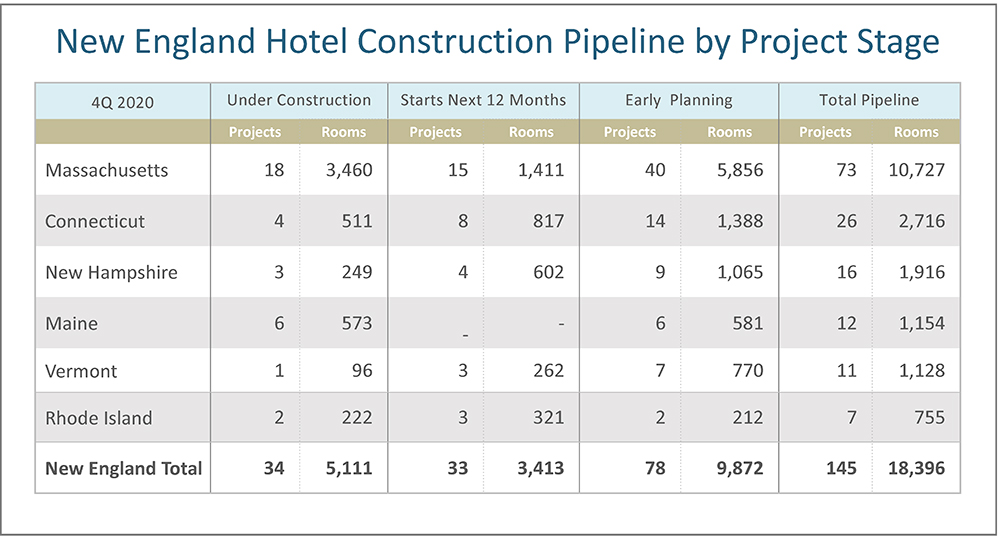

According to Lodging Econometrics’ (LE’s) Hotel Construction Pipeline Trend Report, the total New England Hotel Construction Pipeline at year-end 2020 stands at 145 projects/18,396 rooms. Not surprisingly, this is down slightly year-over-year as new construction totaled 162 projects/19,665 rooms at year-end 2019. Massachusetts has the most hotel projects in the pipeline in New England, with 73 projects/10,727 rooms. Massachusetts new construction projects account for 50% of the total pipeline in New England. Massachusetts is followed by Connecticut with 26 projects/2,716 rooms, New Hampshire with 16 projects/1,916, Maine with 12 projects/1,154 rooms, Vermont with 11 projects/1,128 rooms, and, finally, Rhode Island with 7 projects/755 rooms. (Chart 1)

At the end of Q4 ’20 in New England, projects currently under construction stand at 34 projects/5,111 rooms, another 33 projects/3,413 rooms are scheduled to start construction in the next 12 months, and 78 projects/9,872 rooms are in early planning. Massachusetts leads all three stages of the pipeline and accounts for 53% of the projects under construction, 46% of the projects scheduled to start in the next 12 months, and 51% of the projects in early planning for the region.

The Northeast saw a total of 26 hotels accounting for 2,594 rooms open in 2020. Fifty-eight percent of the projects that opened in 2020 in New England were in Massachusetts, with the Boston market accounting for 46% of Massachusetts’ opens. LE is forecasting 20 more projects/3,049 rooms to open in 2021 and another 23 projects/2,692 rooms to open in 2022 in New England.

