxpayer has 180 days to transfer cash into a QOF following the sale of the asset. However, for gain recognized by an individual through a partnership, the 180-day period does not commence until the end of the calendar year. Thus, a stock sale by a partnership resulting in taxable gain may occur in March, but the 180-day period to place the capital in a QOF by the individual partner does not commence until the end of the calendar year, giving the investor until June 30th to invest in the QOF. Thereafter, the QOF has up to 31 months to deploy the capital. Such period presumably gives the QOF time for permitting and construction to fulfil the substantial improvement requirement of QOFs. No substantial improvement requirement exists for a 1031 exchange.

Reduction and Deferral of Capital Gains: QOFs offer the opportunity to reduce the capital gains tax by 10% after 5 years and by 15% after 7 years, through a step up in basis. However, 1031 exchanges offer no mechanism for a step up in basis, except in the event of and upon the death of the investor/owner of the asset.

Capital gains tax in a 1031 exchange may be deferred indefinitely, as payment of the capital gains tax is triggered only upon sale of the asset. With a QOF, however, capital gain from the sale of the original asset may be deferred only until December 31, 2026. A more significant benefit is, nevertheless, available to the long-term QOF investor who holds the property for at least 10 years. In such case, upon sale of the asset by the QOF, no capital gains tax will be payable.

Conclusion:1031 exchanges still remain a strong investment vehicle for an individual taxpayer or pass-through entity investing in replacement real estate assets. 1031 exchanges can accommodate passive investments such as triple net leased or multi-family properties since such properties do not require substantial improvements, as are required for a QOF. Lastly, the absence of geographic limitations is yet a further benefit for 1031 investors. QOF provide a great benefit but may limit an investor’s options. Investors are encouraged to confer with their legal advisor and their CPA for further guidance in selecting the tax deferral vehicle that best suits their particular investment needs.

Mark Bressler, Esq. is commercial real estate practice leader at Sassoon & Cymrot, LLP, and Jonathan Farrell, C.P.A. is partner and real estate practice leader at DiCicco, Gulman & Company LLP, Boston, Mass.