Lodging Econometrics

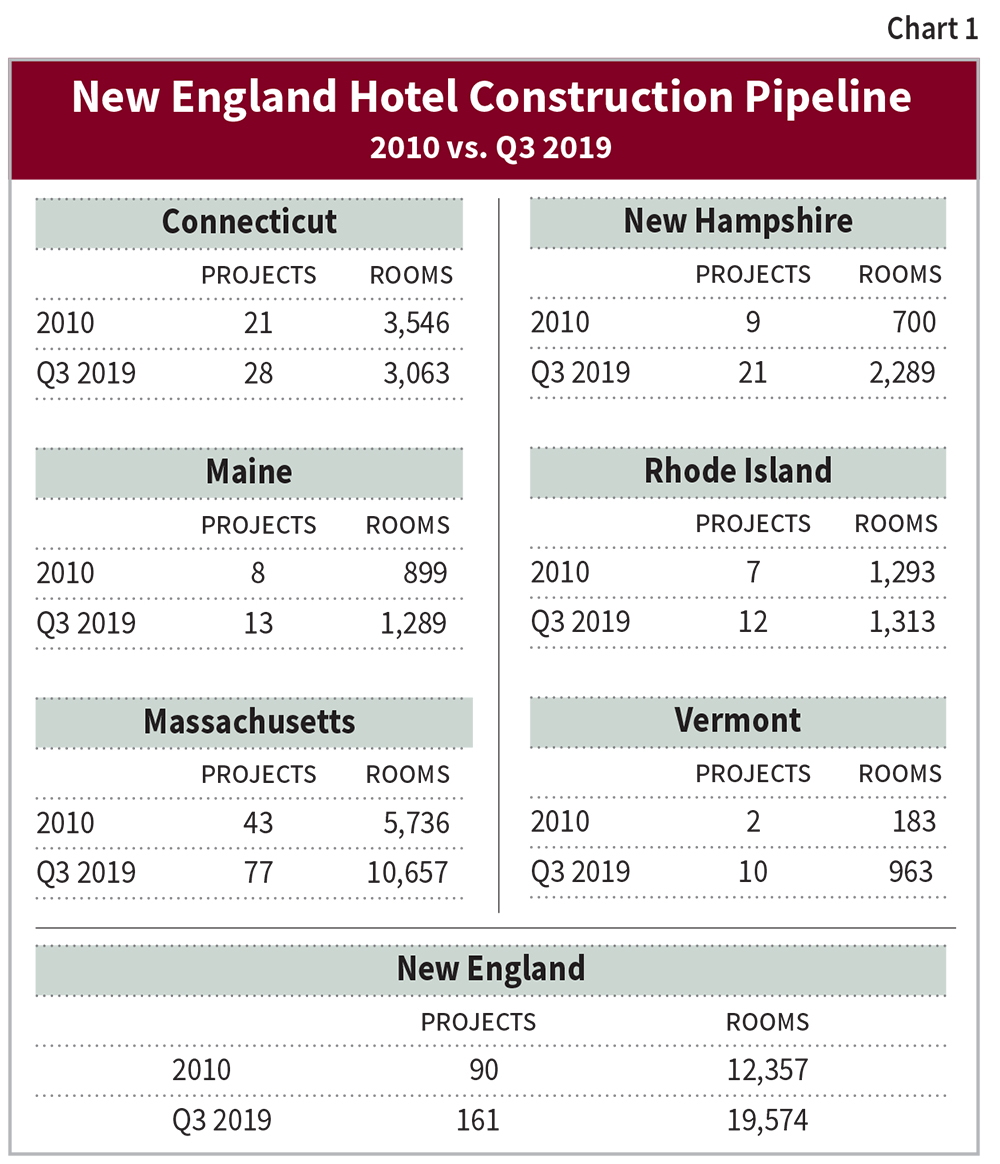

Analysts at Lodging Econometrics (LE), the global leader for hotel real estate intelligence, have seen the United States hotel construction pipeline projects increase an extraordinary 83% over the last decade. This has led to a flourishing New England hotel construction pipeline. At the close of 2010, there were 90 projects/12,357 rooms in the New England hotel construction pipeline. At the end of the third quarter of 2019, New England’s pipeline reached a 10-year all-time high of 161 projects with 19,574 rooms (see Chart 1). This is a whopping 79% increase over the 2010 project total. In fact, New England is on track to close-out its seventh consecutive year of having over 100 projects in its pipeline. These robust pipeline counts have allowed for a total of 209 hotels/22,575 rooms to be added into the open and operating hotel supply base in New England since 2010. LE is expecting another 67 hotels/8,321 rooms to open by the close of 2021.

