By JP Ford, New England Hotel Realty, Portsmouth, N.H.

Nationally, the Lodging Construction Pipeline reached a record level and, likely, its cyclical peak. In its Q4 '07 report to the lodging industry, New England Hotel Realty (NEHR) and its research division Lodging Econometrics stated that the Construction Pipeline contained 5,438 new construction projects being actively pursued by developers, for a total of 718,387 guestrooms. This represents a 36% year over year (YOY) increase for both new projects and new guestrooms. It's the fourth consecutive year of pipeline growth.

At Q4 2007, 31% of the total pipeline - 223,977 rooms - were under construction. Notably, 44% of the pipeline is scheduled to start construction in the next 12 months, with a total of 315,995 rooms.

The development boom is led by projects in the upscale and mid-market sectors, which together make up 83% of the non-casino projects and 76% of the guestrooms in the pipeline. These chain scales include the high profile brands from the top franchise companies - Marriott, Hilton, InterContinental and Choice, as well as, Best Western. These companies had an outstanding year selling their family of brands both to developers for new construction and to investor groups interested in reflagging their open and operating hotels.

The forecast for new openings in 2008 is 1,208 hotels/133,628 rooms, a 2.8% gross supply increase. The 2008 forecast is almost completely derived from hotels already under construction. The net supply increase should finish around 2.5%, as a decline in operating hotels going offline for alternative use is expected.

The forecast for 2009 is 1,456 hotels/166,236 guestrooms, a 3.4% gross growth rate. While these projections already account for anticipated market conditions, 2009 could decline slightly if economic and lending conditions worsen more than expected.

N.E. Construction Pipeline Grows

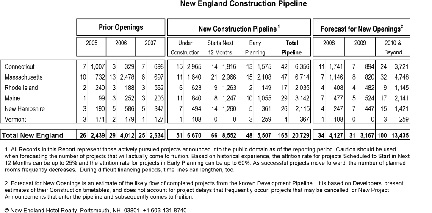

In N.E., at the end of 2007, the total N.E. Pipeline consisted of 165 projects with 20,729 guestrooms (Chart 1). This accounts for about 3% of total new projects and about 2.9% of total new guestrooms in the national pipeline. At the end of 2007, there were 33 more projects with 3,281 more rooms in the pipeline than there were at the end of 2006. Accordingly, NEHR forecasts that 34 hotels with 4,127 new guestrooms will open in '08 for a gross growth rate of 1.9%, which is prior to any removals of hotel rooms from the current census of open and operating hotels. For 2009, NEHR forecasts that 31 hotels with 3,167 new guestrooms will open in N. E. Given the high number of projects scheduled to start construction in the next 12 Months and those in early planning, the supply side forecast for 2010 and beyond is correspondingly significant.

The forecast for individual states in New England reveals more details. Forecasted new hotel openings in Connecticut and Massachusetts for '08 and '09 are the highest, as you might expect, as these are the region's two most populous states. Eighteen new hotels with 2,635 new rooms are expected to open in Connecticut in the next two years. Fifteen new hotels with 1,966 new rooms are expected to open in Massachusetts in the next two years. Surprisingly, Maine is expected to add 12 hotels and 1,001 new rooms during the same time period.

What it means for the region is that over the next 24 months or so, there will be a relatively modest supply increase in New England. Some existing properties will feel the effect of new supply more than others, depending on each specific location.

New England Lodging Transactions and Values

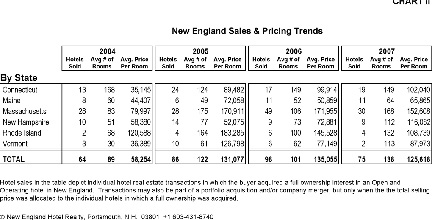

The number of lodging transactions in New England has increased each year from 2004 to 2006, as has the average price on a per room basis (Chart II). In 2007, there were 23 fewer transactions than in 2006. However, we are still seeing strong demand from buyers and investment groups looking to purchase in the New England region and/or increase the size of their existing portfolios.

The Average Number of Rooms per transaction was 138 in 2007, up from 101 rooms in 2006. In 2005, the Average Size Per Transaction was 122 rooms, which was way ahead of '03 and '04.

The Average Price Per Room for transactions in 2007 declined by 7% over 2006. Or, stated another way, the Average Price Per Room sold in 2006 decreased by $9,437. As you would expect, sales in Massachusetts have been a significant contributor to strong prices on a per room basis for the New England region, due to heavy buyer demand attributed to the general recognition that Massachusetts has some of the largest corporate and leisure demand generators.

A further breakdown of New England Lodging Transactions (not shown in Chart II) indicates that 40 transactions in the region occurred in the first half of '07 and 35 in the second half. Furthermore, of the 75 transactions in the region in 2007, 52 were less than 150 rooms and 23 were greater than 150 rooms.

Some larger, significant lodging transactions that occurred in the second half of 2007were:

The Mayflower Inn, Hartford, Conn, 30 rooms at $604,500 per room; Dolce Norwalk Center, Norwalk, Conn, 120 rooms at $207,491 per room; and the Shawmut Inn, Boston, Mass, 66 rooms at $174,242 per room. Many of the buyers were cash-laden equity groups looking for desirable hotel assets in New England. Other notable Massachusetts hotel sales that were part of portfolio transactions included the Hilton Back Bay, 385 rooms, and the Marriott Courtyard, 317 rooms, in downtown Boston.

Tags:

New England Hotel Realty and its Lodging Econometrics researches Hotel Const. Pipeline

March 20, 2008 - Front Section