In our Q2 2012 report to the lodging industry, New England Hotel Realty (NEHR) and its research division, Lodging Econometrics (LE), stated that the U.S. Hotel construction pipeline totaled 2,721 projects with 332,803 guestrooms, a low not seen since 2004. This represents a 54% decline in the number of projects and a 58% decline in the number of rooms from the cyclical peak of 5,883 projects/785,547 rooms in Q2 2008.

In Q2, new project announcements into the pipeline rose rather surprisingly to 352 projects with 45,884 rooms - an increase of 125 projects and 20,000 rooms compared to Q1. A total of 197 new hotels, having 20,924 guestrooms, opened in the first six months of 2012.

Contrary to the increase in new project announcements in Q2, the credit crunch still continues to affect lodging real estate development, especially at the upper end of the market. Early in the cycle, larger (200 rooms or more), high-end projects were severely impacted, as institutional-sized lenders halted real estate lending altogether. Today, regional and community banks are the main source for lodging real estate development financing less than $15 million.

For year ending 2012, LE is forecasting 368 projects/40,597 rooms will have opened across the country. This is a slight increase in the number of projects and the number of rooms that opened in 2011. Total supply growth will be about 0.8% in the US for 2012.

New England

Construction Pipeline

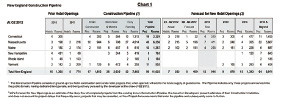

At the end of Q2 2012, New England's hotel construction pipeline consisted of 96 projects with 11,652 guestrooms (Chart 1). This accounts for about 3.5% of total projects and 3.5% of total guestrooms in the National Pipeline. NEHR forecasts that 15 hotels with 944 new guestrooms will open in all of 2012 for a gross growth rate of .5%. For 2013, NEHR forecasts only 9 hotels with 879 new guestrooms will open in New England.

Actual to date and forecasted new hotel openings in New England for 2012 and 2013 combined, show the largest growth in Mass., Conn., and Maine. Nine new hotel openings with 659 new rooms are expected in Mass., while 7 new hotels and 545 new rooms are anticipated in Conn. through 2013. During the same period, Maine should see 6 new hotels with 454 new rooms.

What does it mean for the region? It means that for the next two and a half years there should be very modest overall supply growth in New England. These new supply projections should be great news if you are an existing owner looking for your hotel to continue to rebound, as demand should outpace new supply for many more months to come.

New England Lodging

Transactions and Values

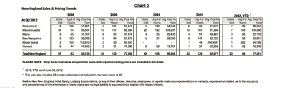

Not surprisingly, the number of lodging transactions in New England has been subdued since the fall of 2008 (Chart 2). Choppy sales activity in terms of the number of hotels sold and the average price per room has done nothing to really inspire sellers to go to market. For the most part, only those sellers motivated by external forces and pressures have sold their hotels. But moods and attitudes about market conditions are changing, as they should be. We are seeing it in our own office - with the rapid sale of three select service hotels.

The "region" is experiencing a surge in demand. Occupancies and RevPARs are up. Couple that with low supply growth and the continued loosening of the financial markets, and you have good reason to be upbeat.

2012 transactions and values should be way ahead of 2011 based on 2012 YTD. Expect continued improvement into 2013 as well.

NEHR is the highest volume hospitality real estate advisory and brokerage firm in the Northeast, providing acquisition, disposition, consulting and market research services to the lodging real estate and lending industries. Since 1977, the NEHR team has provided quality investment opportunities and seller representation in hundreds of hotel transactions. We are frequently called upon as advisors to assist in the analysis of a client's lodging investments.

We are prepared to advise in the strictest confidence on whether to sell an asset or hold it and sell at a more advantageous time. We can assist in the disposition of a single hotel investment or a portfolio of lodging assets of any size.

JP Ford, CHB, ISHC, is the senior vice president of New England Hotel Realty (NEHR).

NEHR provides acquisition, disposition, consulting, and market research services to the lodging real estate industry. NEHR is highly skilled in the sale of lender-owned and distressed hotels.

Ford is responsible for overseeing and directing the company's hospitality brokerage department, working with new clients, and servicing the disposition and acquisition needs of existing clients.

Tags:

A review of hotel development and transactions that have occurred this year

October 18, 2012 - Front Section