National Perspective

In our Q3 2009 report to the lodging industry, New England Hotel Realty (NEHR), and its research division, Lodging Econometrics (LE), stated that the U.S. Hotel Construction Pipeline totaled 3,890 projects with 485,664 guest rooms at the end of September 2009, a low not seen in three years. This represents a 34% decline in the number of projects and a 38% decline in the number of rooms from the cyclical peak of 5,883 projects/785,547 rooms in Q2 2008.

Further, in Q3, New Project Announcements into the Pipeline reached a new low for the cycle, while cancellations/postponements remain at elevatÂed levels. A total of 1,032 new hotels, having 111,642 guestrooms, opened in the first three quarters of 2009.

The credit crisis continues to significantly affect lodging real estate development. Early in the cycle, larger (150 rooms or more), high-end projects were impacted the most, as institutional-sized lenders halted real estate lending. Today, some regional and community banks are experiencing growing balance sheet difficulties of their own and are now cutting back on construction mortgage lending as well, directly affecting smaller projects in the pipeline. The result is that development activity has slowed further and pipeline totals continue to fall.

For Q4 2009, NEHR & LE is forecasting 355 projects/41,804 rooms to open in the U.S. The Forecasts for new hotel openings account for the continued high rate of project cancellations and postponements and reflects lending difficulties. As such, 2010 will see 988 projects/112,684 rooms open, with 749 projects/75,286 rooms expected to come online in 2011.

Nationally, the lack of available funding continues to impact lodging real estate transactions, which remain in a precipitous decline. Transaction volume in 2009 is expected to be just 25% of what it was at the peak in 2007, with selling prices down by 50%.

New England Hotel

Construction Pipeline

At the end of 3Q 2009, New England's Hotel Construction Pipeline consisted of 107 projects with 13,561 guestrooms (Chart 1). This accounts for about 2.8% of total projects and 2.8% of total guestrooms in the National Pipeline. NEHR forecasts that 24 hotels with 2,343 new guestrooms will open in '09 for a gross growth rate of 1.1%, which is prior to any removals of hotel rooms from the current Census of Open and Operating Hotels. For '10, NEHR forecasts that 27 hotels with 2,520 new guestrooms will open in New England. In 2011, 15 hotels with 1,522 guestrooms are expected to open. Given the high number of projects scheduled to start construction in the next 12 months and those in early planning, the supply side forecast for 2012 and beyond is correspondingly significant. However, given the current economic climate and associated financing issues, some of these projects are likely to be delayed, postponed, or even canceled.

The forecast for individual states in New England reveals more details.

Forecasted new hotel openings in New England for '10 and '11 combined show the largest growth in Massachusetts and Connecticut. 17 new hotel openings with 1,688 new rooms are expected in Massachusetts, while 9 new hotels and 980 new rooms are anticipated in Connecticut. During the same period, New Hampshire can expect 7 new hotels, with 631 new rooms.

What does it mean for the region? It means that over the next 24 months or so, there will be a very modest supply increase in New England. An economic rebound coupled with a modest supply increase should bode well for owners.

New England Lodging

Transactions and Values

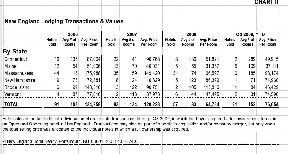

The number of lodging transactions and corresponding values in New England had seen a steady increase from 2003 through 2006. However, by 2007, the decline in transaction volume and average price per room had become apparent. (Chart II)

In 2008, there was a rather precipitous decline, with the number of transactions falling to 57 and the average price per room settling in at just under $65,000 - almost half of the 2007 average price per room.

The number of transactions has continued its downward spiral in 2009, with just 21 hotels sold year-to-date through September. However, values on a price per room basis are showing a slight rebound, with the average price per room up nearly $12,000 compared to 2008.

Because of the economy, slowing demand and the scarcity of financing for hotel deals greater than $12 million, some investors have retreated to the sidelines, especially in the second half of 2008 and into 2009.

However, over the past nine months or so, large new equity groups with significant capital resources have started to form and they are looking for distressed and troubled assets. But, we have not seen the large wave of distressed or lender owned transactions come to market as we have in previous down cycles. For the most part, lenders have been loathe to foreclose and assume ownership of hotels, and have generally been willing to work with their current borrowers through these difficult times. And, like all cycles, we all know better times lay ahead for owners as economic conditions stabilize and rebound.

Some larger significant transactions that occurred in the first nine months of 2009 were: the Hyatt Regency, Boston, MA at $226,908 per room; Marriott Hotel, Newton, MA at $67,442 per room; and the Stamford Plaza & Conference Center, Stamford, CT at $56,587 per room.

New England Hotel Realty (NEHR) is the highest volume hospitality real estate advisory and brokerage firm in the Northeast, providing acquisition, disposition, consulting and market research services to the lodging real estate and lending industries. Since 1977, the NEHR team has provided quality investment opportunities and seller representation in hundreds of hotel transactions. We are frequently called upon as advisors to assist in the analysis of a client's lodging investments.

We are prepared to advise in the strictest confidence on whether to sell an asset or hold it and sell at a more advantageous time. We can assist in the disposition of a single hotel investment or a portfolio of lodging assets of any size. Or, we can identify new hotel investments that meet a client's exacting acquisition specifications.

JP Ford, CHB, ISHC, is senior vice president of New England Hotel Realty (NEHR).

NEHR provides acquisition, disposition, consulting, and market research services to the lodging real estate industry since 1977. NEHR is highly skilled in the sale of lender-owned and distressed hotels.

Ford is responsible for overseeing and directing the company's brokerage department, working with new clients, and servicing the disposition and acquisition needs of existing clients. He specializes in the sale of full and limited service hotels and portfolio sales.

Tags:

Hotel supply continues to fall, transactions too, but prices may be stabilizing

November 17, 2009 - Front Section