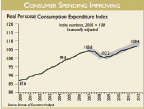

What can we expect for years to come? Much of the same with modest improvement. The industry got a shot in the arm in 2012, as rounds rose by more than 6% nationally over 2011. Rounds had dropped 11%, or 55 million during the past decade, so a 6% increase, or the addition of 28 million rounds was a welcome change. Much of it was weather based, particularly in the Northeast, which experienced a dismal weather year in 2011. The PGA's Performance Trak reported a 7% increase in the number of playable days nationwide. Aside from better weather, consumer confidence is up and so is personal consumption. As indicated in the graphs below, Consumer Confidence hit a low of 25 in January 2009, while normal is 90, yet it stands at 65 as of December 2012. And, personal consumption was recorded at 87.6 in 2000 and while it dropped between 2007 and 2009, it now stands at 109.4 in 2012.

The golf market continues to correct itself; 2012 was the seventh consecutive year of net reduction in courses through closings. This dynamic will help bring supply and demand closer to equilibrium. The number of golfers has stabilized at 26 million, a positive trend after several years of attrition. With recent improvement in the overall U.S. economy, job security and consumer confidence, golf equipment sales have improved but they have not returned to 2008 levels. Economic factors like unemployment, housing values, and stock prices remain the most influential over the golf industry; golf will follow these indicators.

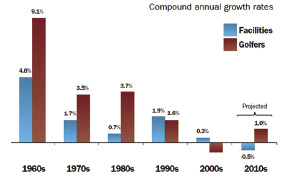

The balance between supply and demand has changed over the years. We have presented a graph that shows the percentage change in both facilities and golfers for each of the past five decades. As noted, golfer demand, as indicated by the number of new golfers, outpaced supply of new courses in the 1960s, '70s and 80's but that changed in the 1990s and it got ugly in the 2000s. Total golf rounds grew from 358.1 million in 1985 to 441.2 million in 1995 and 499.6 million in 2005 but dropped to 463 million in 2011 after peaking at 518.4 million in 2000.

To help figure out where golf is going in the 2000s decade (2010-2020), the NGF hired a national economic consulting firm, HIS Global Insight. By looking at changes in demographics, and economic factors, they project a modest growth in golfers (1%) which is consistent with the projected increase in population (0.9%). It is expected however that facility demand will be down 0.5%, meaning that more closures can be expected for years to come, as the industry continues to self-correct.

Between 500 and 1,000 courses are expected to close in the 2010s. The number of U.S. golfers is expected to reach 30.2 million by 2020. Over the next ten years, rounds should increase gradually by 73 million, or by 15%, or 1.5% per annum on average. This increase is based in part because of the shift in age and income profile and play frequency. There are effectively 78 million baby boomers in the U.S., born between 1946 and 1964, covering a 19 year span. In comparison there are roughly 66 million Generation X, or people in their mid-30's to mid-40's and 56 million Generation Y, or those people born in the late 1970s ad early 1990s. While playing frequency rates rise as people get older, participation rates actually decline, they peak at 12.1% for people between 20-39 and drop to 8.7% for people in the 60's. These figures are somewhat misleading as these rates are for All U.S. golfers; they differ by type of golfer. Participation rates actually peak for Core Golfers between the age of 60-69 at 6.7% and people who earn more than $125k have an 8% rate. And, frequency goes from 18 rounds a year for All golfers to 31.8 rounds a year for people in their 60's.

One must remember that golf is a localized sport, national averages are helpful but don't tell the whole picture. This is particularlly true when it comes to population figures, as some markets have better long term growth prospects than others. Unfortunately, the modest growth in future golf revenue will likely be offset by an increase in expenses. Growth in golf will continue to come from consolidation of ownership, better economies of scale, and margin expansions (cost cutting). Due to lingering effects of the recession, significant changes in pricing are unlikely.

Jeffrey Dugas, MAI, SGA, is a partner in the firm of Wellspeak Dugas & Kane, LLC, and heads the Golf Advisory Group, Cheshire, Conn.