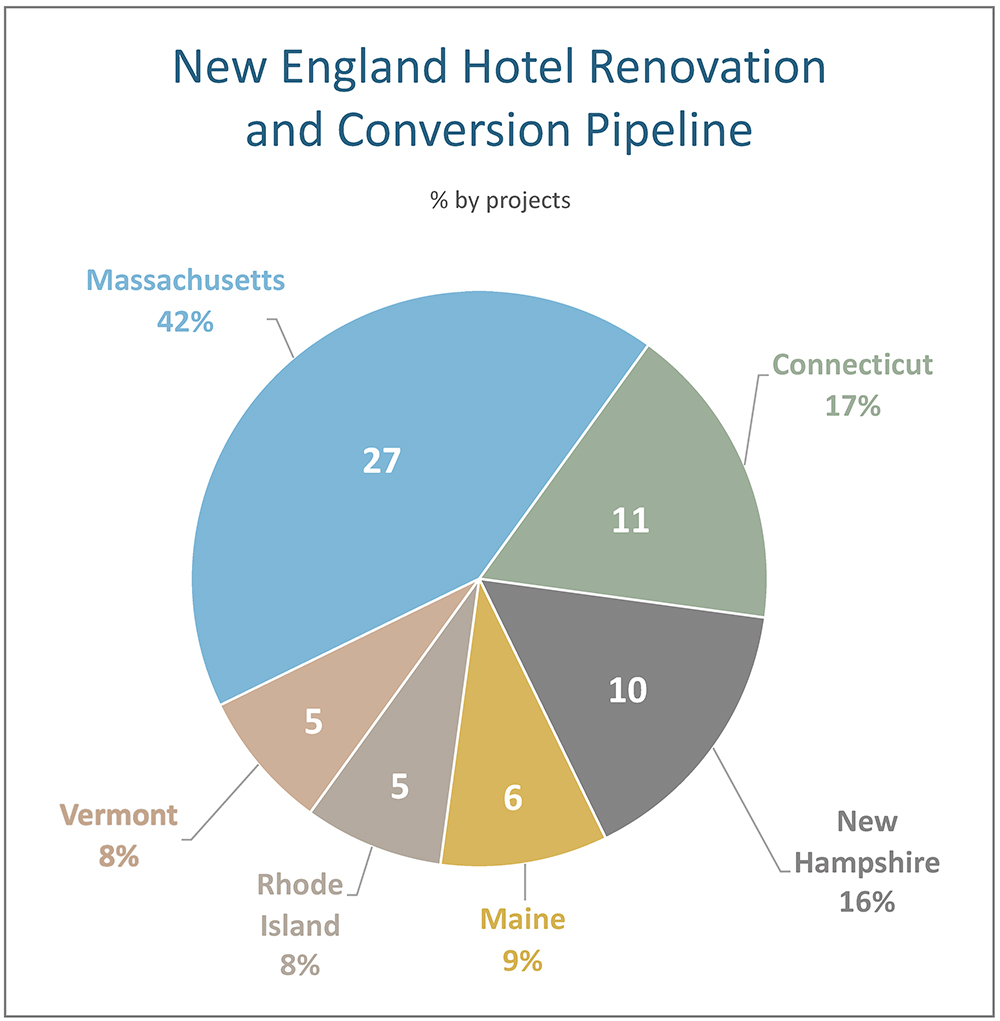

Similar to other parts of the country, renovation and conversion activity has been on an uptick in New England. At the end of Q4 ’20, 64 projects/8,664 rooms were under renovation or conversion. Massachusetts has 27 projects, Connecticut with 11 projects, New Hampshire with 10 projects, Maine with 6 projects, and Rhode and Vermont both with 5 projects. (Chart 2)

The franchise companies with the largest pipelines in New England are Hilton Worldwide, which leads the pipeline with 43 projects/5,135 rooms. Hilton is followed by Marriott International with 27 projects/3,147 rooms, Choice Hotels with 13 projects/1,433 rooms and InterContinental Hotels with 8 projects/726 rooms. These four companies account for 63% of the total projects in the construction pipeline in New England.

The leading brands for each of these companies are Home2Suites by Hilton with 14 projects/1,464 rooms, Fairfield Inn by Marriott with 9 projects/910 rooms, Cambria Suites with 6 projects/771 rooms, and Holiday Inn Express with 7 projects/600 rooms.

In 2020, there were 13 hotels that sold with a reported selling price in New England, and the average selling price per room (ASPR) was $166,101. These sales took place in Massachusetts, Maine, and Connecticut. Massachusetts had the highest number of hotel sales, with eight hotels sold for an ASPR of $224,184. The total number of hotels sold is down substantially over the last four years, wherein any previous year 40 or more hotels sold. The highest ASPR for a hotel sold in New England in 2020 was a Residence Inn in Cambridge, MA, which sold for an ASPR of $468,425. This sale was followed by the Hotel Commonwealth, which sold for an ASPR of $466,942.

For more information on the hotel development pipeline or hotel transactions in New England, any individual market in the U.S. or for the entire U.S., contact LE +1 603.431.8740 or info@lodgingeconometrics.com.

Lodging Econometrics is the leading provider of global hotel development, decision-maker contacts and unparalleled customer service. Combining 40 plus years of industry experience, a real-time pulse on market trends, and extensive knowledge of key decision-makers, LE delivers actionable business development programs for hotel franchise companies looking to accelerate their brand growth, hotel ownership and management companies seeking to expand their portfolios, and lodging vendors/supplier looking to increase their sales.

JP Ford, CHB, ISHC, is a senior vice president and director of global business development for Lodging Econometrics. He is an industry-leading real estate advisory specialist with 33 years of experience providing business development and advisory services in the United States.

Ford serves as a trusted advisor to hotel ownership and management groups looking to add hotel real estate assets and management contracts to their portfolios; hotel franchise companies looking to identify new construction and brand conversion opportunities; and analysts looking to evaluate hotel real estate development, sales transaction trends and investment potential in various hotel markets.