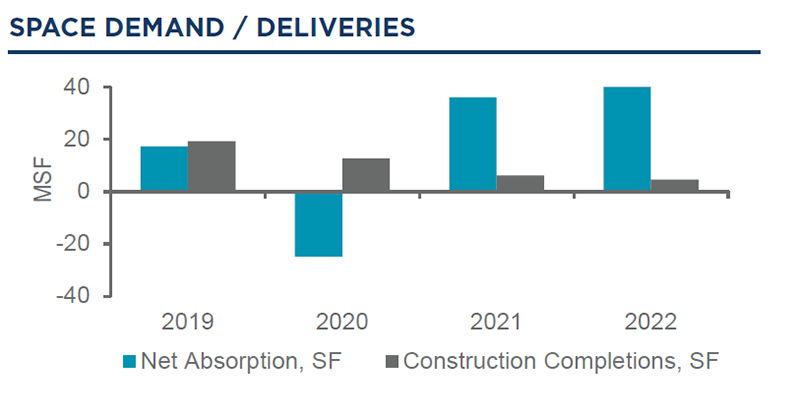

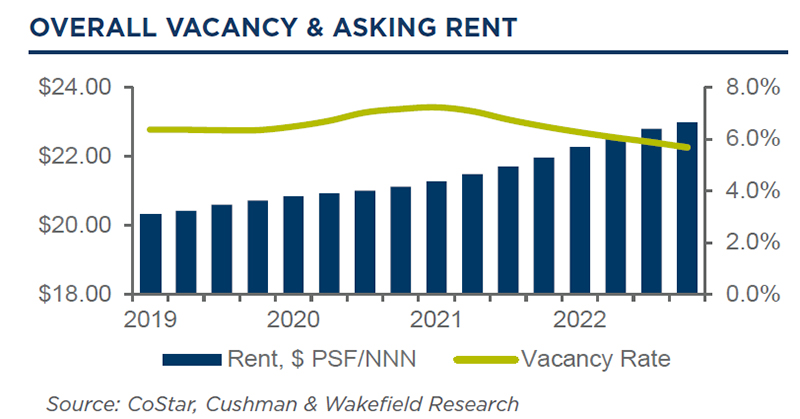

Boston, MA Retail shopping center real estate markets remained strong in the fourth quarter of 2022, as resilient demand drove shopping center vacancy to its lowest level on record—dating back to 2007 according the Cushman & Wakefield research. Asking rents for shopping centers rose nationwide by 0.8% quarter-over-quarter (QoQ) to an average of $22.99 per s/f, while the vacancy rate declined 20 basis points to 5.7%. Net absorption accelerated to a pace of 10.9 million s/f, up from the mid-year lull where absorption averaged 9.4 million s/f over the second and third quarters, but down from 12.9 million s/f in Q4 2021.

Looking at demand regionally, 66 of the 81 markets tracked by Cushman & Wakefield experienced positive net absorption, with Chicago at 1.0 million s/f (msf), Phoenix at 788,000 s/f, Atlanta at 574,000 s/f, Denver at 422,000 s/f, Washington, D.C. at 397,000 s/f, Dallas/Fort Worth at 392,000 s/f and New York City with 353,000 s/f leading the way. Philadelphia, Hartford, Buffalo and Albany each saw a net decline in absorption, as did a handful of secondary markets in the South and West regions.

“The economic backdrop has become highly uncertain over the last several months, with retailers preparing for more challenging conditions in 2023, yet retail fundamentals have not yet flinched. Consumer behaviors remained healthy to close out the year: shopping mall foot traffic exceeded 2019 levels in the final two weeks of December, and holiday sales are expected to have been modestly positive. Inflation continues to be a concern for shoppers and retailers, though the rate of price increases moderated in recent months,” said Barrie Scardina, executive managing director and head of retail services.

“Retailers seem to be confident enough that inflation and a probable recession in 2023 will not be overly disruptive to business; store openings in 2022 outpaced closures by nearly 2,500—the largest net expansion in a decade. In addition to resilience in core retail, consumer services such as medical, entertainment and dining are bolstering retail real estate demand more than they have in past economic cycles,” said Scardina.