The common areas of a condo in Mass. generally are not taxed separately. The Massachusetts Condo Statute MGLA Chapter 183A, Section 14 provides that "common areas and facilities....shall not be deemed to be a taxable parcel"

As the Mass. Appeals Court said in First Main St. Corp. v. Bd. of Assessors of Acton:

"Everything of value, however, it is not necessarily subject to taxation, unless the Legislature makes it so....Under the Mass. tax statutes, real estate generally is to be assessed as a whole unit, not on the basis of separate interests in it. As the unit owners have already been taxed for their interest on the common area land, the assessors may not tax another slice of the same real property to others".

In Spinnaker Island & Yacht Club Holding Trust v. Bd. of Assessors of Hull, the Appeals Court stated that "by reason of the unambiguous exclusion in G.L. c 183A Section 14 of common areas from taxation except to condo unit owners in proportion to their percentage interests, the expansion parcels are not subject, as separate parcels, to real estate taxation." According to a footnote to the case, Spinnaker Island was formerly known as Hog Island.

In my opinion, assessors should learn that when pigs become hogs they get slaughtered.

In First Main St. Corp, the court did say that, unlike the underlying land, development rights are not common area and could, therefore, be assessed.

Except in the case of assessing development rights rather in the underlying land itself, there should be no more double dipping in the assessing of condominium units and common areas in Mass.

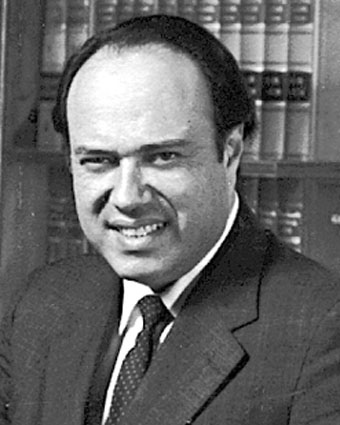

Saul Feldman is a real estate attorney at Feldman & Feldman, PC. Boston, Mass.By Saul Feldman

Tags: