Summer always ends faster than most of us want, but this year seemed unfairly fast. I looked up the other day and realized we moved out of September and into October. Without a baseball team to root for, and possibly not even a football team, all eyes are the economy and those irritating political ads dominating the television airwaves. For those of us in the hospitality industry, there are reasons for celebration, cautious optimism, and concern. This is nothing new, hospitality investment is a risky proposition even in the best of times.

The summer surge of hotel demand was a welcome, and necessary shot in the arm to the business. Pent up travel from the COVID shutdowns appeared in a variety of market segments including transient leisure and group social, primarily wedding blocks and youth groups/sports. The recovery was fueled mostly by average daily rate (ADR) as it returns to pre-pandemic levels. In addition, occupancy rebounded as well falling a few percentage points below 2019 summer numbers. The real question, when will business travel return to pre-pandemic levels and how soon? In the northeast, hotels make real money between May 1 and October 15, the rest of the year they depend on business travel.

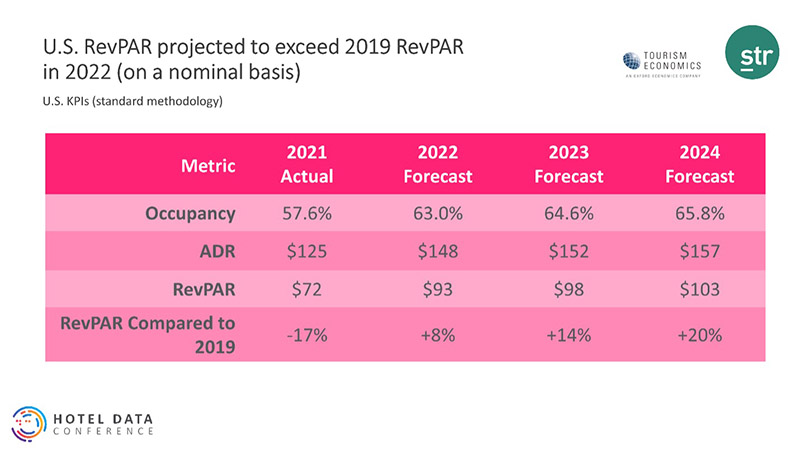

Smith Travel Report (STR) and Tourism Economics recently produces a positive hotel forecast. The chart above compares the 2021 actual results with projections for 2022, 2023 and 2024. In addition, it compares each forecast to YE 2019, the year prior to the pandemic. Assisting this growth is an expected record low supply of new hotels/rooms over the next three years. Most of the debt financing available in the hospitality sector is earmarked toward renovations and acquisitions, not new construction. High interest rates, construction costs and lack of debt will dramatically slow new hotel development.

Regardless of the mostly favorable forecast, hospitality continues to face challenges impacting investor returns and the hotel guest experience. I was fortunate to take part in the club lacrosse tournament circuit this summer throughout the northeast and mid-Atlantic states. From a guest standpoint, rates were high and guest services/amenities reduced or eliminated (no housekeeping, F&B outlets closed or limited hours) combined with poor product quality. Due to a lack of investor cash, and limited or zero reserves, many hotels are in desperate need of renovation with many suffering from a lack for diligence and with the inability to maintain the facility in first-class condition resulting in a poor guest experience.

The significant issues we are focusing on, as a company, as we move toward 2023 and beyond include the following (there are more, but this is the concise list):

Business Travel:

The lifeblood of the hotel industry needs to return to 2019 demand levels in 2023. All eyes are on November, please cross your fingers and toes for the return of the Tuesday sell-outs.

Labor:

Recruiting, training, and maintaining a labor force capable of running our 24/7/365 business in our hotels, event centers and restaurants. With everyone facing the dilemma, how do we do it better while absorbing the 35% increase in labor costs?

Utility Costs:

Utility costs are rising at a rapid rate, we are locking in the best rates possible for one year not knowing what the future holds.

Renovation/Capital Expenditure Plan:

In our hotel portfolio of twelve hotels, two are scheduled for brand changes while three more require renovations within the next three years. Managing project costs and timelines are always a concern but even more challenging in our economic environment.

Interest Rates:

The cost of money is going up, managing long and short-term debt a priority for all real estate investors.

We wish the best of luck to everyone in Quarter 4 and 2023. If you recently returned from a trip, or scheduled one, we thank you and the hospitality sector thanks you!

David Roedel is the business development officer and a member of the company’s executive team. He is responsible for new hotel development and acquisitions. In addition, he oversees Roedel Companies brand marketing, and public relations.