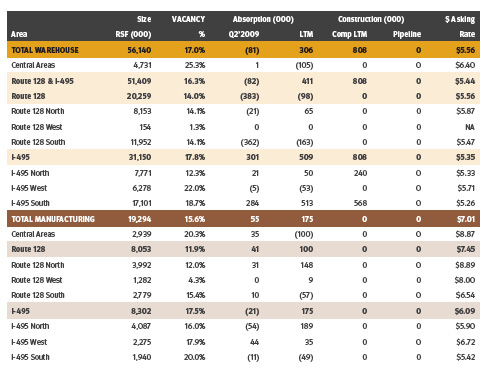

In recognition of the dramatically different characteristics of warehouse-type properties and manufacturing-type properties, Richards Barry Joyce & Partners tracks the two property types separately. This report provides an update of each of these two property types.

Warehouse

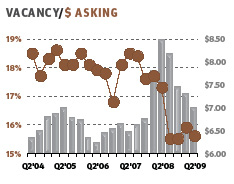

The second quarter of 2009 incurred 81,000 s/f of negative absorption as vacancy increased 0.5% to 17%.

* Brisk absorption of 330,000 s/f in Rte. 495 South high bay properties was offset by 362,000 s/f of negative absorption along Rte. 128 South.

* Rte. 495 South high bay availability jumped from 22.2% to 34.1% in two quarters; direct available s/f has risen from 916,000 s/f to 2.1 million s/f in five quarters.

* Rents have fallen to the lowest levels since 2005.

* Inventory has grown 1.5% due to new construction in the last twelve months, the fastest such pace in 14 quarters.

* Rte. 495 North high-bay properties are 55.3% available.

* Best Buy took occupancy of 238,000 s/f at a new build-to-suit facility in Bellingham while Super-Dog moved into 102,000 s/f in Taunton, in a move from Avon; Franklin Sports vacated 166,000 s/f in Stoughton.

* Sublease available sf increased 23% in the quarter, though remains 30% below a five-year low.

* 35 United Dr. in West Bridgewater was acquired ($23 million, 595,000 s/f, $39 per s/f) by AIC Ventures. Foxrock Properties acquired 105 Research Rd. in Hingham ($4.7 million, 58,000 s/f, $80 per s/f).

Manufacturing

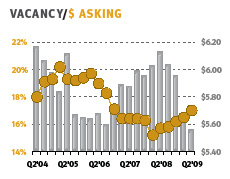

The second quarter of 2009 ushered in absorption of 55,000 s/f, causing vacancy to drop 0.3% to 15.6%.

* Rte. 128 North has experienced 148,000 s/f of positive absorption over the last year, decreasing vacancy from 18.2% to 12%.

* Asking rates have decreased 18% over the last year.

* The amount of space occupied in Greater Boston has decreased by 10.2 million s/f over the last eight years.

* Sublease availability has averaged 1.6% over the past five years, as the sublet market has been far less a pricing influence than in flex, warehouse or office.

* Available space, at 3.8 million s/f, is near an all-time low, as longmarketed space has trended toward redevelopment.

* Rte. 495 North availability has increased from 18.1% to 27.3% in two quarters.

* Properties gaining occupancy outnumbered those losing 18-11, according to the RBJ Activity Index.

* Sterlingwear of Boston took occupancy of 90,000 s/f in Boston. Riggera Company expanded by 18,000 s/f in Woburn; the failure of Frosty Fresh opened up 56,000 s/f in Lawrence.

* The average facility in Greater Boston is 42 years old.

A silver lining of constrained development over the past decade counters industrial market forces that pose significant near-term challenges. While executed leases have driven an increase in occupied Warehouse space, a 34% six-quarter increase in available space suggests an expectation of decreasing demand on the part of business managers over the coming four quarters, consistent with data from the Institute for Supply Management suggesting that inventories remain too high, despite multiple quarters of readjustment. Manufacturing space, while not experiencing rapid increases in occupancy or available, is being pressured heavily with falling lease rates, as landlords proactively respond to market conditions. Industrial property types are likely to experience stagnant or decreasing lease rates, with warehouse properties likely to see substantial negative absorption over the next four quarters.

Tags:

.png)