In our Q1 2013 report to the lodging industry, New England Hotel Realty (NEHR) and its research division, Lodging Econometrics (LE), stated that the U.S. Hotel Construction Pipeline totaled 2,851 projects with 355,176 guestrooms, which is an increase Year over Year (YoY) of 5% by projects and 7% by rooms.

In Q1, new project announcements into the pipeline rose to 331 with 41,248 rooms - an increase of 124 projects and 15,953 rooms compared to Q4 2012. 96 new hotels, having 10,385 guestrooms opened in Q1 2013. Additionally, there are 125 more hotels under construction at the end of Q1 2013 than there were at the end of Q1 2012.

Contrary to the modest increase in the pipeline, the overall sentiment is positive. Optimism pervades the industry due to strong operational improvements, the increase in lending sources and modest new supply growth. The outlook is bright for the foreseeable future.

For year ending 2013, LE is forecasting 501 projects and 55,308 rooms will open across the country. This is an increase of 91 hotels over 2012 openings. Total supply growth will be about 1.1% in the US for 2013... well below a normal growth year.

New England

Construction Pipeline

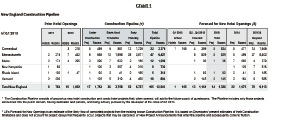

At the end of Q1 2013, New England's hotel construction pipeline consisted of 105 projects with 12,249 guestrooms (See Chart 1). This accounts for about 3.7% of total projects and 3.4% of total guestrooms in the National Pipeline. New England Hotel Realty forecasts that 14 hotels with 1,326 new guestrooms will open in all of 2013. For 2014, NEHR forecasts 22 hotels with 1,975 new guestrooms will open. The remainder of the Pipeline is expected to roll out in 2015 and beyond.

Actual to date, and forecasted new hotel openings in New England for 2013 and 2014 combined, show the largest growth in Mass., Conn., and Maine. Ten new hotel openings with 1,025 new rooms are expected to open in Mass., while 10 new hotels and 995 new rooms are anticipated in Conn. through 2014. During the same period, Maine should see 8 new hotels open with 719 new rooms... most of these in the Portland area.

What does it mean for the region? It means that for the next two and a half years there should be very modest overall supply growth in New England. These supply projections should be great news if you are an existing owner looking for your hotel to continue to rebound, as demand should outpace new supply for many more months to come. There is less clarity in 2015 and beyond, but those results will largely depend upon the number of early planning projects (especially in Massachusetts) that progress through the pipeline. Select Service hotels will be favored by developers because they have large reservation systems, and wide consumer acceptance, hence, their attractiveness to lenders.

New England Lodging

Transactions and Values

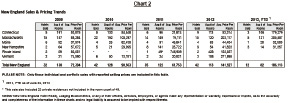

Not surprisingly, the number of lodging transactions in New England has been subdued since the fall of 2009 (See Chart 2). Choppy sales activity in terms of the number of hotels sold has been prevalent. However, last year and into 2013 the average price per room has risen dramatically; attributed to improved operations and an optimistic outlook going forward.

In the New England region transactions are expected to increase. This is a great time to be a buyer as interest rates are low and lending is available from many sources. Additionally, it's also a great time to be a seller. With buyer demand surging and cap rates relatively low it's a great time to take profits. We are in one of those "unusual" times where strong cases can be made to be a buyer and seller. It feels a lot like "equilibrium."

New England Hotel Realty (NEHR) is the highest volume hospitality real estate advisory and brokerage firm in the Northeast, providing acquisition, disposition, consulting and market research services to the lodging real estate and lending industries. Since 1977, the NEHR team has provided quality investment opportunities and seller representation in hundreds of hotel transactions. We are frequently called upon as advisors to assist in the analysis of a client's lodging investments.

We are prepared to advise in the strictest confidence on whether to sell an asset or hold it and sell at a more advantageous time. We can assist in the disposition of a single hotel investment or a portfolio of lodging assets of any size.

JP Ford, CHB, ISHC, is a principal of New England Hotel Realty (NEHR).

NEHR provides acquisition, disposition, consulting, and market research services to the lodging real estate industry. NEHR is highly skilled in the sale of lender-owned and distressed hotels.

Ford is responsible for overseeing and directing the company's hospitality brokerage department, working with new clients, and servicing the disposition and acquisition needs of existing clients.

Tags:

Optimism in hospitality segment: Increase YoY of 5% by projects and 7% by rooms

July 19, 2013 - Front Section