As discussed in our Q1 2018 office market report, transaction volume failed to make headway in Boston’s office market during the first quarter of 2018. With that said, Boston remains a highly-desirable destination for capital among all investor types, and the limited inventory of available properties for sale continues to drive up pricing.

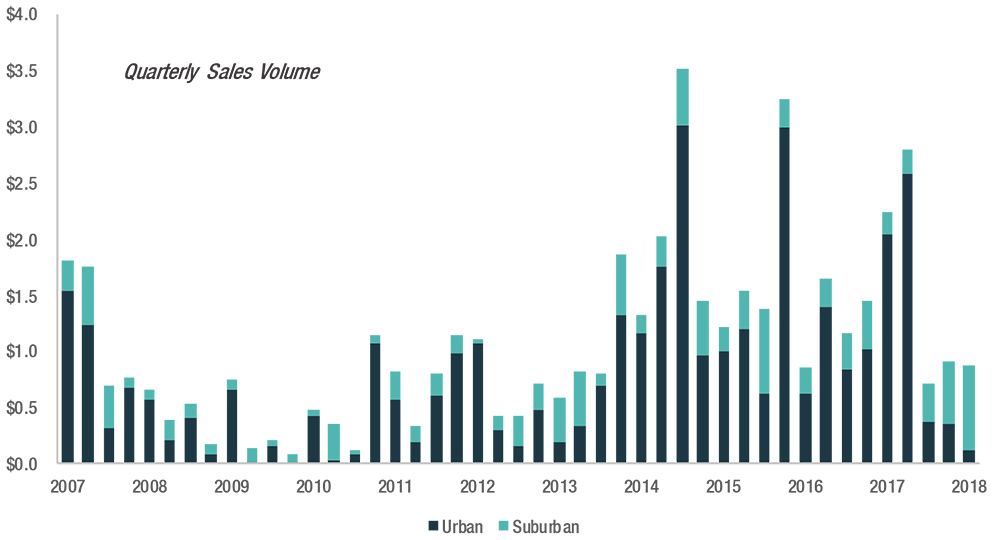

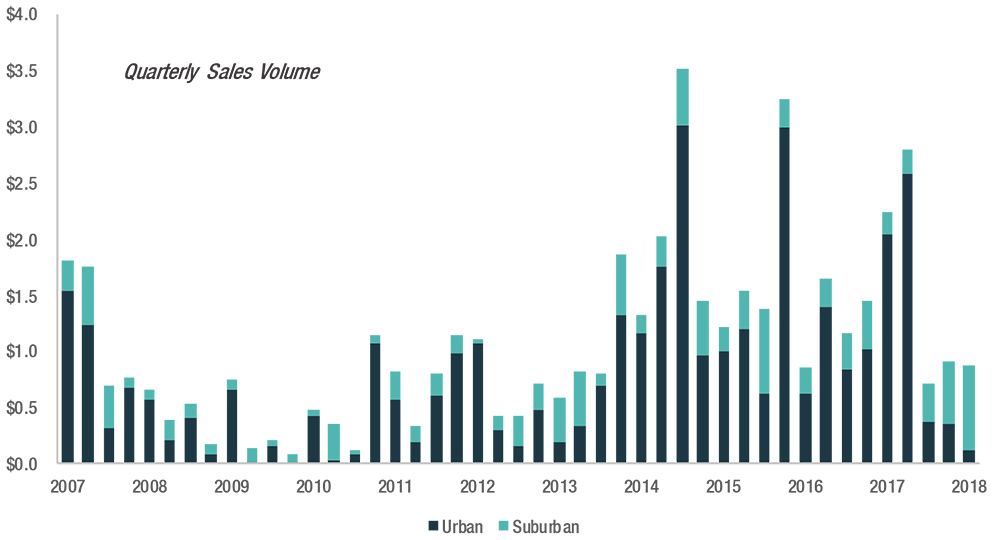

Similar to national office trends, suburban investment is on an upswing. Investors seeking higher yields and greater opportunities are driving this expanded activity. In fact, more than $1.3 billion in suburban assets have changed hands in the last two quarters. In Boston’s urban markets, which encompasses Cambridge, less than $500 million transacted during the same time frame. Three out of the top four largest first-quarter office transactions took place in the ‘burbs, with CrossHarbor Capital Partners’ $277 million purchase of Cross Point in Lowell representing the top deal. Spear Street Capital’s $88 million acquisition of the former Reebok campus in Canton was another major sale that closed in early 2018.

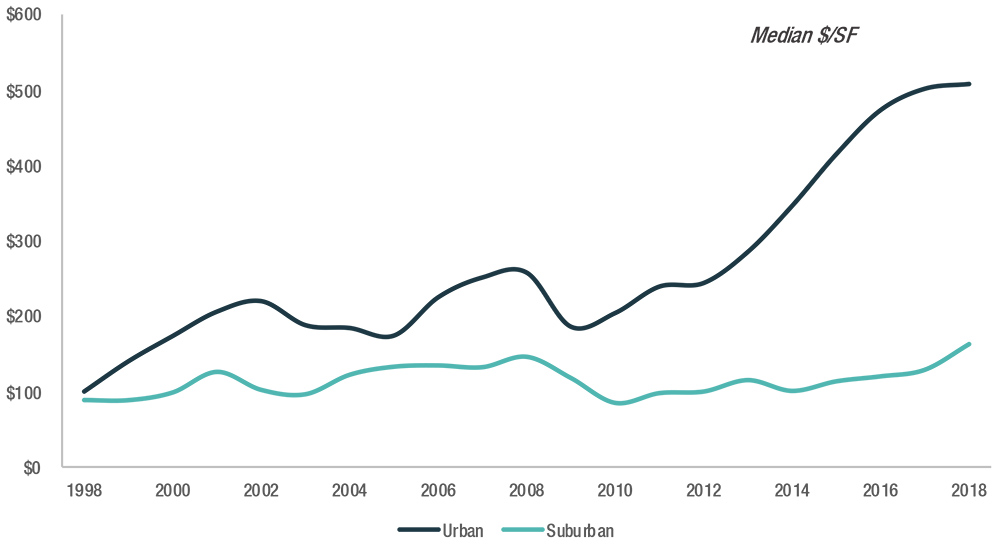

As a result, pricing growth has finally started to gain some momentum in Greater Boston’s suburbs; expanding by 30% from Q1 2017 to Q1 2018. Barring this recent surge, suburban sale prices have remained relatively stable. It wasn’t until very recently that pricing had reached the previous cycle’s peak. While growth has slowed in the urban markets, pricing remains elevated near peak levels and the delta between urban/suburban pricing is as wide as ever. (see Chart 1)

As a result, when downtown assets do change hands, buyers will pay a premium. Exan Capital recently purchased 40 Court St., 109,705 s/f class B asset in the Financial District for $54 million or $492 per s/f at a 4% cap rate. Stars Investment paid just $31 million for the building in 2014. The sale of 28 State St. is reportedly nearing completion, with an estimated price tag of $430 million or $745 per s/f. This would represent a 25% price increase from the asset’s 2014 sale.

Finally, Tishman Speyer’s yet-to-be-delivered Pier 4 office building could fetch $420 million or a whopping $1,100 per s/f. (see Chart 2)

Given these pricing trends and the lack of available product for sale in urban Boston, investors will continue to seek value in suburban assets.

Liz Berthelette is director of research at NAI Hunneman, Boston, Mass.