Over half of the new hotels that have entered into the supply in New England, since 2010, can be found in Massachusetts which had 108 hotels open, followed distantly by Maine with 32 and then Connecticut with 25. The most preferred brands by developers that have been built within the last decade include: Hampton by Hilton with 27 hotels/2,686 rooms; Residence Inn by Marriott with 20 hotels/2,539 rooms; Homewood Suites by Hilton with 16 hotels/1,699 rooms; Fairfield Inn by Marriott with 12 hotels/1,199 rooms; and Courtyard by Marriott with 10 hotels/1,119 rooms.

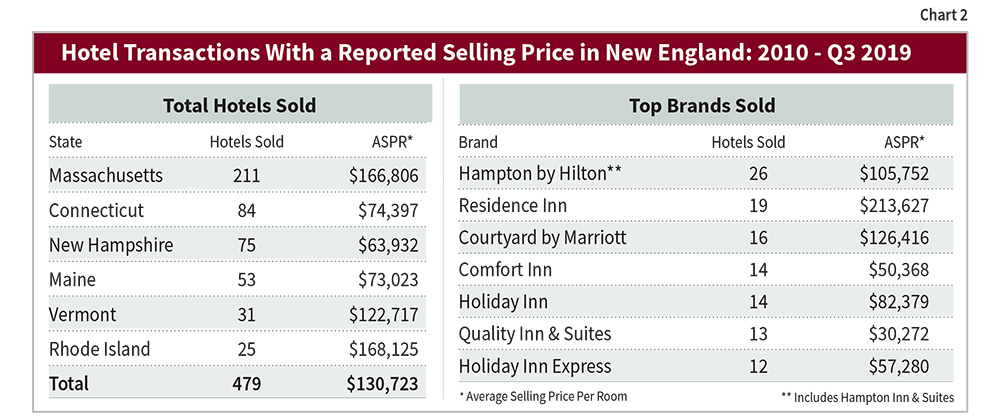

Not only has the pipeline increased over the last decade, but so has the average selling price per room of hotels. Since 2010, LE has seen the average selling price per room (ASPR) rise significantly in the United States and in New England. In 2010, there were 529 hotels sold in the United States with an ASPR of $109,342. New England claimed 42 of those sales at an ASPR of $90,563. From the first quarter of 2019 through the close of the third quarter of 2019, there were 429 hotels that sold in the United States for an ASPR of $183,823. Of those hotels, 22 were sold in New England for an ASPR of $216,220. This is a 68% increase in ASPR for the United States and a remarkable 139% increase in ASPR within New England over the last decade.

At the close of the third quarter of 2019, hotel sales activity in Massachusetts continues to dominate New England with 13 hotel transactions. This is a decrease in the number of hotels sold in Massachusetts when compared to the close of the third quarter of 2018 when 17 hotels sold. Conversely, the ASPR in Massachusetts has increased 36% at the close of the third quarter of 2019, standing at $282,885 compared to $207,648 at the close of the same quarter in 2018.

At the close of the third quarter of 2019, hotel sales activity in Massachusetts continues to dominate New England with 13 hotel transactions. This is a decrease in the number of hotels sold in Massachusetts when compared to the close of the third quarter of 2018 when 17 hotels sold. Conversely, the ASPR in Massachusetts has increased 36% at the close of the third quarter of 2019, standing at $282,885 compared to $207,648 at the close of the same quarter in 2018.

Branded hotels have attracted the most investor interest and account for 58% of the hotels sold in New England since 2010. The brands that have sold most frequently during this time period are Hampton by Hilton with 26 hotel sales, Residence Inn with 19, Courtyard by Marriott with 16, Choice’s Comfort Inn and InterContinental Hotels Group’s Holiday Inn both with 14 hotel transactions, followed by Choice’s Quality Inn & Suites with 13 hotels sold (see Chart 2).

Lodging Econometrics (LE) is the leading provider of global hotel intelligence. Combining unparalleled industry experience, a real-time pulse on market trends and extensive knowledge of key decision-makers, LE delivers actionable business development programs for hotel franchise companies looking to accelerate their brand growth, hotel ownership and management companies seeking to expand their real estate portfolios, and lodging industry vendors wanting to increase their sales. LE’s programs turn a client’s business goals into opportunities that advances their competitive advantage.

JP Ford, CHB, ISHC, is a senior vice president and director of global business development for Lodging Econometrics. He is an industry leading real estate advisory specialist with over 30 years of experience providing business development, and advisory services in the United States.

Ford serves as a trusted advisor to hotel ownership and management groups looking to add hotel real estate assets and management contracts to their portfolios; hotel franchise companies looking to identify new construction and brand conversion opportunities; and analysts looking to evaluate hotel real estate development, sales transaction trends and investment potential in various hotel markets.