Quarter 1 2008 is the consensus view of the start of our current recession. If one were to think back a year, there was no recession in the minds of real estate professionals. Greater Boston had come off a record 2007 with over $15.5 billion in major property trades. In downtown alone, our firm had closed $1.5 billion in lease transactions. We had added 9 new brokers. Our "revenue pipeline was better than one year ago."

In Q1 2008, we were in a classic anti-gravity period. If we look back to the 1991 and 2001 recessions, the same type of reaction was in place. Participants could not believe that the market was on the decline. The story I heard from our brokers was only that the market was "quiet."

In this article I will trace events from Q1 2008 through to the present, chart market change, and address where we sit today.

Quarter 1 2008's Momentum

Even though market contraction had started, real estate professionals did not recognize decline had begun. In Q1 2008, I was involved in several lease arbitrations, one of which lasted to Q3. I had put before me my own CBRE market statistics. These statistics showed office rents for Boston's CBD rising from $60.99 per s/f to $62.20 per s/f for an annualized 8% rate of growth. As of March 2008, there was still upward momentum, despite New England Economic Partnership (NEEP) employment numbers reporting a different picture. The market was beginning to sense that something was going on.

By mid year Q1 2008, "rents were no longer being pushed."

The Year Progresses

When Q2 was reached "there was a flurry of sub-leases." Spaces were not going vacant because landlords were allowing tenants to hold over as they were trying to figure out what to do.

Capital was evaporating and a window was opening for sale-leasebacks in order to monetize companies.

Certain landlords were taking a "big foot" position under the false belief that tenants would not move. As proven by the Hancock Tower, how wrong they were.

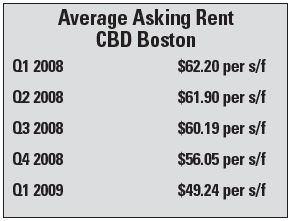

A real gap began to develop between asking rents and taking rents. Landlords were refusing to cut asking prices. A tracking of asking rents by quarter for CBD office space is shown in the chart above.

Landlords held out until Q4 2008 before they truly recognized what had happened. By then it was too late to react. In Boston's CBD, in Q1 2009 there was 857,879 s/f of absorption. For the city, the number was 1,321,512 s/f and for the market as a whole, 2,430,275 s/f. What is clear is that it took one year before the change in the market would be recognized.

One thing about the real estate market is that there are always exceptions. This business is a supply and demand business. There are key parcels of land or key office or lab spaces that are just so choice that no change in rent or change in value will take place. When there is no competitive supply and there is great demand, space will perform counter to market norms.

Conclusion

So where are we today? I like to think we are back to basics. Clearly, the market overall is on hold. There is no financing source to replace CMBS with a workable substitute model. What we learned in particular from the 1991 recession is that transparency requires property write downs. These write downs need not be all at once and can occur over time. This is where the appraisal function becomes critically important. One of the most complex issues developing is how to handle change of values brought about by market change.

At the same time, deals are being done, space is being leased, and small transactions are occurring. There are many signs of activity and opportunities are developing.

The economy overall will bottom out by Q4-2009 to Q1-2010. The real estate market will most likely follow its traditional pattern of slow recovery followed by expansion in the 2012 to 2013 time frame.

Webster Collins, MAI, CRE, FRICS is executive vice president/partner within CB Richard Ellis in their valuation and advisory group, Boston, Mass.

Tags:

The market one year after the start of the recession: How it got to the way it is today

April 08, 2009 - Appraisal & Consulting